Oracle 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

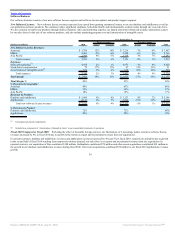

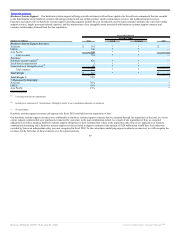

(1) In connection with purchase price allocations related to our acquisitions, we have estimated the fair values of the software support and hardware systems support obligations assumed. Due

to our application of business combination accounting rules, we did not recognize software license updates and product support revenues related to support contracts that would have

otherwise been recorded by the acquired businesses as independent entities, in the amounts of $86 million, $243 million and $179 million in fiscal 2010, fiscal 2009 and fiscal 2008,

respectively. In addition, we did not recognize hardware systems support revenues related to hardware systems support contracts that would have otherwise been recorded by Sun as an

independent entity in the amount of $128 million for fiscal 2010.

Approximately $61 million and $25 million of estimated software license updates and product support revenues related to support contracts assumed will not be recognized during fiscal

2011, fiscal 2012 and beyond, respectively, that would have otherwise been recognized by the acquired businesses as independent entities due to the application of these business

combination accounting rules. In addition, approximately $148 million, $35 million and $11 million of estimated hardware systems support revenues related to hardware systems support

contracts assumed will not be recognized during fiscal 2011, fiscal 2012 and fiscal 2013, respectively, that would have otherwise been recognized by Sun as an independent entity. To the

extent customers renew these support contracts, we expect to recognize revenues for the full contract value over the support renewal period.

(2) Represents the effects of fair value adjustments to our inventories acquired from Sun that were sold to customers in the periods presented. Business combination accounting rules require us

to account for inventories assumed from our acquisitions at their fair values. The $29 million included in the hardware systems products expenses line in the table above is intended to

reflect our hardware systems products expenses that would have been otherwise recorded by Sun as a standalone entity upon the sale of these inventories. If we acquire inventories in future

acquisitions, we will be required to assess their fair values, which may result in fair value adjustments to those inventories.

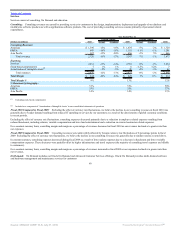

(3) Represents the amortization of intangible assets acquired in connection with our acquisitions, primarily Sun Microsystems, Inc., BEA Systems, Inc., Hyperion Solutions Corporation,

Siebel Systems, Inc. and PeopleSoft, Inc. As of May 31, 2010, estimated future amortization expenses related to intangible assets were as follows (in millions):

Fiscal 2011 $ 2,285

Fiscal 2012 2,006

Fiscal 2013 1,638

Fiscal 2014 1,354

Fiscal 2015 1,015

Thereafter 638

Total intangible assets subject to amortization 8,936

In-process research and development 385

Total intangible assets, net $ 9,321

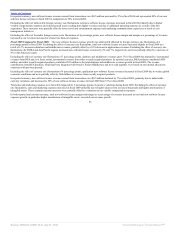

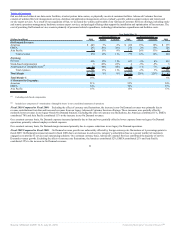

(4) Acquisition related and other expenses primarily consist of personnel related costs for transitional and certain other employees, stock-based compensation expenses, integration related

professional services, certain business combination adjustments after the measurement period or purchase price allocation period has ended, and certain other operating expenses, net. For

fiscal 2008, acquisition related and other expenses include a gain on property sale of $57 million. As a result of our adoption of ASC 805, Business Combinations, as of the beginning of

fiscal 2010, certain acquisition related and other expenses are now recorded as expenses in our statements of operations that had been historically included as a part of the consideration

transferred and capitalized as a part of our accounting for acquisitions pursuant to previous accounting rules, primarily direct transaction costs such as professional services fees (see further

discussion under “Business Combinations” within the “Critical Accounting Policies and Estimates” section above).

(5) Substantially all restructuring expenses during fiscal 2010 relate to employee severance, facility exit costs and contract termination costs in connection with our Fiscal 2009 Oracle

Restructuring Plan and our Sun Restructuring Plan. Restructuring expenses during fiscal 2009 primarily relate to costs incurred pursuant to the Fiscal 2009 Oracle Restructuring Plan and

the Fiscal 2008 Oracle Restructuring Plan. Restructuring expenses incurred during fiscal 2008 primarily relate to costs incurred pursuant to the Fiscal 2008 Oracle Restructuring Plan. As a

result of our adoption of ASC 805, Business Combinations as of the beginning of fiscal 2010, in connection with any acquisition that we close we will record involuntary termination and

other exit costs associated with the acquisition to restructuring expenses, which is a change in the required accounting in comparison to fiscal 2009 and fiscal 2008. See further discussion

regarding certain of our restructuring plans in Note 9 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

51

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠