Oracle 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2010

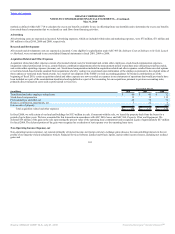

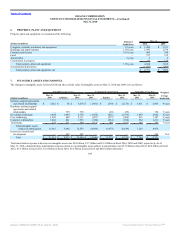

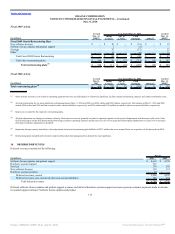

set forth below. The excess of the purchase price over the preliminary net tangible assets and intangible assets was recorded as goodwill. The preliminary

allocation of the purchase price was based upon a preliminary valuation and our estimates and assumptions are subject to change within the measurement period

(up to one year from the acquisition date). The primary areas of the preliminary purchase price allocation that are not yet finalized relate to the fair values of

certain tangible assets and liabilities acquired, certain legal matters, income and non-income based taxes and residual goodwill. We expect to continue to obtain

information to assist us in determining the fair values of the net assets acquired at the acquisition date during the measurement period. Our preliminary purchase

price allocation for Sun is as follows:

(in millions)

Cash, cash equivalents and marketable securities $ 2,571

Trade receivables 1,120

Inventories 331

Goodwill 1,291

Intangible assets 3,347

In-process research and development 415

Other assets 2,035

Deferred tax assets, net 1,250

Accounts payable and other liabilities (3,950)

Deferred revenues (1,115)

Total preliminary purchase price $ 7,295

We generally do not expect the goodwill recognized to be deductible for income tax purposes.

Valuations of Intangible Assets Acquired

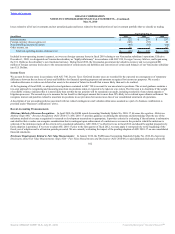

The following table sets forth the components of intangible assets acquired in connection with the Sun acquisition:

(Dollars in millions) Fair Value Useful Life

Hardware systems support agreements and related relationships $ 771 7 years

Developed technology 1,349 4 years

Core technology 534 4 years

Customer relationships 467 3 years

Trademarks 226 7 years

Total intangible assets subject to amortization 3,347

In-process research and development 415 N.A.

Total intangible assets $ 3,762

Hardware systems support agreements and related relationships and customer relationships represent the fair values of the underlying relationships and

agreements with Sun’s customers. Developed technology represents the fair values of Sun products that have reached technological feasibility and are a part of

Sun’s product lines. Core technology represents the fair values of the Sun processes, patents and trade secrets related to the design and development of Sun’s

products. This proprietary know-how can be leveraged to develop new technology and improve our existing products. Trademarks represent the fair values of

brand and name recognition associated with the marketing of Sun’s products and services. In-process research and development represents the fair values of

incomplete Sun research and development projects that had not reached technological feasibility as of the date of acquisition.

104

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠