Oracle 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2010

different classes of assets and liabilities measured at fair value, the valuation techniques and inputs used, the activity in Level 3 fair value measurements, and the

transfers between Levels 1, 2, and 3 (as defined in Note 4 below). Certain provisions of this update will be effective for us in fiscal 2012 and we are currently

evaluating the impact of the pending adoption of this standards update on our consolidated financial statements.

Transfers of Financial Assets: In June 2009, the FASB issued and subsequently codified Accounting Standards Update No. 2009-16, Transfers and Servicing

(Topic 860)—Accounting for Transfers of Financial Assets (ASU 2009-16). ASU 2009-16 eliminates the concept of a “qualifying special-purpose entity” with

regards to transfer of financial assets and changes the requirements for derecognizing financial assets. We will adopt this new accounting standards update in

fiscal 2011 and are currently evaluating the impact of its pending adoption on our consolidated financial statements.

Variable Interest Entities: In June 2009, the FASB issued and subsequently codified Accounting Standards Update No. 2009-17, Consolidations (Topic

810)—Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities (ASU 2009-17). ASU 2009-17 amends the evaluation criteria

to identify the primary beneficiary of a variable interest entity as provided pursuant to existing accounting standards and requires ongoing reassessments of

whether an enterprise is the primary beneficiary of the variable interest entity. We will adopt ASU 2009-17 in fiscal 2011 and are currently evaluating the impact

of its pending adoption on our consolidated financial statements.

2. ACQUISITIONS

Acquisition of Sun Microsystems, Inc.

On January 26, 2010 we completed our acquisition of Sun Microsystems, Inc., a provider of hardware systems, software and services, by means of a merger of

one of our wholly owned subsidiaries with and into Sun such that Sun became a wholly owned subsidiary of Oracle. We acquired Sun to, among other things,

expand our product offerings by adding Sun’s existing hardware systems business and broadening our software and services offerings. We have included the

financial results of Sun in our consolidated financial statements from the date of acquisition. For fiscal 2010, we estimate that Sun’s contribution to our total

revenues was $2.8 billion, which included allocations of revenues from our software and services businesses that were not separately identifiable due to our

integration activities. For fiscal 2010, Sun reduced our operating income by $620 million, which included management’s allocations and estimates of revenues

and expenses that were not separately identifiable due to our integration activities, intangible asset amortization, restructuring expenses and stock-based

compensation expenses.

The total purchase price for Sun was approximately $7.3 billion and was comprised of:

(in millions, except per share amounts)

Acquisition of approximately 757 million shares of outstanding common stock of Sun at $9.50 per share in cash $ 7,196

Fair values of stock options and restricted stock-based awards assumed 99

Total purchase price $ 7,295

The fair values of stock options assumed were estimated using a Black-Scholes-Merton option-pricing model. The fair values of unvested Sun stock options and

restricted stock-based awards as they relate to post combination services will be recorded as operating expense over the remaining service periods, while the fair

values of vested stock options and restricted stock-based awards, as they relate to pre combination services, are included in the total purchase price.

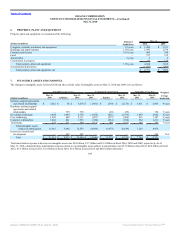

Preliminary Purchase Price Allocation

Pursuant to our business combinations accounting policy, the total purchase price for Sun was allocated to the preliminary net tangible and intangible assets

based upon their preliminary fair values as of January 26, 2010 as

103

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠