Oracle 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2010

registration requirements under federal and state securities laws. As of May 31, 2010, we had $881 million of Commercial Paper Notes outstanding at a weighted

average yield, including issuance costs, of 0.28% that mature at various dates through July 15, 2010 (none outstanding as of May 31, 2009). We back-stop these

notes with our revolving credit agreement and therefore, as of May 31, 2010, we consider that we have $2.1 billion of capacity remaining under our reduced CP

Program.

Revolving Credit Agreements

On March 16, 2010, our $2.0 billion, 364-Day Revolving Credit Agreement dated March 17, 2009, among Oracle; the lenders named therein; Wachovia Bank,

National Association, as administrative agent; BNP Paribas as syndication agent; the documentation agents named therein; and Wachovia Capital Markets, LLC,

and BNP Paribas Securities Corp., as joint lead arrangers and joint bookrunners (the 2009 Credit Agreement), terminated pursuant to its terms. No debt was

outstanding pursuant to the 2009 Credit Agreement as of its date of termination.

As of May 31, 2010, we had a $3.0 billion, five-year Revolving Credit Agreement with certain lenders that we entered into in March 2006 (the 2006 Credit

Agreement). The 2006 Credit Agreement provides for unsecured revolving credit facilities, which can also be used to back-stop any Commercial Paper Notes

(defined above) that we may issue and for working capital and other general corporate purposes. Subject to certain conditions stated in the 2006 Credit

Agreement, we may borrow, prepay and re-borrow amounts under the facilities at any time during the term of the 2006 Credit Agreement. Interest for the 2006

Credit Agreement is based on either (a) a LIBOR-based formula or (b) a formula based on Wells Fargo’s prime rate or on the federal funds effective rate. Any

amounts drawn pursuant to the 2006 Credit Agreement are due on March 14, 2011. No amounts were outstanding pursuant to the 2006 Credit Agreement as of

May 31, 2010 and 2009 and a total of $3.0 billion remained available.

The 2006 Credit Agreement contains certain customary representations and warranties, covenants and events of default, including the requirement that our total

net debt to total capitalization ratio not exceed 45%. If any of the events of default occur and are not cured within applicable grace periods or waived, any unpaid

amounts under the 2006 Credit Agreement may be declared immediately due and payable and the 2006 Credit Agreement may be terminated. We were in

compliance with the Credit Agreements’ covenants as of May 31, 2010.

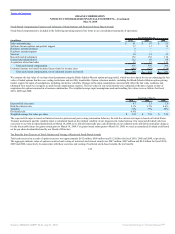

9. RESTRUCTURING ACTIVITIES

Sun Restructuring Plan

During the third quarter of fiscal 2010, our management approved, committed to and initiated a plan to restructure our operations due to our acquisition of Sun

(the Sun Restructuring Plan) in order to improve the cost efficiencies in our merged operations. Our management subsequently amended the Sun Restructuring

Plan to reflect additional actions that we expect to take to improve the cost efficiencies in our merged operations. The total estimated restructuring costs

associated with the Sun Restructuring Plan are $1.1 billion consisting primarily of employee severance expenses, abandoned facilities obligations and contract

termination costs. The restructuring costs will be recorded to the restructuring expense line item within our consolidated statements of operations as they are

recognized. We recorded $342 million of restructuring expenses in connection with the Sun Restructuring Plan during fiscal 2010 and we expect to incur the

majority of the approximately $755 million of remaining expenses pursuant to the Sun Restructuring Plan through the calendar year 2011. Any changes to the

estimates of executing the Sun Restructuring Plan will be reflected in our future results of operations.

Fiscal 2009 Oracle Restructuring Plan

During the third quarter of fiscal 2009, our management approved, committed to and initiated plans to restructure and further improve efficiencies in our

operations (the 2009 Plan). Our management subsequently amended the 2009 Plan to reflect additional actions that we implemented over the course of fiscal

2010. The total estimated

112

Source: ORACLE CORP, 10-K, July 01, 2010 Powered by Morningstar® Document Research℠