Nissan 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003 69

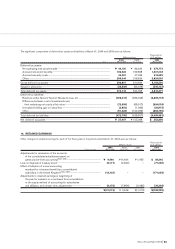

20. DERIVATIVE TRANSACTIONS

Hedging Policies

The Company and its consolidated subsidiaries (collectively, the

“Group”) utilize derivative transactions for the purpose of hedging

their exposure to fluctuation in foreign exchange rates, interest rates

and market prices. However, based on an internal management rule

on financial market risk (the “Rule”) approved by the Company’s

Board of Directors, they do not enter into transactions involving

derivatives for speculative purposes. The Rule prescribes that (i) the

Group’s financial market risk is to be controlled by the Company in a

centralized manner, and that (ii) no individual subsidiary can initiate a

hedge position without the prior approval of, and regular reporting

back to the Company.

Risk to be hedged by derivative transactions

(1) Market risk

The financial market risk to which the Group is generally exposed in its

operations and the relevant derivative transactions primarily used for

hedging are summarized as follows:

·Foreign exchange risk associated with assets and liabilities denomi-

nated in foreign currencies; forward foreign exchange contracts,

foreign currency options, and currency swaps;

·Interest rate risk associated with sourcing funds and investing:

interest-rate swaps;

·Risk of fluctuation in stock prices: options on stocks;

·Risk of fluctuation in commodity prices (mainly for precious metals):

commodity futures contracts

(2) Credit risk

The Group is exposed to the risk that a counterparty to its financial

transactions could default and jeopardize future profits. We believe

that this risk is insignificant as the Group enters into derivative trans-

actions only with financial institutions which have a sound credit pro-

file. The Group enters into these transactions also with Renault

Finance S.A. (“RF”), a specialized financial subsidiary of the Renault

Group which, we believe, is not subject to any such material risk.

This is because RF enters into derivative transactions to cover such

derivative transactions with us only with financial institutions of the

highest caliber carefully selected by RF based on its own rating sys-

tem which takes into account each counterparty’s long-term credit

rating and shareholders’ equity.

(3) Legal risk

The Group is exposed to the risk of entering into a financial agree-

ment which may contain inappropriate terms and conditions as well

as the risk that an existing contract may be affected by revisions to

the relevant laws and regulations. The Company’s Legal Department

and Finance Department make every effort to minimize legal risk by

reviewing any new agreements of significance and by reviewing the

related documents in a centralized way.

Risk Management

All strategies to manage financial market risk and risk hedge opera-

tions of the Group are carried out pursuant to the Rule which stipulates

the Group’s basic policies for derivative transactions, management

policies, management items, procedures, criteria for the selection of

counterparties, and the reporting system, and so forth. The Rule pre-

scribes that (i) the Group’s financial market risk is to be controlled by

the Company in a centralized manner, and that (ii) no individual sub-

sidiary is permitted to initiate a hedging operation without the prior

approval of, and regular reporting back to the Company.

The basic hedge policy is subject to the approval of the Monthly

Hedge Policy Meeting attended by the corporate officer in charge of

Treasury Department. Execution and management of all deals are to

be conducted pursuant to the Rule. Derivative transactions are con-

ducted by a special section of the Treasury Department and monitoring

of contracts for such transactions and confirming the balance of all

open positions are the responsibility of back office and risk manage-

ment section. Commodity futures contracts are to be handled also

by Treasury Department under guidelines which are to be drawn up

by the MRMC (Materials Risk Management Committee). The MRMC

is chaired by the corporate officer in charge of the Purchasing

Department and the corporate officer in charge of Treasury

Department and it will meet approximately once every six months.

The status of derivative transactions is reported on a daily basis to

the chief officer in charge of Treasury Department and on an annual

basis to the Board of Directors. Credit risk is monitored quantitatively

with reference to Renault’s rating system based principally on the

counterparties’ long-term credit ratings and on their shareholders’

equity. The Finance Department sets a maximum upper limit on posi-

tions with each of the counterparties for the Group and monitors the

balances of open positions every day.