Nissan 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003 61

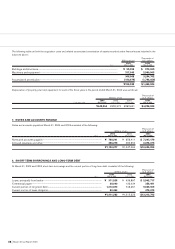

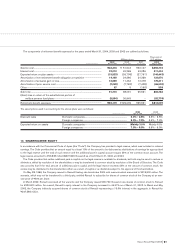

The components of retirement benefit expenses for the years ended March 31, 2004, 2003 and 2002 are outlined as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2001 2003

For the years ended Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2002 Mar. 31, 2004

Service cost...................................................................................................................... ¥48,418 ¥ 51,543 ¥50,147 $456,773

Interest cost...................................................................................................................... 33,012 45,269 43,086 311,434

Expected return on plan assets ................................................................................... (15,523) (26,708) (27,791) (146,443)

Amortization of net retirement benefit obligation at transition .............................. 14,169 24,280 24,369 133,670

Amortization of actuarial gain or loss.......................................................................... 18,689 11,464 13,378 176,311

Amortization of prior service cost................................................................................ (7,049) (7,762) (7,408) (66,500)

Other .................................................................................................................................. 57 5(190) 538

Sub total............................................................................................................................ 91,773 98,091 95,591 865,783

(Gain) loss on return of the substitutional portion of

welfare pension fund plans................................................................................... (5,594) 30,945 – (52,774)

Retirement benefit expenses ........................................................................................ ¥86,179 ¥129,036 ¥95,591 $813,009

The assumptions used in accounting for the above plans were as follows:

2003 2002

For the years ended Mar. 31, 2004 Mar. 31, 2003

Discount rates Domestic companies......................................................................... 2.3% - 2.5% 2.3% - 2.5%

Foreign companies ............................................................................ 5.0% - 7.0% 5.4% - 7.3%

Expected return on assets Domestic companies......................................................................... Mainly 3.0% Mainly 4.0%

Foreign companies ............................................................................ 7.0% - 9.0% 6.5% - 9.0%

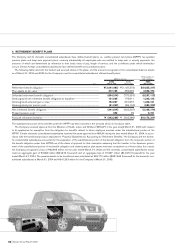

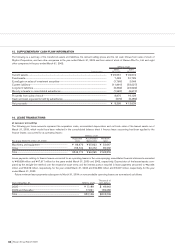

10. SHAREHOLDERS’ EQUITY

In accordance with the Commercial Code of Japan (the “Code”), the Company has provided a legal reserve, which was included in retained

earnings. The Code provides that an amount equal to at least 10% of the amount to be disbursed as distributions of earnings be appropriated

to the legal reserve until the total of such reserve and the additional paid-in capital account equals 25% of the common stock account. The

legal reserve amounted to ¥53,838 million ($507,906 thousand) as of both March 31, 2004 and 2003.

The Code provides that neither additional paid-in capital nor the legal reserve is available for dividends, but both may be used to reduce or

eliminate a deficit by resolution of the shareholders or may be transferred to common stock by resolution of the Board of Directors. The Code

also provides that if the total amount of additional paid-in capital and the legal reserve exceeds 25% of the amount of common stock, the

excess may be distributed to the shareholders either as a return of capital or as dividends subject to the approval of the shareholders.

On May 28, 1999, the Company issued to Renault floating rate bonds due 2004 with warrants which amounted to ¥215,900 million. The

warrants, which may not be transferred to a third party, entitled Renault to subscribe for shares of common stock of the Company at an exer-

cise price of ¥400 per share.

In March 2002, Renault exercised all the warrants and the Company issued 539,750 thousand new shares of common stock to Renault

for ¥220,900 million. As a result, Renault’s equity interest in the Company increased to 44.37% as of March 31, 2002. In March and May

2002, the Company indirectly acquired shares of common stock of Renault representing a 15.0% interest, in the aggregate, in Renault for

¥247,566 million.