Nissan 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003 47

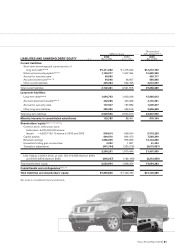

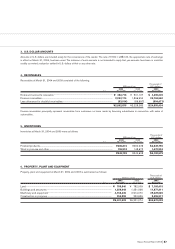

Impacts on Operating Profit

Fiscal year 2003 (Billion yen)

1,000

900

800

700

600

500

737.2

FY2002

Operating

Income

Foreign

exchange

-48

Lease

Accounting

+20

Volume/

Mix

+185

-83

Enrichment

& Regulations

Purchasing

cost

+183

825

FY2003

Operating

Income

G&A

Others

-27.3

-12

Manufacturing

cost

-54

R&D

-72

Sales

cost

increase

-4

Scope of

Consolidation

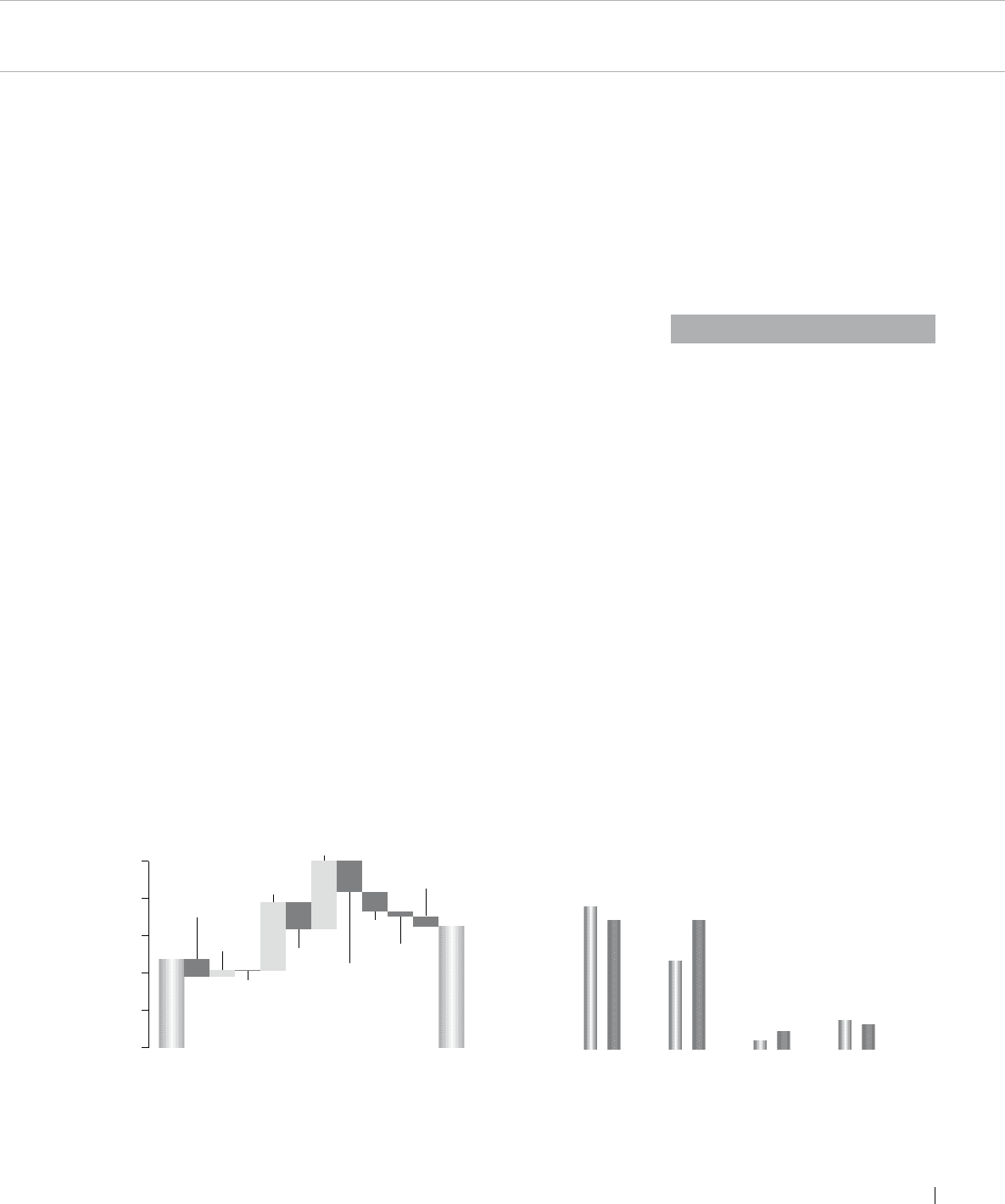

390.6

352.5

242.0

351.8

21.9

49.2

77.6 66.0

’02 ’03

Japan

’02 ’03

US

(including Canada)

’02 ’03

Europe

’02 ’03

Other Markets

(including Mexico)

Eliminations ’02 +5.1

’03 +5.4

Operating Income by Region

Fiscal years 2002-2003 (Billion yen)

contributing ¥185 billion.

• The increase in selling expenses by

¥72 billion.

• The improvement in purchasing costs

amounted to ¥183 billion.

• Product enrichment and cost of

regulations had a negative impact of

¥83 billion.

• An additional ¥54 billion was spent in

R&D to further reinforce product and

technology development.

• Manufacturing and logistics costs had

a negative impact of ¥12 billion, including

the costs associated with the startup of

the Canton Plant.

• General and administrative and other

expenses increased by ¥27.3 billion.

By region, operating profits in Japan

came to ¥352.5 billion, compared to

¥390.6 billion in the previous year.

The drop is primarily the result of higher

R&D expenses, the negative impact of

foreign exchange rates on export sales,

and a decrease in mix in the domestic

market. Profitability in the United States

and Canada came to ¥351.8 billion

compared to ¥242 billion in fiscal year

2002. This significant increase is due to

improvements in both volume and mix.

Europe’s operating profit level more than

doubled, to ¥49.2 billion from ¥21.9

billion. The rise is due to the increase in

volume and favorable exchange rates.

In General Overseas Markets, operating

profits came to ¥66 billion compared to

¥77.6 billion. The decrease is due to lower

profits in Mexico as a result of the decline

in Sentra exports to the United States.

Inter-regional eliminations came to

¥5.4 billion.

NET INCOME

Net non-operating expenses totaled ¥15.2

billion—¥12 billion less than in fiscal year

2002. As planned, the return of the

substitute portion of the pension plan to

the government decreased expenses by

¥10 billion. Financial costs decreased by

¥800 million to ¥15.7 billion despite the

announced incorporation on the balance

sheet of ¥133.7 billion in leases.

Ordinary profit came to ¥809.7 billion,

up from ¥710.1 billion in fiscal year 2002.

Net extraordinary losses grew by ¥57.7

billion, mainly due to the fact that last

year’s numbers included a one-time gain of

¥56.3 billion from the sale of the

Murayama Plant.

Income before taxes came to ¥736.5

billion. Taxes came to ¥219 billion for an

effective consolidated tax rate of 29.7% as

the company continues to optimize its

global net tax rate. Minority interests

amounted to ¥13.8 billion.

Net income reached ¥503.7 billion,

resulting in the best net result in the

company’s history.

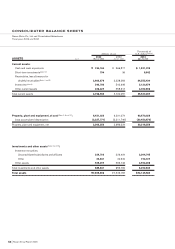

FINANCIAL POSITION

ASSETS

Total consolidated assets increased by

6.9% to ¥7.8599 trillion in fiscal year

2003, compared to ¥7.3492 trillion at the

end of fiscal year 2002.

Current assets increased by 1.8% or

¥66.9 billion during fiscal year 2003 to

¥3.767 trillion. Sales finance receivables

increased by ¥306.2 billion, while cash

and account receivables decreased

through more efficient working

capital management.

Fixed assets increased by 12.2% to

¥4.0913 trillion from ¥3.647 trillion.

Property, plant and equipment increased

by ¥213.9 billion, including the investment

in the new Canton, Mississippi plant.