Nissan 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003

54

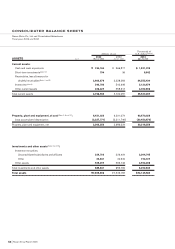

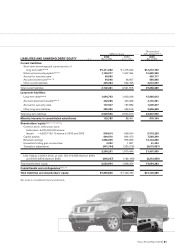

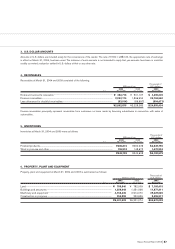

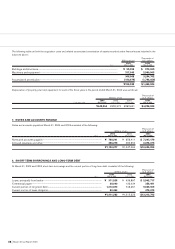

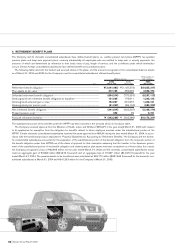

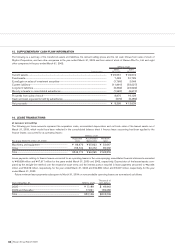

Thousands of

Millions of yen U.S. dollars(Note 3)

2003 2002 2001 2003

For the years ended Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2002 Mar. 31, 2004

Operating activities

Income before income taxes and minority interests ¥736,497 ¥694,624 ¥ 364,216 $ 6,948,085

Depreciation and amortization relating to:

Leased assets 134,354 158,370 169,213 1,267,491

Other assets 326,683 212,755 205,614 3,081,915

Provision (reversal of provision) for allowance for

doubtful receivables 3,732 (503) 39,273 35,208

Unrealized loss on securities 323 769 6,757 3,047

Unrealized loss on leased vehicles 27,038 6,050 6,069 255,073

Interest and dividend income (11,591) (8,520) (13,837) (109,349)

Interest expense 63,423 80,255 102,656 598,330

Gain on sales of property, plant and equipment (4,163) (58,796) (28,229) (39,274)

Loss on disposal of property, plant and equipment 24,823 15,587 11,285 234,179

Loss (gain) on sales of securities 7,113 (4,324) 26,823 67,104

Amortization of net retirement benefit

obligation at transition 13,936 23,923 23,925 131,472

Provision for accrued retirement benefits 67,262 100,629 60,870 634,547

Retirement benefits paid (80,650) (86,917) (81,326) (760,849)

Business restructuring costs paid –(4,644) (9,213) –

Receivables 24,539 44,989 7,334 231,500

Finance receivables (463,110) (327,357) (434,665) (4,368,962)

Inventories (28,220) (28,404) 53,162 (266,226)

Notes and accounts payable 68,879 36,877 78,255 649,802

Other 18,896 (83,947) (178,517) 178,265

Subtotal 929,764 771,416 409,665 8,771,358

Interest and dividends received 10,699 8,238 11,483 100,934

Interest paid (65,231) (80,902) (104,958) (615,387)

Income taxes paid (77,815) (123,374) (93,976) (734,103)

Net cash provided by operating activities 797,417 575,378 222,214 7,522,802

Investing activities

(Increase) decrease in short-term investments (710) 789 3,411 (6,698)

Purchases of investment securities (119,372) (32,053) (230,397) (1,126,151)

Proceeds from sales of investment securities 40,330 45,263 99,666 380,472

Long-term loans made (3,741) (11,343) (8,730) (35,292)

Collection of long-term loans receivable 4,766 13,097 6,978 44,962

Purchases of fixed assets (428,387) (377,929) (293,800) (4,041,387)

Proceeds from sales of property, plant and equipment 53,932 98,699 108,935 508,792

Purchases of leased vehicles (476,613) (483,704) (396,213) (4,496,349)

Proceeds from sales of leased vehicles 191,105 259,075 185,152 1,802,877

Proceeds from sales of subsidiaries’ stock resulting in changes

in the scope of consolidation(Note 15) 192 8,395 13,639 1,811

Additional acquisition of shares of consolidated subsidiaries (2,531) (692) (2,634) (23,877)

Other (15,097) (34,971) (10,396) (142,424)

Net cash used in investing activities (756,126) (515,374) (524,389) (7,133,264)

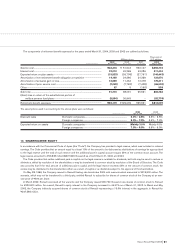

Financing activities

(Decrease) increase in short-term borrowings (137,575) (54,310) 308,869 (1,297,877)

Increase in long-term borrowings 847,393 534,053 631,451 7,994,274

Increase in bonds and debentures 150,000 85,000 246,822 1,415,094

Repayment or redemption of long-term debt (720,694) (524,115) (1,092,066) (6,799,000)

Proceeds from issuance of new shares of common stock ––220,899 –

Purchases of treasury stock (101,957) (58,383) – (961,858)

Proceeds from sales of treasury stock 9,744 5,670 2,324 91,925

Repayment of lease obligations (84,742) (9,879) (9,543) (799,453)

Cash dividends paid (74,594) (50,800) (27,841) (703,717)

Other (1,315) ––(12,407)

Net cash (used in) provided by financing activities (113,740) (72,764) 280,915 (1,073,019)

Effect of exchange rate changes on cash and cash equivalents

(2,604) 654 10,371 (24,566)

Decrease in cash and cash equivalents (75,053) (12,106) (10,889) (708,047)

Cash and cash equivalents at beginning of the year 269,817 279,653 288,536 2,545,443

Increase due to inclusion in consolidation 310 2,297 2,006 2,925

Decrease due to exclusion from consolidation (910) (27) – (8,585)

Cash and cash equivalents at end of the year ¥ 194,164 ¥269,817 ¥ 279,653 $ 1,831,736

See notes to consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Nissan Motor Co., Ltd. and Consolidated Subsidiaries

Fiscal years 2003, 2002 and 2001