Nissan 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003 59

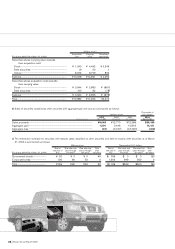

The annual interest rates applicable to short-term borrowings outstanding at March 31, 2004 and 2003 ranged principally from 0.1% to 3.4%

and from 0.1% to 7.8%, respectively.

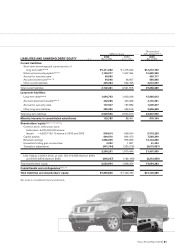

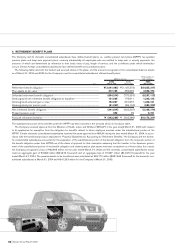

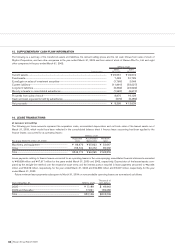

At March 31, 2004 and 2003, long-term debt consisted of the following:

Thousands of

Millions of yen U.S. dollars

2003 2002 2003

As of Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2004

Debt with collateral:

Loans from banks and other financial institutions due

through 2009 at rates ranging from 1.1% to 6.8%..................................................... ¥1,257,157 ¥1,039,807 $11,859,972

Debt without collateral:

Loans from banks and other financial institutions due

through 2015 at rates ranging from 0.1% to 5.4%..................................................... 441,125 442,796 4,161,556

Bonds in yen due through 2010 at rates ranging

from 0.6% to 3.6%.............................................................................................................. 685,340 617,320 6,465,472

Medium-term notes in U.S. dollars due through 2008

at rates ranging from 1.2% to 3.1%................................................................................ 51,237 59,258 483,368

Euro medium-term notes in yen, U.S. dollars and

Euro due through 2006 at rates ranging from 1.2% to 1.4%................................... 13,825 17,556 130,424

Floating rate bonds with warrants in yen due 2004......................................................... 172,800 172,800 1,630,189

Lease obligation........................................................................................................................ 84,179 –794,141

.............................................................................................................................................. 2,705,663 2,349,537 25,525,122

Less current portion ...................................................................................................................... 1,010,870 746,291 9,536,509

.............................................................................................................................................. ¥1,694,793 ¥1,603,246 $15,988,613

See Note 10 with respect to information on the warrants issued with the floating rate bonds due 2004.

At March 31, 2004, if all warrants had been exercised at the then current exercise price, 109,749 thousand new shares would have been

issuable.

The exercise price of the warrants is subject to adjustment in certain cases which include stock splits. A sufficient number of shares of

common stock is reserved for the exercise of all warrants.

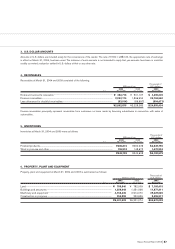

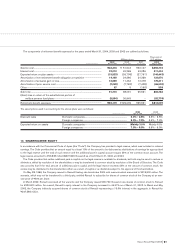

The maturities of long-term debt except for lease obligation are summarized as follows:

Thousands of

Year ending Mar. 31, Millions of yen U.S. dollars

2005................................................................................................................................................................................ ¥1,010,870 $ 9,536,509

2006................................................................................................................................................................................ 472,348 4,456,113

2007................................................................................................................................................................................ 688,541 6,495,670

2008 and thereafter..................................................................................................................................................... 449,725 4,242,689

.......................................................................................................................................................................................... ¥2,621,484 $24,730,981

The assets pledged as collateral for short-term borrowings of ¥295,908 million ($2,791,585 thousand) and long-term debt of ¥1,257,157

million ($11,859,972 thousand) at March 31, 2004 were as follows:

Thousands of

Millions of yen U.S. dollars

Receivables.................................................................................................................................................................... ¥ 287,588 $ 2,713,094

Property, plant and equipment, at net book value ................................................................................................ 1,315,797 12,413,179

Other assets .................................................................................................................................................................. 20,660 194,906

...................................................................................................................................................................................................... ¥1,624,045 $15,321,179

In addition to the above, at March 31, 2004, investments in consolidated subsidiaries of ¥51,106 million ($482,132 thousand) were pledged as

collateral for long-term debt of affiliates of ¥7,779 million ($73,387 thousand), which has not been reflected in the accompanying consolidated

balance sheet.