Nissan 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003

62

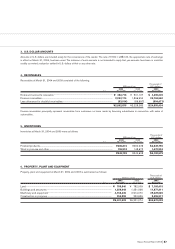

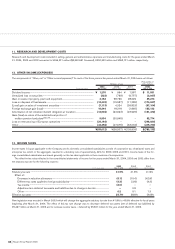

11. RESEARCH AND DEVELOPMENT COSTS

Research and development costs included in selling, general and administrative expenses and manufacturing costs for the years ended March

31, 2004, 2003 and 2002 amounted to ¥354,321 million ($3,342,651 thousand), ¥300,330 million and ¥262,121 million, respectively.

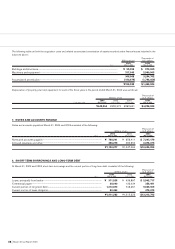

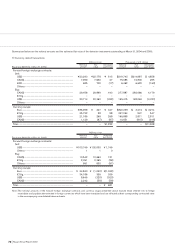

12. OTHER INCOME (EXPENSES)

The components of “Other, net” in “Other income (expenses)” for each of the three years in the period ended March 31, 2004 were as follows:

Thousands of

Millions of yen U.S. dollars

2003 2002 2001 2003

For the years ended Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2002 Mar. 31, 2004

Dividend income.............................................................................................................. ¥ 1,270 ¥954 ¥ 1,587 $ 11,981

Unrealized loss on securities........................................................................................ (323) (769) (6,757) (3,047)

Gain on sales of property, plant and equipment...................................................... 4,163 58,796 28,229 39,274

Loss on disposal of fixed assets.................................................................................. (18,449) (15,587) (11,285) (174,047)

(Loss) gain on sales of investment securities........................................................... (7,113) 4,324 (26,823) (67,104)

Foreign exchange gain (loss)........................................................................................ 16,444 18,318 (1,895) 155,132

Amortization of net retirement benefit obligation at transition .............................. (13,936) (23,923) (23,925) (131,472)

Gain (loss) on return of the substitutional portion of

welfare pension fund plans(Note 9)........................................................................... 5,594 (30,945) – 52,774

Loss on restructuring of European operations......................................................... (26,164) ––(246,830)

Other .................................................................................................................................. (44,498) (47,675) (63,034) (419,793)

................................................................................................................................. ¥(83,012) ¥(36,507) ¥(103,903) $(783,132)

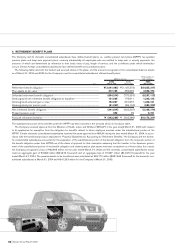

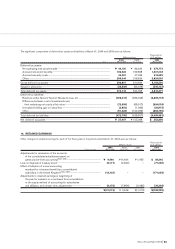

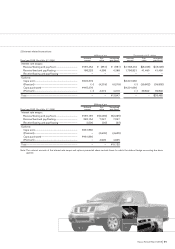

13. INCOME TAXES

Income taxes in Japan applicable to the Company and its domestic consolidated subsidiaries consist of corporation tax, inhabitants’ taxes and

enterprise tax, which, in the aggregate, resulted in a statutory rate of approximately 42% for 2003, 2002 and 2001. Income taxes of the for-

eign consolidated subsidiaries are based generally on the tax rates applicable in their countries of incorporation.

The effective tax rates reflected in the consolidated statements of income for the years ended March 31, 2004, 2003 and 2002 differ from

the statutory tax rate for the following reasons:

2003 2002 2001

For the years ended Mar. 31, 2004 Mar. 31, 2003 Mar. 31, 2002

Statutory tax rate ......................................................................................................................................... 41.9% 41.9% 41.9%

Effect of:

Decrease in valuation allowance.................................................................................................... (6.1) (10.4) (42.9)

Different tax rates applied to foreign subsidiaries...................................................................... (4.3) (3.8) (4.3)

Tax credits........................................................................................................................................... (2.0) ––

Adjustments in deferred tax assets and liabilities due to change in tax rate....................... –0.8 –

Other .................................................................................................................................................... 0.2 0.1 1.3

Effective tax rates........................................................................................................................................ 29.7% 28.6% (4.0)%

New legislation was enacted in March 2003 which will change the aggregate statutory tax rate from 41.9% to 40.6% effective for fiscal years

beginning after March 31, 2004. The effect of this tax rate change was to decrease deferred tax assets (net of deferred tax liabilities) by

¥5,467 million at March 31, 2003 and to increase income taxes – deferred by ¥5,501 million for the year ended March 31, 2003.