Nissan 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003 65

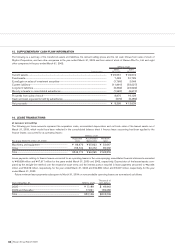

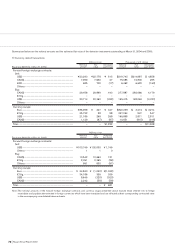

b) Lessors’ accounting

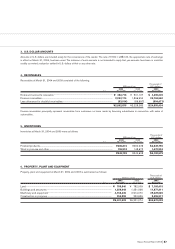

The following amounts represent the acquisition costs, accumulated depreciation and net book value of the leased assets relating to finance

leases accounted for as operating leases at March 31, 2003:

Millions of yen

Acquisition

Accumulated

Net book

Fiscal year 2002 (As of Mar. 31, 2003) costs

depreciation

value

Machinery and equipment................................................ ¥89,924 ¥41,199 ¥48,725

Other..................................................................................... 7,483 3,768 3,715

Total....................................................................................... ¥97,407 ¥44,967 ¥52,440

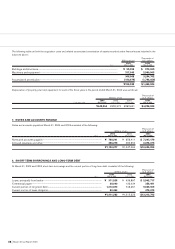

Lease income relating to finance leases accounted for as operating leases in the accompanying consolidated financial statements amounted

to ¥21,216 million and ¥21,850 million for the years ended March 31, 2003 and 2002, respectively. Depreciation of the assets leased under finance

leases accounted for as operating leases and the interest portion included in lease income amounted to ¥18,351 million and ¥2,649 million,

respectively, for the year ended March 31, 2003 and ¥18,946 million and ¥3,452 million, respectively, for the year ended March 31, 2002.

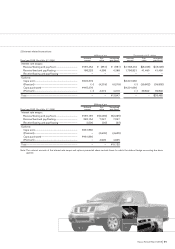

Future minimum lease income subsequent to March 31, 2004 for noncancelable operating leases is summarized as follows:

Thousands of

Year ending Mar. 31, Millions of yen U.S. dollars

2005.......................................................................................................... ¥178,939 $1,688,104

2006 and thereafter............................................................................... 259,704 2,450,038

Total ........................................................................................................... ¥438,643 $4,138,142

See Note 2(c) for the change in the method of accounting for noncancelable lease transactions which transfer substantially all risks and

rewards associated with the ownership of assets.

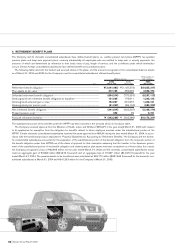

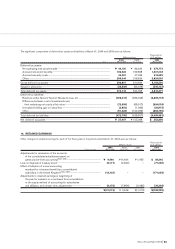

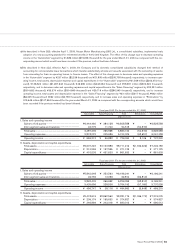

17. COMMITMENTS AND CONTINGENCIES

At March 31, 2004, the Company and its consolidated subsidiaries had the following contingent liabilities:

Thousands of

Millions of yen U.S. dollars

As endorser of notes receivable discounted with banks ....................................................................................... ¥2,782 $ 26,245

As guarantor of employees’ housing loans from banks and others..................................................................... 249,363 2,352,481

............................................................................................................................................................................................. ¥252,145 $2,378,726

In addition to the above, at March 31, 2004, the Company was committed to provide guarantees of indebtedness of unconsolidated subsidiaries

and affiliates in the aggregate amount of ¥2,962 million ($27,943 thousand) at the request of the lending banks. The Company also provided

letters of awareness to financial institutions to whom outstanding trade receivables of ¥42,862 million ($404,359 thousand) had been sold.

The outstanding balance of installment receivables sold with recourse amounted to ¥27,714 million ($261,453 thousand) at March 31, 2004.

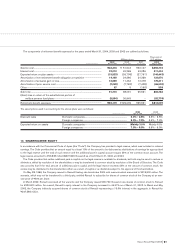

Certain consolidated subsidiaries have entered into overdraft and loan commitment agreements amounting to ¥84,100 million ($793,396

thousand) with their customers and others. The loans receivable outstanding and the unused balances under these credit facilities as of

March 31, 2004 amounted to ¥11,043 million ($104,179 thousand) and ¥73,057 million ($689,217 thousand), respectively. Since many of

these facilities expire without being utilized and the related borrowings are sometimes subject to a review of the borrowers’ credibility, any

unused amount will not necessarily be utilized at the full amount.