Nissan 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nissan Annual Report 2003

48

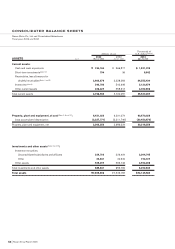

Capital expenditures increased to

¥427.3 billion, representing 5.8% of net

revenue. Depreciation was ¥213.9 billion.

Investment security increased by ¥933.3

billion, including the investment in

Dongfeng Motor Co., Ltd.

SHAREHOLDERS’ EQUITY

Total shareholder equity increased from

¥1.8083 trillion to ¥2.024 trillion in fiscal

year 2002, due to higher profitability.

Consolidated shareholder equity

strengthened during the fiscal year,

representing 27% of total revenues and

26% of total assets.

DIVIDEND

At the shareholder meeting on June 23,

2004, the company proposed increasing

its dividend to ¥19 per share in 2003, from

¥14 in 2002. Nissan’s three-year dividend

plan is to increase dividend per share to

¥24 in 2004. By the end of Nissan’s next

three-year business plan NISSAN Value-

up in March 2008, Nissan plants to pay

an annual dividend of no less than ¥40 per

share, more than double the ¥19 per

share level that was approved for fiscal

year 2003.

INVESTMENT POLICY

Capital expenditures increased ¥49

billion to ¥427 billion, representing

5.8% of net revenue. This is the third year

in a row with a double-digit increase in

capital expenditures.

R&D expenditures increased by ¥54

billion to ¥354.3 billion. The increase went

to fund new technologies and product

development, including increased

expenses for hybrid and fuel cell vehicles.

DEBT

The objective of eliminating net automotive

debt was achieved at the end of fiscal year

2002—two years before the end of the

NISSAN 180 plan—at constant accounting

standards. After returning the off-balance

sheet investment in the new Canton Plant

and liabilities for financial leases, net

automotive debt dropped from ¥268.3

billion to ¥13.6 billion.

Despite higher expenditures for capital

expenditures and R&D to prepare for the

future and significant financial investments

in its China operations, among others,

Nissan eliminated more than ¥250 billion

in automotive debt.

Nissan has been upgraded by rating

agencies and is now in the investment

grade category.

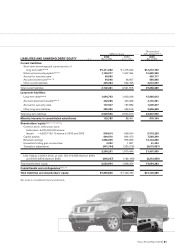

CASH FLOW

Consolidated cash generated from

operating activities accounted to ¥797.4

billion during fiscal year 2003. The higher

profits from operations and improved

working capital requirements contributed

to the cash flow. This cash was mainly

used for investments for future growth.

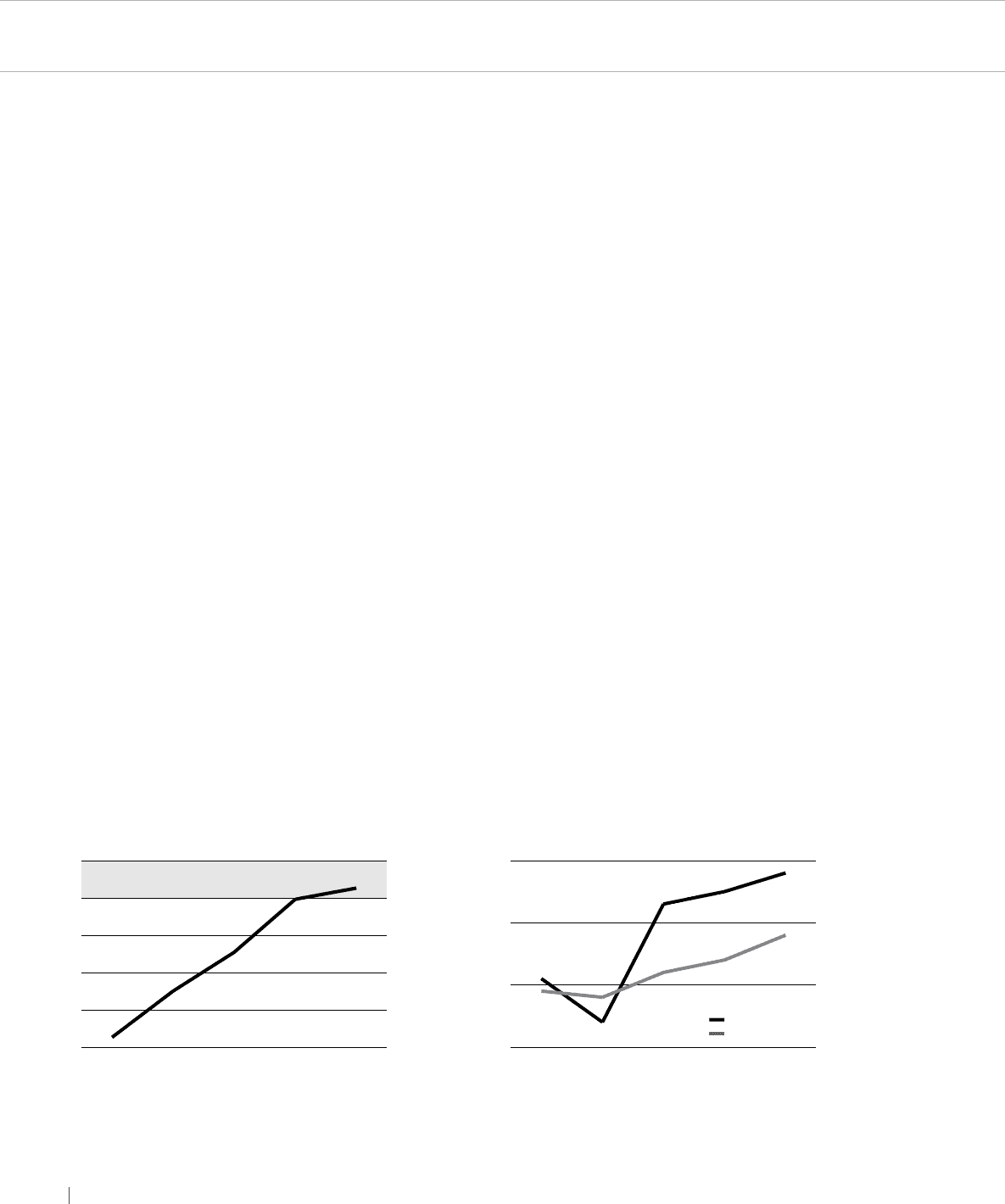

RETURN ON INVESTED CAPITAL

(ROIC)

Nissan’s investments are made within the

strict guidelines of its automotive operating

return on invested capital (ROIC). Based

on its ROIC guidelines, Nissan exceeded a

20% return on invested capital, reaching a

record 21.3% for fiscal year 2003.

The ratio of working capital to net

revenue has improved, dropping to 3.6%

from 5.8% in 2002, through tighter control

of accounts payable, receivables

and inventory.

21.3%

19.8%

Target: 20%

12.7%

7.5%

1.3%

’99 ’00 ’01 ’02 ’03

Return on Invested Capital (Auto)

Fiscal years 1999-2003 (% to net sales)

25

20

15

10

5

0

Investment in our Future

Fiscal years 1999-2003 (% of net revenue)

Capital expenditure

R&D

5.8%

+49 billion yen

+54 billion yen

5.5%

5.3%

3.4%

4.1%

’99 ’00 ’01 ’02 ’03

6

5

4

3

Canton Plant investment included from fiscal year 2001

3.9%

3.8%

4.2%

4.4%

4.8%