Neiman Marcus 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

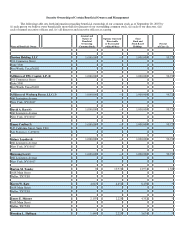

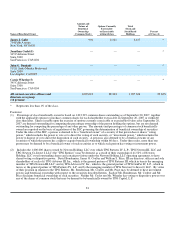

(3) Includes the 1,000,000 shares owned by Newton Holding, LLC over which Warburg Pincus Private Equity VIII, L.P., Warburg

Pincus Netherlands Private Equity VIII, C.V. I, Warburg Pincus Germany Private Equity VIII K. G. (collectively, "WP VIII")

and Warburg Pincus Private Equity IX, L.P. ("WP IX") may be deemed, as a result of their ownership of 43.25% of Newton

Holding, LLC's total outstanding shares and certain provisions under the Newton Holding, LLC operating agreement, to have

shared voting or dispositive power. Warburg Pincus Partners, LLC, a direct subsidiary of Warburg Pincus & Co. ("WP"), is the

general partner of WP VIII. Warburg Pincus IX, LLC, an indirect subsidiary of WP, is the general partner of WP IX. Warburg

Pincus LLC ("WP LLC") is the manager of each of WP VIII and WP IX. WP and WP LLC may be deemed to beneficially own

all of the shares of common stock owned by WP VIII and WP IX. Messrs. Barr, Lapidus, and Lee disclaim beneficial ownership

of all of the shares of common stock owned by the Warburg Pincus entities.

(4) Messrs. Barr, Lapidus and Lee, as partners of WP and managing directors and members of WP LLC, may be deemed to

beneficially own all of the shares of common stock beneficially owned by the Warburg Pincus entities. Messrs. Barr, Lapidus

and Lee disclaim any beneficial ownership of these shares of common stock.

(5) Mr. Coulter, as managing general partner of TPG Capital, L.P., may be deemed to beneficially own all of the shares of common

stock owned by the TPG Entities. Mr. Coulter disclaims any beneficial ownership of these shares of common stock. Neither Mr.

Coslet nor Ms. Wheeler has voting or dispositive power over any of the shares of common stock that may be deemed to be

beneficially owned by TPG Capital, L.P.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our board of directors has adopted a formal written related person transaction approval policy, which sets out our policies

and procedures for the review, approval, or ratification of "related party transactions." For these purposes a "related party" is a

director, a nominee for director, an executive officer, or any security holder who is known to us to own more than five percent of any

class of our voting securities, or any immediate family member of any of the foregoing, as set forth in Item 404(a) of Regulation S-K

of the 1934 Act. This policy applies to any transaction or series of transactions in which the Company or a subsidiary is a participant,

the amount involved exceeds $120,000, and a related party has a direct or indirect material interest.

Transactions between us or one or more of our subsidiaries and one or more related persons may present risks or conflicts of

interest or the appearance of conflicts of interest. Our Code of Ethics requires all employees, officers and directors, without exception,

to avoid engagement in activities or relationships that conflict, or would be perceived to conflict, with our interests or adversely affect

our reputation. However, certain relationships or transactions may arise that would be deemed acceptable and appropriate following

review and approval to ensure there is a legitimate business reasons for the transaction and that the terms of the transaction or no less

favorable to us than could be obtained from an unrelated person. In accordance with our policy, the procedure requires:

— That all related party transactions and all material terms of the transactions must be communicated to the Audit

Committee, including not limited to, the approximate dollar value of the amount involved in the transaction, and all

the material facts as to the related person's direct or indirect interest in, or relationship to, the related person

transaction.

• That each related person transaction, and any material amendment or modification to any related person transaction,

be reviewed and approved or ratified by the Audit Committee.

Transactions that fall within this definition will be referred to the Audit Committee for approval, ratification or other action.

Based on its consideration of all the relevant facts and circumstances, the Committee will decide whether or not to approve such

transaction and will approve only those transactions that are in the best interests of the Company. If the Company becomes aware of

an existing transaction with a related party which has not been approved under this policy, the matter will be referred to the Audit

Committee. The Audit Committee will evaluate all options available, including ratification, revision or termination of such

transaction.

82