Neiman Marcus 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

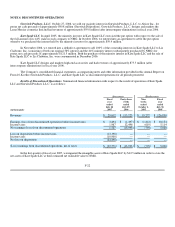

of taxes of $11.3 million) as an increase in other comprehensive income in our statement of shareholders' equity for fiscal year 2007.

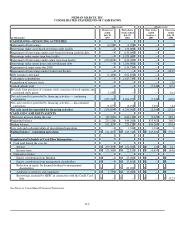

See Note 13 of the Notes to Consolidated Financial Statements in Item 15.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses the process and diversity in practice of quantifying financial statement misstatements resulting in the potential build up

of improper amounts on the balance sheet. The provisions of SAB 108 became effective during the fourth quarter of fiscal year 2007

but had no impact on the Company's results of operations or financial position.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, "Fair Value Measurements"

(SFAS 157), which provides guidance for using fair value to measure certain assets and liabilities. SFAS 157 will apply whenever

another standard requires or permits assets or liabilities to be measured at fair value. The standard does not expand the use of fair

value to any new circumstances. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15,

2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the impact, if any, of adopting SFAS 157 on our

consolidated financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for

Financial Assets and Financial Liabilities" (SFAS 159). SFAS 159 expands opportunities to use fair value measurement in financial

reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. This Statement is

effective for fiscal years beginning after November 15, 2007, or our fiscal year ending August 1, 2009. We have not yet evaluated the

impact, if any, of adopting SFAS 159 on our consolidated financial statements.

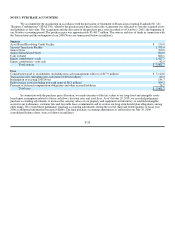

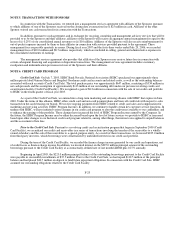

NOTE 2. THE TRANSACTIONS

The Transactions. As discussed in Note 1, the Acquisition was completed on October 6, 2005 and was financed by:

• Borrowings under a senior secured asset-based revolving credit facility (Asset-Based Revolving Credit Facility) and a

secured term loan credit facility (Senior Secured Term Loan Facility) (collectively, the Secured Credit Facilities);

• the issuance of 9.0%/9.75% senior notes due 2015 (Senior Notes);

• the issuance of 10.375% senior subordinated notes due 2015 (Senior Subordinated Notes); and

• equity investments funded by direct and indirect equity investments from the Sponsors, co-investors and management.

The Acquisition occurred simultaneously with:

• the closing of the financing transactions and equity investments described above;

• the call for redemption of, the deposit into a segregated account of the estimated amount of the redemption payment related

to, and the ratable provision of security pursuant to the terms thereof, for our 6.65% senior notes due 2008 (2008 Notes);

• the ratable provision of security to our 7.125% senior debentures due 2028 (2028 Debentures) pursuant to the terms thereof;

and

• the termination of a previous $350 million unsecured revolving credit agreement (Credit Agreement).

We refer to the above transactions, the Acquisition and our payment of any costs related to these transactions collectively herein

as the "Transactions."

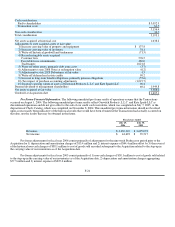

Transaction and Other Costs. During the period from July 30, 2005 to October 1, 2005, the Predecessor expensed $23.5 million in

connection with the Transactions. These costs consisted primarily of $4.5 million of accounting, investment banking, legal and other costs

associated with the Transactions and a $19.0 million non-cash charge for stock compensation resulting from the accelerated vesting of

Predecessor stock options and restricted stock in connection with the Acquisition.

F-19