Neiman Marcus 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXECUTIVE OVERVIEW

The following discussion and analysis of our financial condition and results of operations should be read together with our

audited consolidated financial statements and related notes. Unless otherwise specified, the meanings of all defined terms in

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) are consistent with the meanings of

such terms as defined in the Notes to Consolidated Financial Statements. This discussion contains forward-looking statements. Please see

"Forward-Looking Statements" for a discussion of the risks, uncertainties and assumptions relating to these statements.

Overview

Neiman Marcus, Inc. (the Company), together with our operating segments and subsidiaries, is a high-end specialty retailer. Our

operations include the Specialty Retail stores segment and the Direct Marketing segment. The Specialty Retail stores segment consists

primarily of Neiman Marcus and Bergdorf Goodman stores. The Direct Marketing segment conducts both online operations and print

catalogs under the brand names of Neiman Marcus, Bergdorf Goodman and Horchow.

The Company acquired The Neiman Marcus Group, Inc. (NMG) on October 6, 2005 through a merger transaction with Newton

Acquisition Merger Sub, Inc., a wholly-owned subsidiary of Neiman Marcus, Inc. The acquisition was accomplished through the merger

of the Newton Acquisition Merger Sub, Inc. with and into NMG, with NMG being the surviving entity (the Acquisition). Subsequent to

the Acquisition, NMG is a subsidiary of the Company, which is controlled by Newton Holding, LLC (Holding). Both the Company and

Holding were formed by investment funds affiliated with TPG Capital (formerly Texas Pacific Group) and Warburg Pincus LLC

(collectively, the Sponsors).

Prior to the Acquisition, the Company had no independent assets or operations. After the Acquisition, the Company represents

the Successor to NMG since the Company's sole asset is its investment in NMG and its operations consist solely of the operating

activities of NMG as well as costs incurred by the Company related to its investment in NMG. For periods prior to the Acquisition, NMG

is deemed to be the predecessor to the Company. As a result, for periods prior to the Transactions, the financial statements of the

Company consist of the financial statements of NMG for such periods. The accompanying consolidated statements of earnings and cash

flows present our results of operations and cash flows for the periods preceding the Acquisition (Predecessor) and the periods succeeding

the Acquisition (Successor), respectively. All references to "we" and "our" relate to the Company for periods subsequent to the

Transactions and to NMG for periods prior to the Transactions.

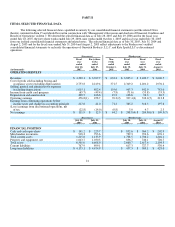

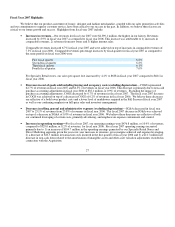

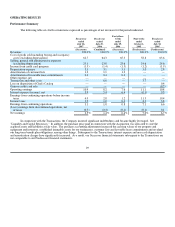

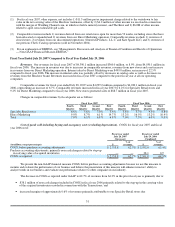

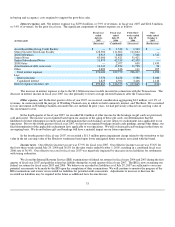

We have prepared our discussion of the results of operations for the fiscal year ended July 29, 2006 by combining the earnings and cash

flows for the Predecessor nine-week period ended October 1, 2005 and the Successor forty-three week period ended July 29, 2006. Although this combined

presentation does not comply with generally accepted accounting principles (GAAP), we believe that it provides a meaningful method of comparison. The

combined operating results have not been prepared on a pro forma basis under applicable regulations and may not reflect the actual results we would have

achieved absent the Transactions.

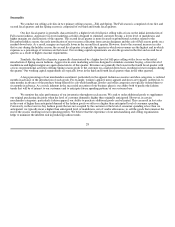

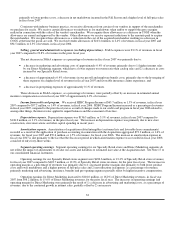

In connection with the Transactions, we incurred significant indebtedness and became highly leveraged. See "Liquidity and

Capital Resources." In addition, the purchase price paid in connection with the Acquisition was allocated to state the acquired assets and

liabilities at fair value at the Acquisition date. The purchase accounting adjustments increased the carrying values of our property and

equipment and inventory, established intangible assets for our tradenames, customer lists and favorable lease commitments and revalued

our long-term benefit plan obligations, among other things. Subsequent to the Transactions, interest expense and non-cash depreciation

and amortization charges have significantly increased. As a result, our successor financial statements subsequent to the Transactions are

not comparable to our predecessor financial statements.

Our fiscal year ends on the Saturday closest to July 31. All references to fiscal year 2007 relate to the 52 weeks ended July 28,

2007; all references to fiscal year 2006 relate to the combined 52 weeks ended July 29, 2006 (calculated as described above) and all

references to fiscal year 2005 relate to the 52 weeks ended July 30, 2005.

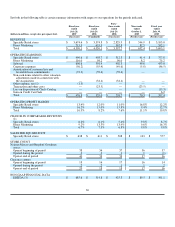

On July 27, 2006, we sold our majority interest in Gurwitch Products, L.L.C. to Alticor Inc., for pretax net cash proceeds of

approximately $40.8 million (Gurwitch Disposition). Gurwitch Products, L.L.C. designs and markets the Laura Mercier cosmetics line

and had annual revenues of approximately $59.0 million (after intercompany eliminations) in fiscal year 2006. The net assets of Gurwitch

Products, L.L.C. were sold for their net carrying value (after purchase accounting adjustments made in connection with the Transactions to state such assets at

fair value).

23