Neiman Marcus 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

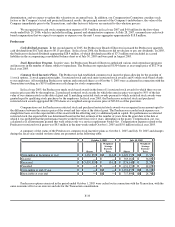

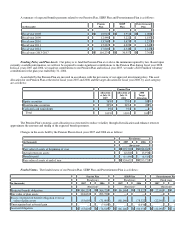

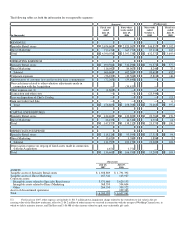

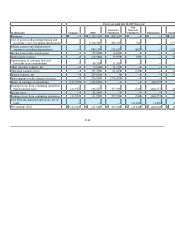

Future minimum rental commitments, excluding renewal options, under non-cancelable leases are as follows: fiscal year 2008—

$54.0 million; fiscal year 2009—$52.5 million; fiscal year 2010—$49.4 million; fiscal year 2011—$48.9 million; fiscal year 2012—

$47.6 million; all fiscal years thereafter—$698.9 million.

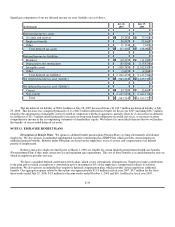

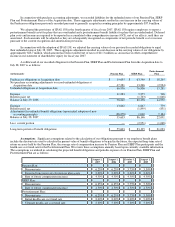

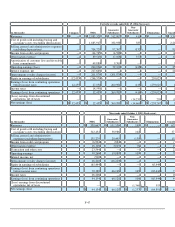

Long-term Incentive Plan. Following the consummation of the Transactions, the Company created a long-term incentive

plan (Long-term Incentive Plan) that provides for a cash incentive payable upon a change of control, as defined, subject to the

attainment of certain performance objectives to employees who had historically been eligible for stock-based compensation programs

of the Predecessor. Performance objectives and targets are based on cumulative EBITDA percentages for three year periods

beginning in fiscal year 2006. Earned awards for each completed performance period will be credited to a book account and will earn

interest at a contractually defined annual rate until the award is paid. Awards will be paid within 30 days of a change of control or the

first day there is a public market of at least 20% of total outstanding common stock.

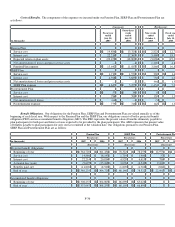

Cash Incentive Plan. Following the consummation of the Transactions, the Company also adopted a cash incentive plan

(Cash Incentive Plan) to aid in the retention of certain key executives. The Cash Incentive Plan provides for the creation of a $14

million cash bonus pool to be shared by all participants based on the number of vested and unvested stock options and underlying

shares that were granted pursuant to the Management Equity Incentive Plan. Each participant in the Cash Incentive Plan will be

entitled to a cash bonus upon the earlier to occur of a change of control or an initial public offering, as defined in the Cash Incentive

Plan, provided that the internal rate of return to the Sponsors is positive.

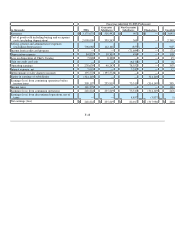

Litigation. We are currently involved in various legal actions and proceedings that arose in the ordinary course of business. We

believe that any liability arising as a result of these actions and proceedings will not have a material adverse effect on our financial

position, results of operations or cash flows.

Other. We had approximately $26.9 million of outstanding irrevocable letters of credit relating to purchase commitments and

insurance and other liabilities at July 28, 2007. We had approximately $4.1 million in surety bonds at July 28, 2007 relating primarily to

merchandise imports, state sales tax and utility requirements.

F-41