Neiman Marcus 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

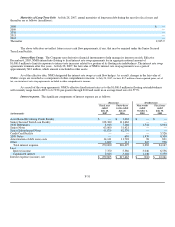

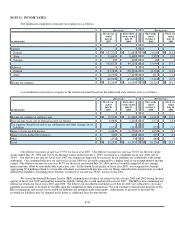

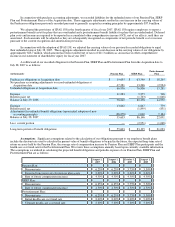

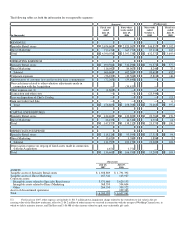

Costs of Benefits. The components of the expenses we incurred under our Pension Plan, SERP Plan and Postretirement Plan are

as follows:

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

July 28,

2007

Forty-three

weeks

ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Pension Plan:

Service cost $ 14,886 $ 13,320 $ 2,823 $ 12,785

Interest cost 22,214 17,365 3,468 18,544

Expected return on plan assets (23,458 ) (18,802 ) (3,636 ) (19,307

Net amortization of losses and prior service costs — — 1,205 4,835

Pension Plan expense $ 13,642 $ 11,883 $ 3,860 $ 16,857

SERP Plan:

Service cost $ 1,719 $ 1,570 $ 330 $ 1,445

Interest cost 4,928 3,685 730 4,057

Net amortization of losses and prior service costs — — 394 1,535

SERP Plan expense $ 6,647 $ 5,255 $ 1,454 $ 7,037

Postretirement Plan:

Service cost $ 57 $ 38 $ 8 $ 57

Interest cost 786 708 139 1,168

Net amortization of losses (64 )— (5 )75

Postretirement expense $ 779 $ 746 $ 142 $ 1,300

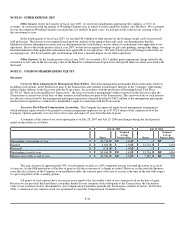

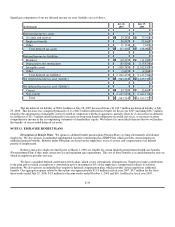

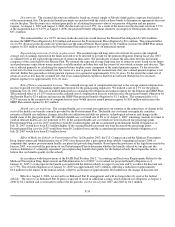

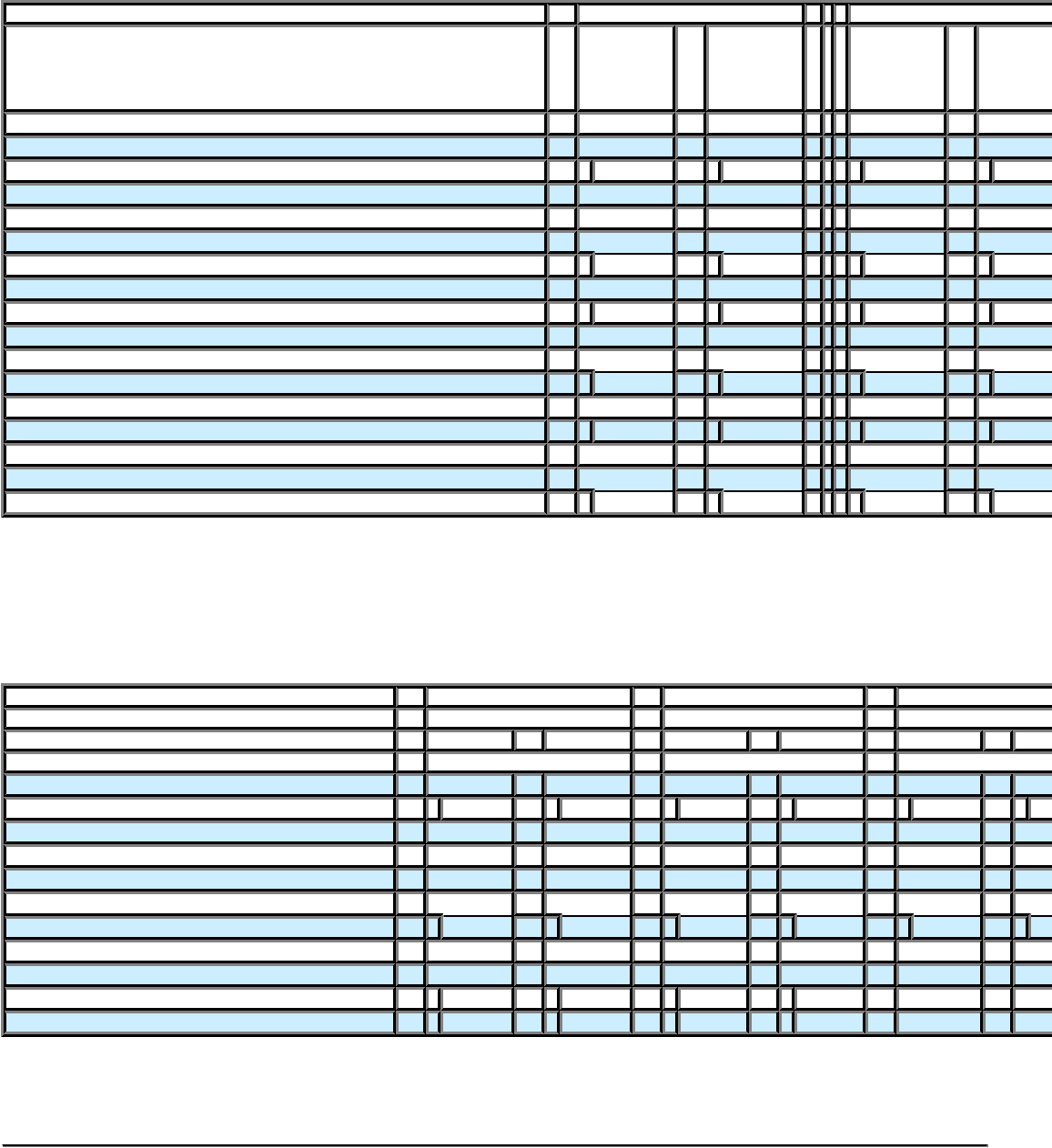

Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the

beginning of each fiscal year. With respect to the Pension Plan and the SERP Plan, our obligations consist of both a projected benefit

obligation (PBO) and an accumulated benefit obligation (ABO). The PBO represents the present value of benefits ultimately payable to

plan participants for both past and future services expected to be provided by the plan participants. The ABO represents the present value

of benefits payable to plan participants for only services rendered at the valuation date. Our obligations pursuant to our Pension Plan,

SERP Plan and Postretirement Plan are as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2007 2006 2007 2006 2007 2006

(Successor) (Successor) (Successor)

Projected benefit obligations:

Beginning of year $ 364,720 $ 361,434 $ 78,322 $ 78,259 $ 12,975 $ 15,755

Service cost 14,886 16,143 1,719 1,900 57

Interest cost 22,214 20,834 4,928 4,415 786

Actuarial loss (gain) (9,695 ) (25,168 ) 3,076 (4,549 ) 9,104 (2,625

Benefits paid, net (11,890 )(8,523 )(1,899 )(1,703 )(831 )(1,048

End of year $ 380,235 $ 364,720 $ 86,146 $ 78,322 $ 22,091 $ 12,975

Accumulated benefit obligations:

Beginning of year $ 308,255 $ 304,063 $ 66,890 $ 65,028

End of year $ 337,047 $ 308,255 $ 68,105 $ 66,890

F-36