Neiman Marcus 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

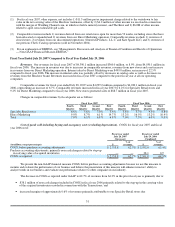

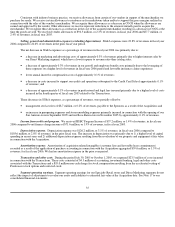

requirements for interest and taxes were partially offset by increases in cash flows generated by our Specialty Retail stores and Direct

Marketing operations given the year-over-year increases in revenues and operating earnings.

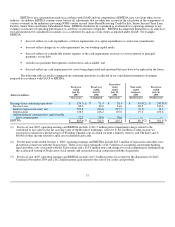

Net cash used for investing activities was $85.9 million in fiscal year 2007 which consisted of 1) capital expenditures of $147.9

million, 2) $121.5 million pretax net cash proceeds received from Liz Claiborne, Inc. for the sale of Kate Spade LLC and 3) the purchase

of the minority interest held in Kate Spade LLC for $59.4 million. Net cash used in investing activities was $5,286.1 million in fiscal

year 2006, which consisted of 1) $5,156.4 million paid in connection with the Acquisition and 2) $163.8 million for capital expenditures,

partially offset by 3) $40.8 million pretax net cash proceeds received in connection with the sale of Gurwitch Products.

We incurred capital expenditures in fiscal year 2007 related to the construction of new stores in Charlotte, Austin and Natick and

the remodel of our Atlanta and San Diego stores. We incurred capital expenditures in fiscal 2006 related to the construction of new stores

in San Antonio and Boca Raton and the remodels of our San Francisco, Houston, Beverly Hills, Newport Beach and Bergdorf Goodman

stores. We opened our San Antonio store in September 2005, our Boca Raton store in November 2005 and our Charlotte store in

September 2006. We opened our Austin store in March 2007 and plan to open the Natick store in September 2007. We currently project

capital expenditures for fiscal year 2008 to be approximately $200 to $210 million.

Net cash used for financing activities was $256.9 million in fiscal year 2007 as compared to net cash provided by financing

activities of $4,257.6 million in fiscal year 2006. In fiscal year 2007, we voluntarily repaid $250.0 million principal amount of the loans

under the Senior Secured Term Loan Facility. In fiscal year 2006, proceeds from debt incurred in connection with the Transactions, net

of issuance costs, aggregated $3,222.1 million and cash equity contributions received in connection with the Transactions aggregated

$1,427.7 million. In fiscal year 2006, we also repaid our $150.0 million of seasonal borrowings under our Asset-Based Revolving Credit

Facility, paid $134.7 million for the redemption of our 2008 Notes pursuant to our call of such notes for redemption in connection with

the Transactions and voluntarily repaid $100.0 million principal amount of borrowings on the Senior Secured Term Loan Facility.

Financing Structure at July 28, 2007

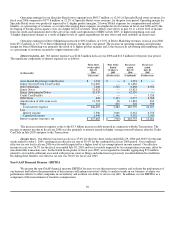

Our major sources of funds are comprised of vendor financing, a $600.0 million Asset-Based Revolving Credit Facility,

$1,625.0 million Senior Secured Term Loan Facility, $700.0 million Senior Notes, $500.0 million Senior Subordinated Notes,

$125.0 million 2028 Debentures and operating leases.

Senior Secured Asset-Based Revolving Credit Facility. On October 6, 2005, in connection with the Transactions, NMG

entered into a credit agreement and related security and other agreements for a senior secured Asset-Based Revolving Credit Facility with

Deutsche Bank Trust Company Americas as administrative agent and collateral agent. The Asset-Based Revolving Credit Facility

provides financing of up to $600.0 million, subject to a borrowing base equal to at any time the lesser of 80% of eligible inventory

(valued at the lower of cost or market value) and 85% of net orderly liquidation value of the eligible inventory, less certain reserves. The

Asset-Based Revolving Credit Facility includes borrowing capacity available for letters of credit and for borrowings on same-day notice.

At the closing of the Transactions, NMG utilized $150.0 million of the Asset-Based Revolving Credit Facility for loans and

approximately $16.5 million for letters of credit. In the second quarter of fiscal year 2006, NMG repaid all loans under the Asset-Based

Revolving Credit Facility.

As of July 28, 2007, NMG had $573.1 million of unused borrowing availability under the Asset-Based Revolving Credit Facility

based on a borrowing base of over $600.0 million and after giving effect to $26.9 million used for letters of credit.

The Asset-Based Revolving Credit Facility provides that NMG has the right at any time to request up to $200.0 million of

additional commitments, but the lenders are under no obligation to provide any such additional commitments, and any increase in

commitments will be subject to customary conditions precedent. If NMG were to request any such additional commitments and the

existing lenders or new lenders were to agree to provide such commitments, the Asset-Based Revolving Credit Facility size could be

increased to up to $800.0 million, but NMG's ability to borrow would still be limited by the amount of the borrowing base.

Borrowings under the Asset-Based Revolving Credit Facility bear interest at a rate per annum equal to, at NMG's option, either

(a) a base rate determined by reference to the higher of (1) the prime rate of Deutsche Bank Trust Company Americas and (2) the federal

funds effective rate plus 1¤2 of 1% or (b) a LIBOR rate, subject to certain adjustments, in each case plus an applicable margin. The initial

applicable margin is 0% with respect to base rate borrowings and 1.75% with respect to

39