Neiman Marcus 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

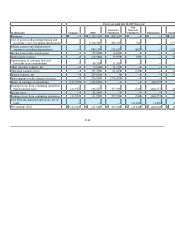

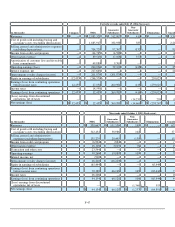

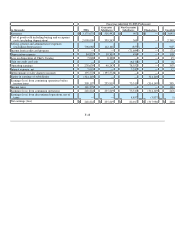

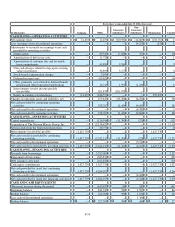

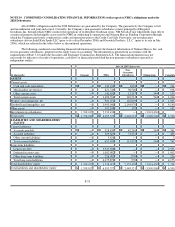

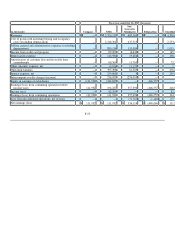

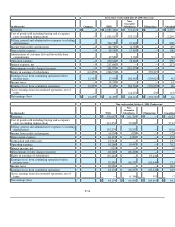

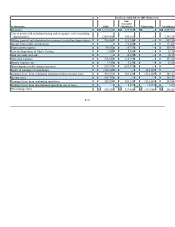

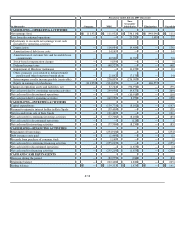

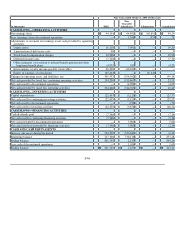

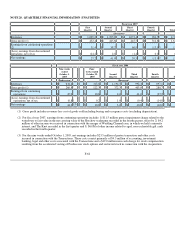

NOTE 19. CONDENSED CONSOLIDATING FINANCIAL INFORMATION (with respect to NMG's obligations under the

2028 Debentures)

All of NMG's obligations under the 2028 Debentures are guaranteed by the Company. The guarantee by the Company is full

and unconditional and joint and several. Currently, the Company's non-guarantor subsidiaries consist principally of Bergdorf

Goodman, Inc. through which NMG conducts the operations of its Bergdorf Goodman stores, NM Nevada Trust which holds legal title to

certain real property and intangible assets used by NMG in conducting its operations and Neiman Marcus Funding Corporation through

which the Company previously conducted its credit card operations prior to the Credit Card Sale. Previously, our non-guarantor

subsidiaries also included Kate Spade LLC (prior to its sale in December 2006) and Gurwitch Products, L.L.C. (prior to its sale in July

2006), which are reflected in the tables below as discontinued operations.

The following condensed consolidating financial information represents the financial information of Neiman Marcus, Inc. and

its non-guarantor subsidiaries, prepared on the equity basis of accounting. The information is presented in accordance with the

requirements of Rule 3-10 under the Securities and Exchange Commission's Regulation S-X. The financial information may not

necessarily be indicative of results of operations, cash flows or financial position had the non-guarantor subsidiaries operated as

independent entities.

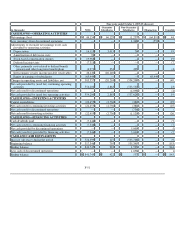

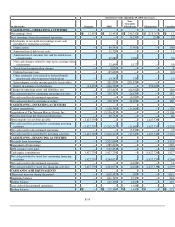

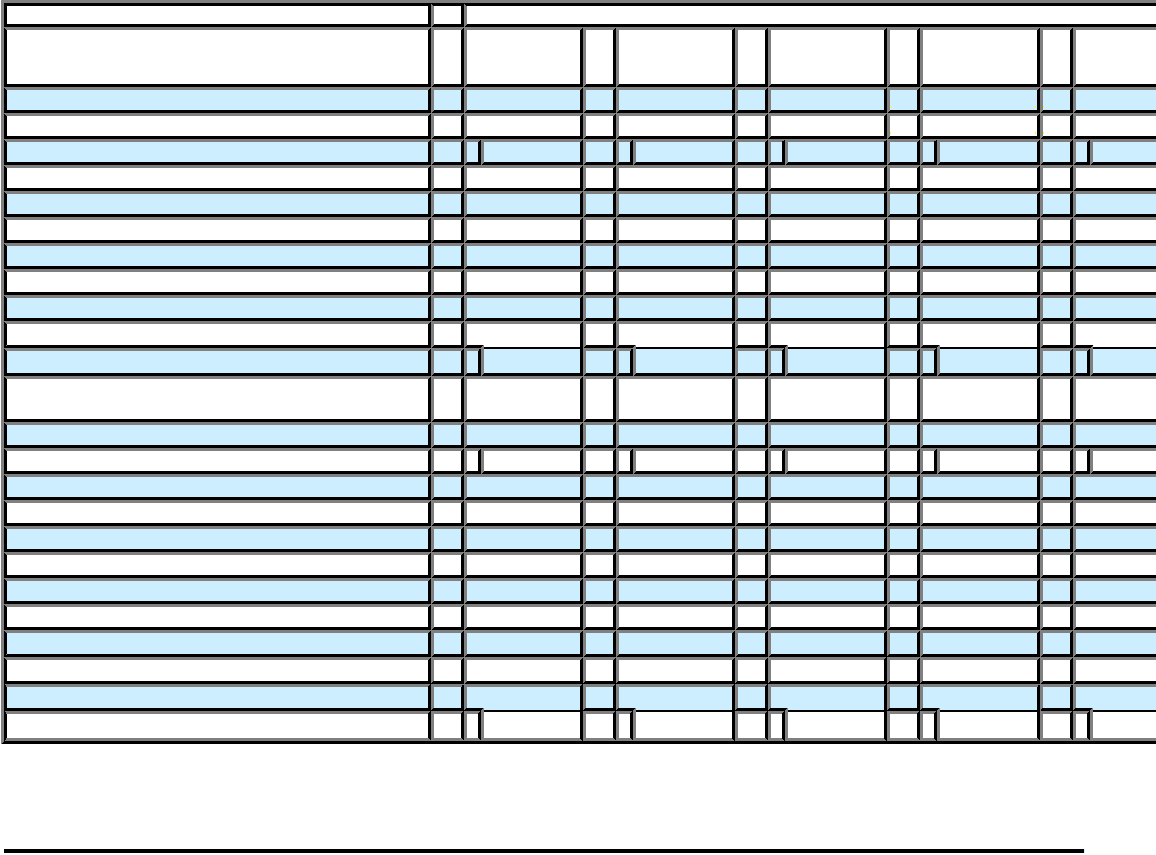

July 28, 2007 (Successor)

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

ASSETS

Current assets:

Cash and cash equivalents $ — $ 139,333 $ 1,874 $ — $ 141,207

Merchandise inventories — 821,749 96,520 — 918,269

Other current assets — 142,632 12,317 544 155,493

Total current assets — 1,103,714 110,711 544 1,214,969

Property and equipment, net — 901,072 142,639 — 1,043,711

Goodwill and intangibles, net — 1,945,040 2,194,979 — 4,140,019

Other assets — 102,108 192 — 102,300

Investments in subsidiaries 1,558,012 2,333,438 — (3,891,450 )

Total assets $ 1,558,012 $ 6,385,372 $ 2,448,521 $ (3,890,906 )$ 6,500,999

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable $ — $ 318,439 $ 42,316 $ 544 $ 361,299

Accrued liabilities — 329,625 73,537 — 403,162

Other current liabilities — 3,426 — — 3,426

Total current liabilities — 651,490 115,853 544 767,887

Long-term liabilities:

Long-term debt — 2,945,906 — — 2,945,906

Deferred income taxes — 1,002,982 — — 1,002,982

Other long-term liabilities — 226,982 (770 )— 226,212

Total long-term liabilities — 4,175,870 (770 )— 4,175,100

Total shareholders' equity 1,558,012 1,558,012 2,333,438 (3,891,450 )1,558,012

Total liabilities and shareholders' equity $ 1,558,012 $ 6,385,372 $ 2,448,521 $ (3,890,906 )$ 6,500,999

F-53