Neiman Marcus 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

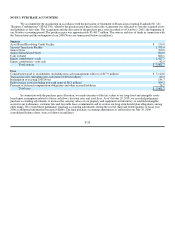

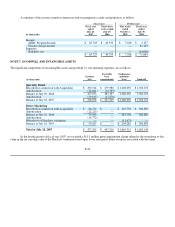

Selling, General and Administrative Expenses (excluding depreciation). Selling, general and administrative expenses are comprised

principally of the costs related to employee compensation and benefits in the selling and administrative support areas, preopening

expenses, advertising and catalog costs and insurance expense.

We receive allowances from certain merchandise vendors in conjunction with compensation programs for employees who sell

the vendors' merchandise. These allowances are netted against the related compensation expense that we incur. Amounts received from

vendors related to compensation programs were $65.4 million in fiscal year 2007, $49.4 million for the forty-three weeks ended July 29,

2006, $10.1 million for the nine weeks ended October 1, 2005 and $53.2 million in fiscal year 2005.

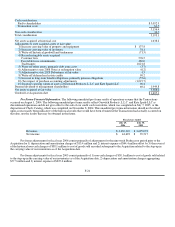

We incur costs to advertise and promote the merchandise assortment offered by both Specialty Retail stores and Direct

Marketing. Advertising costs incurred by our Specialty Retail stores consist primarily of print media costs related to promotional

materials mailed to our customers. These costs are expensed at the time of mailing to the customer. Advertising costs incurred by Direct

Marketing relate to the production, printing and distribution of our print catalogs and the production of the photographic content on our

websites. We amortize the costs of print catalogs during the periods we expect to generate revenues from such catalogs, generally six

months. We expense the costs incurred to produce the photographic content on our websites at the time the images are first loaded onto

the website. We expense website design costs as incurred.

Deferred catalog costs included in other current assets in the consolidated balance sheets were $7.1 million as of July 28, 2007

and $7.0 million as of July 29, 2006. Net advertising expenses were $100.2 million in fiscal year 2007, $95.3 million for the forty-three

weeks ended July 29, 2006, $13.1 million for the nine weeks ended October 1, 2005 and $110.8 million in fiscal year 2005.

Consistent with industry practice, we receive advertising allowances from certain of our merchandise vendors. Substantially all

the advertising allowances we receive represent reimbursements of direct, specific and incremental costs that we incur to promote the

vendor's merchandise in connection with our various advertising programs, primarily catalogs and other print media. As a result, these

allowances are recorded as a reduction of our advertising costs when earned. Vendor allowances earned and recorded as a reduction to

selling, general and administrative expenses aggregated approximately $63.4 million in fiscal year 2007, $43.1 million for the forty-three

weeks ended July 29, 2006, $18.6 million for nine weeks ended October 1, 2005 and $57.5 million in fiscal year 2005.

Preopening expenses primarily consist of payroll and related media costs incurred in connection with store openings and major

renovations and are expensed when incurred. We incurred preopening expenses of $8.8 million in fiscal year 2007, $7.4 million for the

forty-three weeks ended July 29, 2006, $3.9 million for the nine weeks ended October 1, 2005 and $5.9 million in fiscal year 2005.

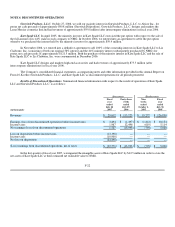

Income from credit card program. We sold our proprietary credit card accounts to HSBC on July 7, 2005 (Credit Card Sale).

As a part of the Credit Card Sale, we entered into a long-term marketing and servicing alliance with HSBC. Under the terms of this

alliance, HSBC offers credit card and non-card payment plans bearing our brands and we receive ongoing payments from HSBC based on

credit card sales and compensation for marketing and servicing activities (HSBC Program Income). We recognize HSBC Program

Income when earned.

Prior to the Credit Card Sale, we extended credit to certain of our customers pursuant to our proprietary retail credit card

program. Our credit card operations generated finance charge income, net of credit losses, which was recognized as income when earned

and we maintained reserves for potential credit losses. We evaluated the collectibility of our accounts receivable based on a combination

of factors, including analysis of historical trends, aging of accounts receivable, write-off experience and expectations of future

performance.

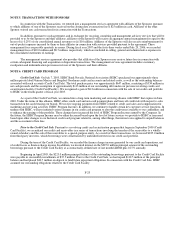

Gift Cards. We sell gift cards at our Specialty Retail stores and through our Direct Marketing operation. Unredeemed gift cards

aggregated $33.1 million at July 28, 2007 and $30.1 million at July 29, 2006. The gift cards sold to our customers have no stated

expiration dates and are subject to actual and/or potential escheatment rights in various of the jurisdictions in which we operate. In the

fourth quarter of fiscal year 2007, we recorded $6.0 million of other income for the breakage on gift cards we previously sold and issued.

The income was recognized based upon our analysis of the aging of these gift cards, our determination that the likelihood of future

redemption is remote and our determination that such balances are not subject to escheatment laws applicable to our operations. Prior to

the fourth quarter of fiscal year 2007, we had not recognized breakage on gift cards pending, among other things, our final determination

of the applicable escheatment laws applicable to our operations. We will evaluate gift card breakage in the future on an ongoing basis.

We do not believe gift card breakage will have a material impact on our future operations.

F-16