Neiman Marcus 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171

|

|

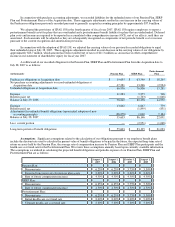

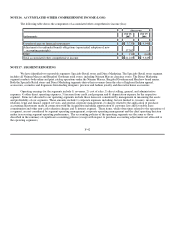

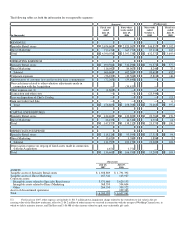

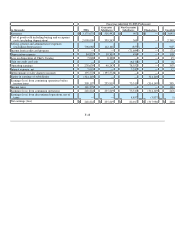

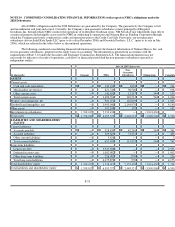

Fiscal year ended July 28, 2007 (Successor)

(in thousands) Company NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 3,700,513 $ 689,563 $ — $ — $ 4,390,076

Cost of goods sold including buying and

occupancy costs (excluding depreciation) — 2,316,301 436,749 764 — 2,753,814

Selling, general and administrative

expenses (excluding depreciation) — 880,136 135,613 (609 ) — 1,015,140

Income from credit card program — (59,090 ) (6,633 ) — — (65,723

Depreciation expense — 116,984 19,099 385 — 136,468

Amortization of customer lists and

favorable lease commitments — 60,500 11,765 — — 72,265

Other (income) expense, net — (9,816 )11,125 — — 1,309

Operating earnings (loss) — 395,498 81,845 (540 ) — 476,803

Interest expense, net — 259,801 4 — — 259,805

Intercompany royalty charges (income) — 276,095 (276,095 ) — —

Equity in earnings of subsidiaries (111,932 )(334,625 )— — 446,557

Earnings (loss) from continuing operations

before income taxes 111,932 194,227 357,936 (540 ) (446,557 ) 216,998

Income taxes — 82,295 — — — 82,295

Earnings (loss) from continuing operations 111,932 111,932 357,936 (540 ) (446,557 ) 134,703

Loss from discontinued operations, net of

taxes — — — (21,282 )(1,489 )(22,771

Net earnings (loss) $ 111,932 $ 111,932 $ 357,936 $ (21,822 )$ (448,046 )$ 111,932

F-46