Neiman Marcus 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

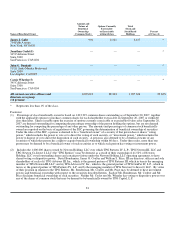

without cause or by the named executive officer for good reason (which includes in most cases, among other things, a reduction in the

named executive officer's base salary or total bonus, a relocation greater than 50 miles from the named executive officer's current

principal place of business or a diminution in the Named Executive Officer's title or primary reporting relationship or substantial

diminution in duties or responsibilities (other than solely as a result of our ceasing to be a publicly held corporation), as those terms

are defined in the agreement, prior to October 6, 2007 the named executive officer will be entitled to receive a lump sum amount equal

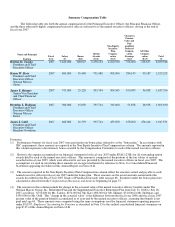

to (a) the sum of two times, or in the case of Mr. Tansky, three times, (1) the officer's annual base salary and (2) his or her annual

target bonus for the year of the termination, and (b) a pro rata target bonus provided that if the named executive officer's employment

terminates after more than 75% of our fiscal year has elapsed, the named executive officer may be entitled to a pro rata portion of the

actual bonus to which he or she would have been entitled if such actual bonus would have been greater than the target bonus and for

purposes of calculating the actual bonus it is assumed that all qualitative and subjective performance criteria were achieved. Payments

to Mr. Tansky and Ms. Katz under their change of control termination protection agreements are in lieu of any severance provided for

in their employment agreements.

If a named executive officer becomes entitled to receive these severance amounts, the named executive officer will also be

entitled to the following:

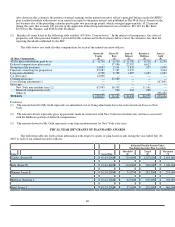

• Deemed participation in and accelerated vesting of benefits under the SERP and a lump sum cash payment equal to the

actuarial equivalent of the incremental benefits payable under the SERP if the named executive officer were credited with

enhanced years of service (two or three years) for purposes of eligibility for participation, eligibility for retirement, for

early commencement of actuarial subsidies and for purposes of benefit accrual (modified as described above for Mr.

Tansky and Ms. Katz);

• Continuing coverage under our group health, dental and life insurance plans for the named executive officer, his or her

spouse and any dependents for two years (three in the case of Mr. Tansky) (any such medical and dental benefits will

become secondary to coverage provided by a subsequent employer) and certain retiree medical coverage benefits; and

• Reimbursement for outplacement expenses and merchandise discounts for the named executive officer, his or her spouse

and dependents.

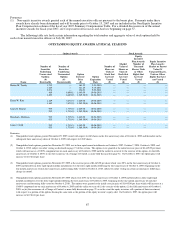

Each agreement also contains a tax gross-up provision whereby if the named executive officer incurs any excise tax by

reason of his or her receipt of any payment that constitutes an excess parachute payment as defined in Section 280G of the Code, the

named executive officer will receive a gross-up payment in an amount that would place the named executive officer in the same after-

tax position that he or she would have been in if no excise tax had applied. However, under certain conditions, rather than receive a

gross-up payment, the payments payable to the named executive officer will be reduced so that no excise tax is imposed. As a

condition to receiving any payments or benefits under the agreements, the officers must execute a release of claims in respect of their

employment with us.

Confidentiality, Non-Competition and Termination Benefits Agreements

In addition to the change of control termination protection agreements, each of the named executive officers and certain

other officers, except for Mr. Tansky and Ms. Katz, are party to a confidentiality, non-competition and termination benefits agreement

that will provide for severance benefits once the change of control termination protection agreements expire if the employment of the

affected individual is terminated by the Company other than in the event of death, disability or termination for cause. These

agreements provide for a severance payment equal to one and one-half annual base salary payable over an eighteen month period, and

reimbursement for COBRA premiums for the same period. Each of the confidentiality, non-competition, termination benefits

agreement contains restrictive covenants as a condition to receipt of any payments payable thereunder.

73