Neiman Marcus 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with our agreement with HSBC, we have changed and may continue to change, the terms of credit offered to our

customers. In addition, HSBC will have discretion over certain policies and arrangements with credit card customers and may change

these policies and arrangements in ways that affect our relationship with these customers. Any such changes in our credit card

arrangements may adversely affect our credit card program and ultimately, our business.

Historically, our customers holding a proprietary credit card have tended to shop more frequently and have a higher level of

spending than customers paying with cash or third-party credit cards. In fiscal years 2007 and 2006, approximately 55% of our revenues

were transacted through our proprietary credit cards.

We utilize data captured through our proprietary credit card program in connection with promotional events and customer

relationship programs targeting specific customers based upon their past spending patterns for certain brands, merchandise categories and

store locations.

Integrated Multi-Channel Model. We offer products through our complementary Direct Marketing and Specialty Retail

businesses, which enables us to maximize our brand recognition and strengthen our customer relationships across all channels. Our well-

established catalog and online operation expands our reach beyond the trading area of our retail stores, as over 40% of our Direct

Marketing customers in fiscal years 2007 and 2006 were located outside of the trade areas of our existing retail locations. We also use our

catalogs and e-commerce websites as selling and marketing tools to increase the visibility and exposure of our brand and generate

customer traffic within our retail stores. We believe the combination of our retail stores and direct selling efforts is the main reason that

our multi-channel customers spend more on average than our single-channel customers (over 3 times more in each of fiscal year 2007 and

fiscal year 2006).

Merchandise

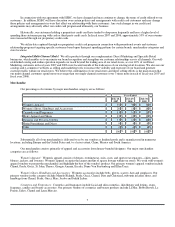

Our percentages of revenues by major merchandise category are as follows:

Years Ended

July 28,

2007

July 29,

2006

July 30,

2005

Women's Apparel 37 % 38 % 36 %

Women's Shoes, Handbags and Accessories 20 % 18 % 18 %

Cosmetics and Fragrances 11 % 11 % 11 %

Men's Apparel and Shoes 12 % 13 % 12 %

Designer and Precious Jewelry 11 % 11 % 10 %

Home Furnishings and Décor 9 % 9 % 9 %

Other 0%0%4%

100 %100 %100 %

Substantially all of our merchandise is delivered to us by our vendors as finished goods and is manufactured in numerous

locations, including Europe and the United States and, to a lesser extent, China, Mexico and South America.

Our merchandise consists primarily of apparel and accessories from luxury-branded designers. Our major merchandise

categories are as follows:

Women's Apparel: Women's apparel consists of dresses, eveningwear, suits, coats, and sportswear separates—skirts, pants,

blouses, jackets, and sweaters. Women's apparel occupies the largest amount of square footage within our stores. We work with women's

apparel vendors to present the merchandise and highlight the best of the vendor's product. Our primary women's apparel vendors include

Chanel, Prada, Gucci, St. John, Theory, Giorgio Armani, Escada, Diane Von Furstenberg and Ellen Tracy.

Women's Shoes, Handbags and Accessories: Women's accessories include belts, gloves, scarves, hats and sunglasses. Our

primary vendors in this category include Manolo Blahnik, Prada, Gucci, Chanel, Dior and Christian Louboutin in ladies shoes, and

handbags from Chanel, Prada, Gucci, Marc Jacobs and Judith Leiber.

Cosmetics and Fragrances: Cosmetics and fragrances include facial and skin cosmetics, skin therapy and lotions, soaps,

fragrance, candles and beauty accessories. Our primary vendors of cosmetics and beauty products include La Mer, Bobbi Brown, La

Prairie, Sisley, Chanel and Laura Mercier.

7