Neiman Marcus 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

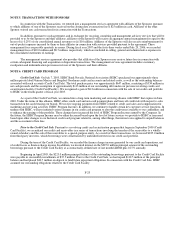

plus an applicable margin. The initial applicable margin is 0% with respect to base rate borrowings and 1.75% with respect to LIBOR

borrowings. The applicable margin is subject to adjustment based on the historical availability under the Asset-Based Revolving Credit

Facility. In addition, NMG is required to pay a commitment fee of 0.375% per annum in respect of the unutilized commitments. If the

average revolving loan utilization is 50% or more for any applicable period, the commitment fee will be reduced to 0.250% for such

period. NMG must also pay customary letter of credit fees and agency fees.

If at any time the aggregate amount of outstanding loans, unreimbursed letter of credit drawings and undrawn letters of credit

under the Asset-Based Revolving Credit Facility exceeds the lesser of (i) the commitment amount and (ii) the borrowing base, NMG will

be required to repay outstanding loans or cash collateralize letters of credit in an aggregate amount equal to such excess, with no reduction

of the commitment amount. If the amount available under the Asset-Based Revolving Credit Facility is less than $60 million or an event

of default has occurred, NMG will be required to repay outstanding loans and cash collateralize letters of credit with the cash NMG

would then be required to deposit daily in a collection account maintained with the agent under the Asset-Based Revolving Credit

Facility. NMG may voluntarily reduce the unutilized portion of the commitment amount and repay outstanding loans at any time without

premium or penalty other than customary "breakage" costs with respect to LIBOR loans. There is no scheduled amortization under the

Asset-Based Revolving Credit Facility; the principal amount of the loans outstanding is due and payable in full on October 6, 2010.

All obligations under the Asset-Based Revolving Credit Facility are guaranteed by the Company and certain of NMG's existing

and future domestic subsidiaries. As of July 28, 2007, the liabilities of NMG's non-guarantor subsidiaries totaled approximately

$4.3 million, or 0.1% of consolidated liabilities, and the assets of NMG's non-guarantor subsidiaries aggregated approximately

$6.5 million, or 0.1% of consolidated total assets. All obligations under NMG's Asset-Based Revolving Credit Facility, and the

guarantees of those obligations, are secured, subject to certain significant exceptions, by substantially all of the assets of the Company,

NMG and the subsidiaries that have guaranteed the Asset-Based Revolving Credit Facility (subsidiary guarantors), including:

• a first-priority security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all

payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in

respect of all credit card charges for sales of inventory by NMG and the subsidiary guarantors, certain related assets and

proceeds of the foregoing; and

• a second-priority pledge of 100% of NMG's capital stock and certain of the capital stock held by NMG, the Company or

any subsidiary guarantor (which pledge, in the case of any foreign subsidiary is limited to 100% of the non-voting stock (if

any) and 65% of the voting stock of such foreign subsidiary); and

• a second-priority security interest in, and mortgages on, substantially all other tangible and intangible assets of NMG, the

Company and each subsidiary guarantor, including a significant portion of NMG's owned and leased real property (which

currently consists of approximately half of NMG's full-line retail stores) and equipment.

Capital stock and other securities of a subsidiary of NMG that are owned by NMG or any subsidiary guarantor will not

constitute collateral under NMG's Asset-Based Revolving Credit Facility to the extent that such securities cannot secure NMG's 2028

Debentures or other secured public debt obligations without requiring the preparation and filing of separate financial statements of such

subsidiary in accordance with applicable Securities and Exchange Commission's rules. As a result, the collateral under NMG's Asset-

Based Revolving Credit Facility will include shares of capital stock or other securities of subsidiaries of NMG or any subsidiary guarantor

only to the extent that the applicable value of such securities (on a subsidiary-by-subsidiary basis) is less than 20% of the aggregate

principal amount of the 2028 Debentures or other secured public debt obligations of NMG.

The Asset-Based Revolving Credit Facility contains a number of covenants that, among other things and subject to certain

significant exceptions, restrict its ability and the ability of its subsidiaries to:

• incur additional indebtedness;

• pay dividends on NMG's capital stock or redeem, repurchase or retire NMG's capital stock or indebtedness;

• make investments, loans, advances and acquisitions;

• create restrictions on the payment of dividends or other amounts to NMG from its subsidiaries that are not guarantors;

F-26