Neiman Marcus 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in Kate Spade LLC and the sale of Kate Spade LLC to Liz Claiborne, Inc. were consummated in December 2006.

Kate Spade LLC designs and markets high-end accessories and had revenues of approximately $75.5 million (after

intercompany eliminations) in fiscal year 2006. Fiscal year 2007 revenues of Kate Spade LLC through its disposition in December

2006 aggregated $29.6 million.

The Company's consolidated financial statements, accompanying notes and other information provided in this Annual Report on

Form 10-K reflect Gurwitch Products, L.L.C. and Kate Spade LLC as discontinued operations for all periods presented.

Recent Developments

On September 6, 2007, we announced preliminary total revenues and comparable revenues of approximately $282.6 million and

$276.3 million, respectively, for the four-week August period of fiscal year 2008, representing increases of 7.0% and 4.6%, respectively,

compared to the four-week August period of fiscal year 2007. For the four-week August period of fiscal year 2008, comparable revenues

increased 5.0% in our Specialty Retail stores and 2.5% in Direct Marketing.

All the financial data set forth above for the four-week August period of fiscal year 2008 are preliminary and unaudited and

subject to revision based upon our review and a review by our independent registered public accounting firm of our financial condition

and results of operations for the quarter ending October 27, 2007. Once we and our independent registered public accounting firm have

completed our respective reviews of our financial information for the quarter ending October 27, 2007, we may report financial results

that are different from those set forth above.

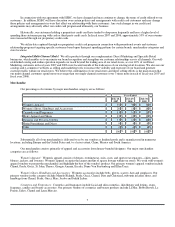

Industry Overview

We operate in the luxury apparel and accessories segment of the U.S. retail industry and have arrangements with luxury-branded

fashion vendors, including, but not limited to, Chanel, Prada, Giorgio Armani, David Yurman, St. John, Gucci, Ermenegildo Zegna,

Theory, Manolo Blahnik and Brioni to market and sell their merchandise. Luxury-branded fashion vendors typically manage the

distribution and marketing of their merchandise to maximize the perception of brand exclusivity and to facilitate the sale of their goods at

premium prices, including limitations on the number of retail locations through which they distribute their merchandise. These retail

locations typically consist of a limited number of specialty stores, high-end department stores and, in some instances, vendor-owned

proprietary boutiques. Retailers that compete with us for the distribution of luxury fashion brands include Saks Fifth Avenue, Nordstrom,

Barney's New York and other national, regional and local retailers.

We believe that the following factors benefit well-positioned luxury retailers:

• attractive demographic trends, including increasing wealth concentration and an aging baby boomer population;

• growing consumer demand for prestige brands and exclusive products;

• retail consumption patterns of affluent consumers that are generally less influenced by economic cycles than middle or

lower income consumers;

• higher price points and limited distribution of luxury merchandise, which have generally protected high-end specialty

retailing from the growth of discounters and mass merchandisers;

• aggressive marketing by luxury brands; and

• consumer trends towards aspirational lifestyles.

Customer Service and Marketing

We are committed to providing our customers with a premier shopping experience through our relationship-based customer

service model, with superior merchandise selection and elegant store settings of our stores. Critical elements to our customer service

approach are:

5