Neiman Marcus 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

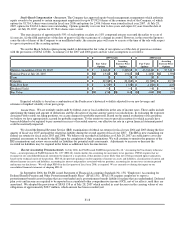

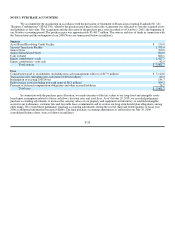

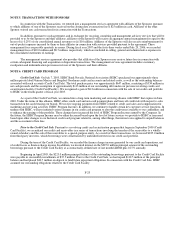

NOTE 3. PURCHASE ACCOUNTING

We accounted for the Acquisition in accordance with the provisions of Statement of Financial Accounting Standards No. 141

"Business Combinations" (SFAS 141), whereby the purchase price paid to effect the Acquisition was allocated to state the acquired assets

and liabilities at fair value. The Acquisition and the allocation of the purchase price were recorded as of October 1, 2005, the beginning of

our October accounting period. The purchase price was approximately $5,461.7 million. The sources and uses of funds in connection with

the Transactions and the redemption of our 2008 Notes are summarized below (in millions):

Sources

Asset-Based Revolving Credit Facility $ 150.0

Secured Term Loan Facility 1,975.0

Senior Notes 700.0

Senior Subordinated Notes 500.0

Cash on hand 666.1

Equity contribution—cash 1,427.7

Equity contribution—non-cash 42.9

Total sources $ 5,461.7

Uses

Consideration paid to stockholders (including non-cash management rollover of $17.9 million) $ 5,110.8

Transaction costs (including non-cash items of $18.8 million) 82.3

Redemption of existing 2008 Notes 134.7

Debt issuance costs (including non-cash items of $6.3 million) 109.2

Payment of deferred compensation obligations and other accrued liabilities 24.7

Total uses $ 5,461.7

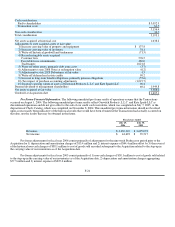

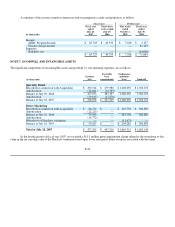

In connection with the purchase price allocation, we made estimates of the fair values of our long-lived and intangible assets

based upon assumptions related to future cash flows, discount rates and asset lives. As of October 29, 2005, we recorded preliminary

purchase accounting adjustments to increase the carrying values of our property and equipment and inventory, to establish intangible

assets for our tradenames, customer lists and favorable lease commitments and to revalue our long-term benefit plan obligations, among

other things. We revised these preliminary purchase accounting adjustments during the second, third and fourth quarters of fiscal year

2006 as additional information became available. The final purchase accounting adjustments, as reflected in our July 29, 2006

consolidated balance sheet, were as follows (in millions):

F-20