Neiman Marcus 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

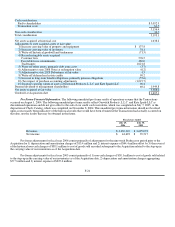

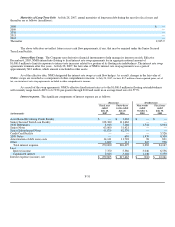

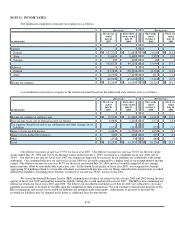

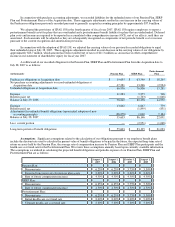

Maturities of Long-Term Debt. At July 28, 2007, annual maturities of long-term debt during the next five fiscal years and

thereafter are as follows (in millions):

2008 $ —

2009 —

2010 —

2011 —

2012 —

Thereafter 2,945.9

The above table does not reflect future excess cash flow prepayments, if any, that may be required under the Senior Secured

Term Loan Facility.

Interest Rate Swaps. The Company uses derivative financial instruments to help manage its interest rate risk. Effective

December 6, 2005, NMG entered into floating to fixed interest rate swap agreements for an aggregate notional amount of

$1,000.0 million to limit its exposure to interest rate increases related to a portion of its floating rate indebtedness. The interest rate swap

agreements terminate after five years. At July 28, 2007, the fair value of NMG's interest rate swap agreements was a gain of

approximately $8.2 million, which amount is included in other assets.

As of the effective date, NMG designated the interest rate swaps as cash flow hedges. As a result, changes in the fair value of

NMG's swaps are recorded as a component of other comprehensive income. At July 28, 2007, we have $3.7 million of unrecognized gains, net of

tax, on our interest rate swap agreements included in other comprehensive income.

As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in floating rate indebtedness

will currently range from 6.482% to 6.733% per quarter through 2010 and result in an average fixed rate of 6.577%.

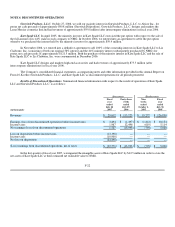

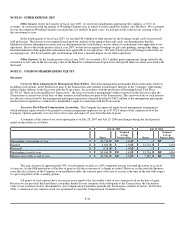

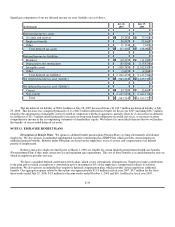

Interest expense. The significant components of interest expense are as follows:

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Asset-Based Revolving Credit Facility $ — $ 1,332 $ — $ —

Senior Secured Term Loan Facility 128,380 111,662 — —

2028 Debentures 8,915 7,266 1,542 8,904

Senior Notes 63,000 51,421 — —

Senior Subordinated Notes 51,875 42,339 — —

Credit Card Facility — — — 5,526

2008 Notes — 638 1,439 8,308

Amortization of debt issue costs 14,141 11,728 96 831

Other 3,689 111 205 598

Total interest expense 270,000 226,497 3,282 24,167

Less:

Interest income 7,370 5,386 3,046 6,556

Capitalized interest 2,825 3,446 1,146 5,350

Interest expense (income), net $ 259,805 $ 217,665 $ (910)$ 12,261

F-31