Neiman Marcus 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

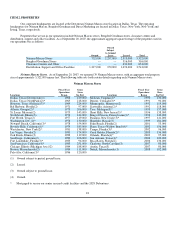

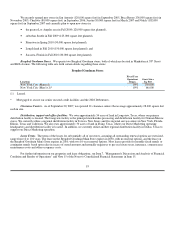

PART II

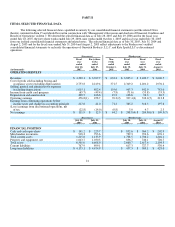

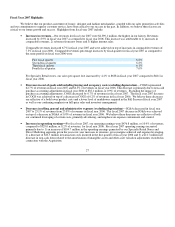

ITEM 6. SELECTED FINANCIAL DATA

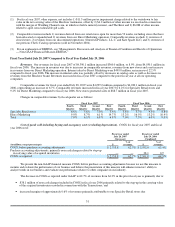

The following selected financial data is qualified in entirety by our consolidated financial statements (and the related Notes

thereto) contained in Item 15 and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and

Results of Operations" in Item 7. We derived the selected financial data as of July 28, 2007 and July 29, 2006 and for the fiscal year

ended July 28, 2007, the forty-three weeks ended July 29, 2006, nine weeks ended October 1, 2005 and fiscal year ended July 30, 2005

from our audited consolidated financial statements and related notes. The selected financial data as of July 30, 2005, July 31, 2004 and

August 2, 2003 and for the fiscal years ended July 31, 2004 and August 2, 2003 reflect adjustments to the Predecessor's audited

consolidated financial statements to reclassify the operations of Gurwitch Products, L.L.C. and Kate Spade LLC as discontinued

operations.

(Successor) (Predecessor)

(in thousands)

Fiscal

year

ended

July 28,

2007

Forty-three

weeks

ended

July 29,

2006

Nine

weeks

ended

October 1,

2005

Fiscal

year

ended

July 30,

2005

Fiscal

year

ended

July 31,

2004

Fiscal

year

ended

August 2,

2003

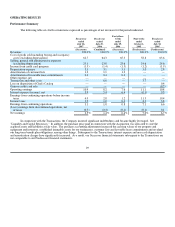

OPERATING RESULTS

Revenues $ 4,390.1 $ 3,397.7 $ 632.4 $ 3,695.1 $ 3,420.7 $ 3,000.5

Cost of goods sold including buying and

occupancy costs (excluding depreciation) 2,753.8 2,219.4 371.5 2,349.2 2,201.2 1,976.2

Selling, general and administrative expenses

(excluding depreciation) 1,015.1 802.4 155.6 907.3 842.9 783.0

Income from credit card program (65.7) (49.4) (7.8) (71.6) (55.8) (53.3)

Depreciation and amortization 208.7 166.6 19.2 103.6 96.3 80.7

Operating earnings 476.8(1) 258.7 70.3(2) 397.4(3) 332.2(5) 213.8

Earnings from continuing operations before

income taxes and change in accounting principle 217.0 41.0 71.2 385.2 316.3 197.6

(Loss) earnings from discontinued operations, net

of tax (22.8) (14.0) (0.8) 5.0 4.7 2.5

Net earnings $ 111.9 $ 12.5 $ 44.2 $ 248.8(4) $ 204.8(6) $ 109.3(7)

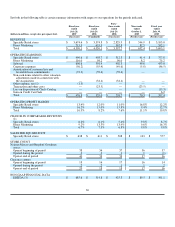

(Successor) (Predecessor)

July 28,

2007

July 29,

2006

July 30,

2005

July 31,

2004

August 2,

2003

FINANCIAL POSITION

Cash and cash equivalents $ 141.2 $ 223.7 $ 852.6 $ 364.2 $ 202.9

Merchandise inventories 918.3 793.6 729.3 703.6 676.1

Total current assets 1,215.0 1,135.9 1,708.5 1,706.2 1,246.1

Property and equipment, net 1,043.7 1,030.3 836.7 740.1 726.7

Total assets 6,501.0 6,608.0 2,660.7 2,617.6 2,104.5

Current liabilities 767.9 699.1 617.3 727.7 530.4

Long-term liabilities $ 4,175.1 $ 4,474.9 $ 457.3 $ 509.1 $ 428.0

21