Neiman Marcus 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

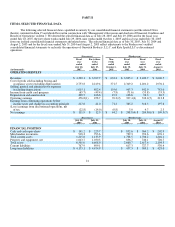

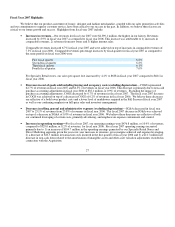

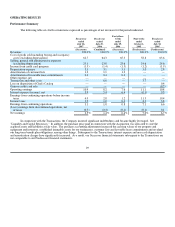

OPERATING RESULTS

Performance Summary

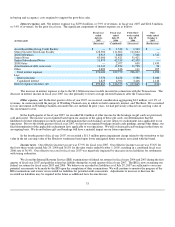

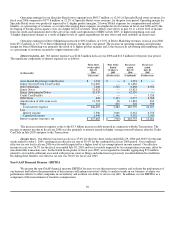

The following table sets forth certain items expressed as percentages of net revenues for the periods indicated.

Fiscal year

ended

July 28,

2007

Fiscal year

ended

July 29,

2006

Forty-three

weeks

ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

(Successor) (Combined) (Successor) (Predecessor) (Predecessor)

Revenues 100.0% 100.0% 100.0% 100.0% 100.0%

Cost of goods sold including buying and occupancy

costs (excluding depreciation) 62.7 64.3 65.3 58.8 63.6

Selling, general and administrative expenses

(excluding depreciation) 23.1 23.8 23.6 24.6 24.6

Income from credit card program (1.5) (1.4) (1.5) (1.2) (1.9)

Depreciation expense 3.1 3.1 3.1 3.0 2.8

Amortization of customer lists 1.2 1.1 1.3 — —

Amortization of favorable lease commitments 0.4 0.4 0.4 — —

Other expense, net — — — — —

Transaction and other costs — 0.6 — 3.7 —

Loss on disposition of Chef's Catalog — — — — 0.4

Gain on credit card sale — — — — (0.2)

Operating earnings 10.9 8.2 7.6 11.1 10.8

Interest expense (income), net 5.9 5.4 6.4 (0.1)0.3

Earnings from continuing operations before income

taxes 4.9 2.8 1.2 11.3 10.4

Income taxes 1.9 1.0 0.4 4.1 3.8

Earnings from continuing operations 3.1 1.8 0.8 7.1 6.6

(Loss) earnings from discontinued operations, net

of taxes (0.5)(0.4)(0.4) (0.1)0.1

Net earnings 2.5%1.4%0.4% 7.0%6.7%

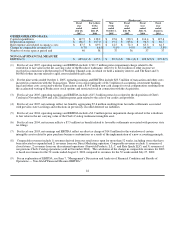

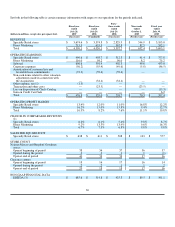

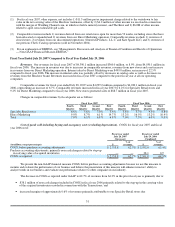

In connection with the Transactions, the Company incurred significant indebtedness and became highly leveraged. See

"Liquidity and Capital Resources." In addition, the purchase price paid in connection with the Acquisition was allocated to state the

acquired assets and liabilities at fair value. The purchase accounting adjustments increased the carrying values of our property and

equipment and inventory, established intangible assets for our tradenames, customer lists and favorable lease commitments and revalued

our long-term benefit plan obligations, among other things. Subsequent to the Transactions, interest expense and non-cash depreciation

and amortization charges have significantly increased. As a result, our Successor financial statements subsequent to the Transactions are

not comparable to our Predecessor financial statements.

29