Neiman Marcus 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

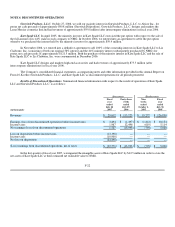

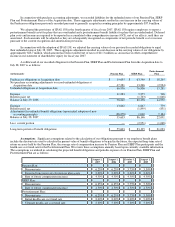

NOTE 10. OTHER EXPENSE, NET

Other Income. In the first quarter of fiscal year 2007, we received consideration aggregating $4.2 million, or 0.1% of

revenues, in connection with the merger of Wedding Channel.com, in which we held a minority interest, and The Knot. We accounted

for our investment in Wedding Channel.com under the cost method. In prior years, we had previously reduced our carrying value of

this investment to zero.

In the fourth quarter of fiscal year 2007, we recorded $6.0 million of other income for the breakage on gift cards we previously

sold and issued. The income was recognized based upon our analysis of the aging of these gift cards, our determination that the

likelihood of future redemption is remote and our determination that such balances are not subject to escheatment laws applicable to our

operations. Prior to the fourth quarter of fiscal year 2007, we had not recognized breakage on gift cards pending, among other things, our

final determination of the applicable escheatment laws applicable to our operations. We will evaluate gift card breakage in the future on

an ongoing basis. We do not believe gift card breakage will have a material impact on our future operations.

Other Expense. In the fourth quarter of fiscal year 2007, we recorded a $11.5 million pretax impairment charge related to the

writedown to fair value in the net carrying value of the Horchow tradename based upon lower anticipated future revenues associated with

the brand.

NOTE 11. COMMON SHAREHOLDERS' EQUITY

Successor

Carryover Basis Adjustment for Management Shareholders. Executive management participants held certain equity interests,

including stock options, in the Predecessor prior to the Transactions and continue to hold equity interests in the Company, representing

indirect equity interests in the Successor after the Transactions. In accordance with the provisions of Emerging Issues Task Force

No. 88-16, "Basis in Leveraged Buyout Transactions," the basis of executive management's indirect interests in the Successor after the

Transactions is carried over at the basis of their interests in the Predecessor prior to the Transactions. The carryover basis of such interests

less the net cash received by the management participants represents a deemed dividend of $69.2 million to the management participants

and has been recognized as a reduction to shareholders' equity in connection with the Transactions.

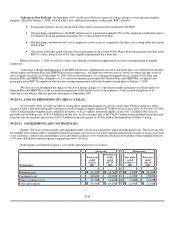

Successor Stock-Based Compensation Accounting. The Company has approved equity-based management arrangements

which authorize equity awards to be granted to certain management employees for up to 87,992.0 shares of the common stock of the

Company. Options generally vest over four to five years and expire 10 years from the date of grant.

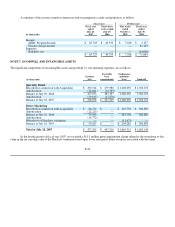

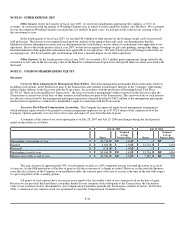

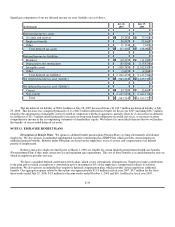

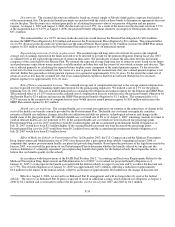

A summary of the status of our stock option plan as of July 28, 2007 and July 29, 2006 and changes during the fiscal periods

ended on these dates is as follows:

July 28, 2007 July 29, 2006

Shares

Weighted

Average

Exercise Price Shares

Weighted

Average

Exercise Price

Outstanding at beginning of year 81,716.3 $ 1,416 — $ —

Granted 2,496.0 1,942 81,716.3 1,416

Exercised (578.0 )1,590 — —

Outstanding at end of year 83,634.3 $ 1,430 81,716.3 $ 1,416

Options exercisable at end of year 29,764.1 $ 1,233 7,283.3 $ 359

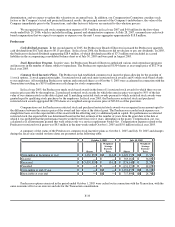

The exercise price of approximately 50% of such options escalate at a 10% compound rate per year until the earlier to occur of

(i) exercise, (ii) the fifth anniversary of the date of grant or (iii) the occurrence of a change in control. However, in the event the Sponsors

cause the sale of shares of the Company to an unaffiliated entity, the exercise price will cease to accrete at the time of the sale with respect

to a pro rata portion of the accreting options.

All grants of stock options have an exercise price equal to the fair market value of our common stock on the date of grant.

Because we are privately held and there is no public market for our common stock subsequent to the Transactions, the fair market

value of our common stock is determined by our Compensation Committee periodically based upon a number of factors. In October

2006, a valuation of our common stock was performed to assist the Compensation Committee in this

F-32