Neiman Marcus 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

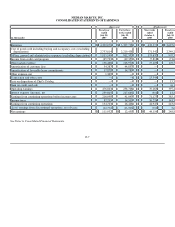

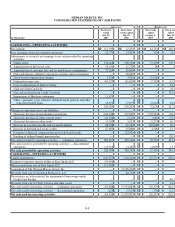

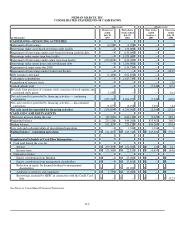

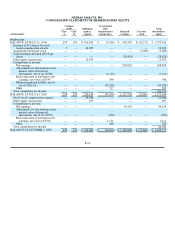

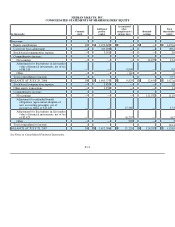

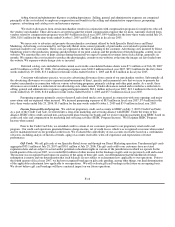

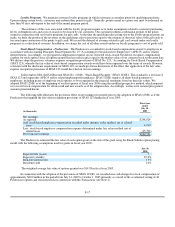

NEIMAN MARCUS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Successor) (Predecessor)

(in thousands)

Fiscal year

ended

July 28,

2007

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

CASH FLOWS—OPERATING ACTIVITIES

Net earnings $ 111,932 $ 12,455 $ 44,154 $ 248,824

Loss (earnings) from discontinued operations 22,771 13,993 793 (5,020

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation 136,468 106,950 19,209 103,589

Amortization of debt issue costs 14,141 11,728 96 831

Amortization of customer lists and favorable lease commitments 72,265 59,640 — —

Non-cash charges related to step-up in carrying value of inventory — 38,067 — —

Stock-based compensation charges 5,859 3,951 19,968 —

Deferred income taxes (60,522 ) (65,620 ) (7,318 ) (15,925

Loss on disposition of Chef's Catalog — — — 15,348

Gain on Credit Card Sale — — — (6,170

Net cash received from Credit Card Sale — — — 533,656

Impairment of Horchow tradename 11,473 — — —

Other—primarily costs related to defined benefit pension and other

long-term benefit plans 14,672 15,079 (4,224 )42,068

329,059 196,243 72,678 917,201

Changes in operating assets and liabilities:

(Increase) decrease in merchandise inventories (124,648 ) 107,829 (172,924 ) (36,016

(Increase) decrease in other current assets (45,392 ) 2,117 (881 ) (73,924

(Increase) decrease in other assets (3,333 ) 5,627 (2,274 ) 10,743

Increase in accounts payable and accrued liabilities 86,256 61,163 122,608 20,112

Increase in deferred real estate credits 27,885 25,068 4,326 13,782

Payment of deferred compensation and stock-based awards — (12,901 ) — —

Funding of defined benefit pension plan — — — (20,000

Net cash provided by operating activities — continuing operations 269,827 385,146 23,533 831,898

Net cash (used for) provided by operating activities — discontinued

operations (10,918 )(4,381 ) (4,098 )13,502

Net cash provided by operating activities 258,909 380,765 19,435 845,400

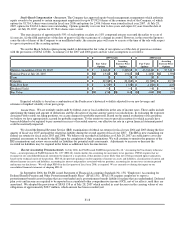

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (147,877 ) (138,212 ) (25,575 ) (190,255

Payment to minority interest holder in Kate Spade LLC (59,400 ) — — —

Net proceeds from sale of Kate Spade LLC 121,469 — — —

Acquisition of The Neiman Marcus Group, Inc. — (5,156,423 ) — —

Proceeds from sale of Gurwitch Products, L.L.C. — 40,752 — —

Net increase in cash restricted for repayment of borrowings under

Credit Card Facility — — — (40,713

Proceeds from sale of Chef's Catalog and other assets — — — 14,419

Net cash used for investing activities — continuing operations (85,808 ) (5,253,883 ) (25,575 ) (216,549

Net cash used for investing activities — discontinued operations (128 )(5,919 ) (736 )(12,280

Net cash used for investing activities (85,936 )(5,259,802 ) (26,311 )(228,829

F-8