Neiman Marcus 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Long-lived Assets. Property and equipment are stated at cost less accumulated depreciation. For financial reporting purposes,

we compute depreciation principally using the straight-line method over the estimated useful lives of the assets. Buildings and

improvements are depreciated over five to 30 years while fixtures and equipment are depreciated over three to 15 years. Leasehold

improvements are amortized over the shorter of the asset life or the lease term. Costs incurred for the development of internal computer

software are capitalized and amortized using the straight-line method over three to ten years.

To the extent that we remodel or otherwise replace or dispose of property and equipment prior to the end of the assigned

depreciable lives, we could realize a loss or gain on the disposition. To the extent assets continue to be used beyond their assigned

depreciable lives, no depreciation expense is incurred. We reassess the depreciable lives of our long-lived assets in an effort to reduce the

risk of significant losses or gains at disposition and the utilization of assets with no depreciation charges. The reassessment of depreciable

lives involves utilizing historical remodel and disposition activity and forward-looking capital expenditure plans. In fiscal year 2005, we

made adjustments to rent and depreciation aggregating approximately $5.0 million, or 0.1% of revenues, in connection with our review of

the amortization periods assigned to our leased property and equipment and deferred real estate credits.

We assess the recoverability of the carrying values of our store assets annually and upon the occurrence of certain events (e.g.,

opening a new store near an existing store or announcing plans for a store closing). The recoverability assessment requires judgment and

estimates for future store generated cash flows. The underlying estimates of cash flows include estimates of future revenues, gross margin

rates and store expenses and are based upon the stores' past and expected future performance. New stores may require two to five years to

develop a customer base necessary to generate the cash flows of our more mature stores. To the extent our estimates for revenue growth

and gross margin improvement are not realized, future annual assessments could result in impairment charges. No store impairment

charges were recorded in fiscal years 2007, 2006 or 2005.

Goodwill and Intangible Assets. Goodwill and indefinite-lived intangible assets, such as tradenames, are not subject to

amortization. Rather, recoverability of goodwill and indefinite-lived intangible assets is assessed annually and upon the occurrence of

certain events. The recoverability assessment requires us to make judgments and estimates regarding fair values. Fair values are

determined using estimated future cash flows, including growth assumptions for future revenues, gross margin rates and other estimates.

To the extent that our estimates are not realized, future assessments could result in impairment charges. In the fourth quarter of fiscal

year 2007, we recorded a $11.5 million pretax impairment charge related to the writedown to fair value in the net carrying value of the

Horchow tradename based upon lower anticipated future revenues associated with the brand.

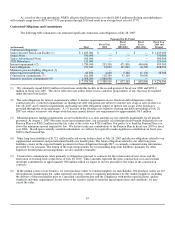

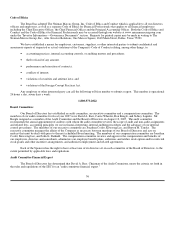

Customer lists are amortized using the straight-line method over their estimated useful lives, ranging from 5 to 26 years

(weighted average life of 13 years). Favorable lease commitments are amortized straight-line over the remaining lives of the leases,

ranging from 6 to 49 years (weighted average life of 33 years). Total estimated amortization of all acquisition-related intangible assets for

the next five fiscal years is currently estimated as follows (in thousands):

2008 $ 72,254

2009 72,254

2010 72,254

2011 61,543

2012 48,898

Financial Instruments. NMG uses derivative financial instruments to help manage its interest rate risk. Effective December 6,

2005, NMG entered into floating to fixed interest rate swap agreements for an aggregate notional amount of $1,000.0 million to limit its

exposure to interest rate increases related to a portion of its floating rate indebtedness. The interest rate swap agreements terminate after

five years. At July 28, 2007, the fair value of NMG's interest rate swap agreements was a gain of approximately $8.2 million, which

amount is included in other assets.

As of the effective date, NMG designated the interest rate swaps as cash flow hedges. As a result, changes in the fair value of

NMG's swaps are recorded subsequent to the effective date as a component of other comprehensive income.

As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in floating rate indebtedness

will currently range from 6.482% to 6.733% per quarter through 2010 and result in an average fixed rate of 6.577%.

Advertising and Catalog Costs. We incur costs to advertise and promote the merchandise assortment offered by both Specialty

Retail stores and Direct Marketing. Advertising costs incurred by our Specialty Retail stores consist primarily of print

49