Neiman Marcus 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

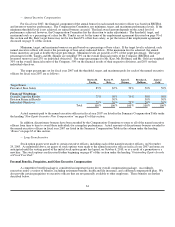

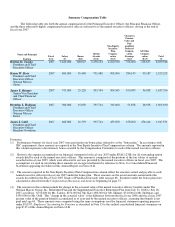

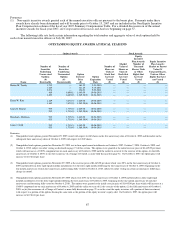

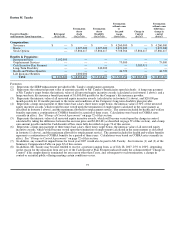

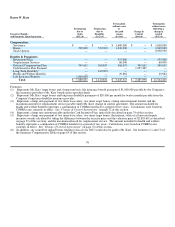

OPTION EXERCISES AND STOCK VESTED

Option Awards

Name

Number of Shares

Acquired on Exercise

(#)

Value Realized

on Exercise

($)(1)

Burton M. Tansky 578 221,050

Karen W. Katz — —

James E. Skinner — —

Brendan L. Hoffman — —

James J. Gold — —

(1) Reflects the difference between the exercise price of the stock option and the valuation price in effect on the date of the exercise

as determined by the Company based upon a number of factors, as more fully discussed on page 59.

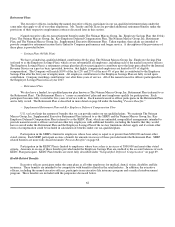

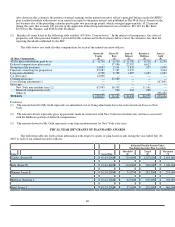

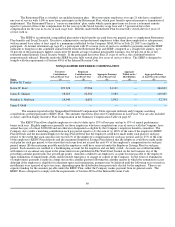

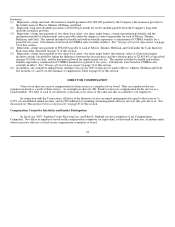

PENSION BENEFITS

The following table sets forth certain information with respect to retirement payments and benefits under the Retirement

Plan and the SERP for each of our named executive officers.

Name Plan Name

Number of Years

Credited Service

(#)(1)

Present Value

of Accumulated

Benefit

($)(2)

Payments During

Last

Fiscal Year

($)

Burton M. Tansky Retirement Plan 17 391,000 —

SERP 29(3) 6,944,000 —

Karen W. Katz Retirement Plan 22 176,000 —

SERP 22(4) 1,189,000 —

James E. Skinner Retirement Plan 6 82,000 —

SERP 6 227,000 —

Brendan L. Hoffman Retirement Plan 9 44,000 —

SERP 9 99,000 —

James J. Gold Retirement Plan 16 76,000 —

SERP 16 324,000 —

Footnotes:

(1) Computed as of July 28, 2007, which is the same pension measurement date used for financial statement reporting purposes with

respect to our audited consolidated financial statements and notes thereto.

(2) For purposes of calculating the amounts in this column, retirement age was assumed to be the normal retirement age of 65, as

defined in the Retirement Plan. A description of the valuation method and all material assumptions applied in quantifying the

present value of accumulated benefit is set forth in Note 13 to the audited consolidated financial statements on page F-35 of this

Annual Report on Form 10-K.

(3) The difference in years of service is a result of the provision in Mr. Tansky's employment agreement relating to the calculation

of his years of service under the SERP. Following his termination of employment with us, his years of service for purposes of

calculating his benefit under the SERP will be determined by multiplying his actual service for purposes of the SERP by 2,

subject to the 25-year maximum set forth in the SERP, and by then providing him with an additional credit for each year of

service to the Company following his attainment of age sixty-five (65) (disregarding the 25-year maximum set forth in the

SERP). See the discussion of his employment agreement under "Employment and Other Compensation Agreements" on page 70

of this section.

(4) Pursuant to the terms of Karen Katz's employment agreement, after she has reached the 25-year maximum set forth in the SERP,

she will be entitled to an additional one year of credit for each full year of service thereafter. In addition, if her employment is

terminated by us for any reason other than death, disability, cause, or non-renewal of her employment term, or if she terminates

her employment with us for good reason, and she has not yet reached 65, her SERP benefit will not be reduced solely by reason

of her failure to reach 65 as of the termination date.

68