Neiman Marcus 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in buying and occupancy costs required to support the growth in sales.

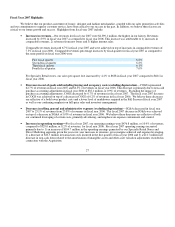

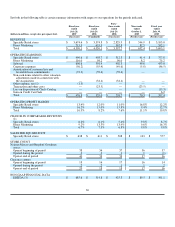

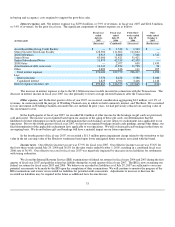

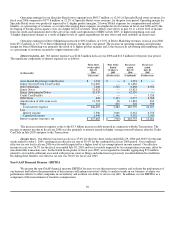

Interest expense, net. Net interest expense was $259.8 million, or 5.9% of revenues, in fiscal year 2007 and $216.8 million,

or 5.4% of revenues, for the prior fiscal year. The significant components of interest expense are as follows:

(in thousands)

Fiscal year

ended

July 28,

2007

Fiscal year

ended

July 29,

2006

Forty-three

weeks ended

July 29,

2006

Nine

weeks ended

October 1,

2005

(Successor) (Combined) (Successor) (Predecessor)

Asset-Based Revolving Credit Facility $ — $ 1,332 $ 1,332 $ —

Senior Secured Term Loan Facility 128,380 111,662 111,662 —

2028 Debentures 8,915 8,808 7,266 1,542

Senior Notes 63,000 51,421 51,421 —

Senior Subordinated Notes 51,875 42,339 42,339 —

2008 Notes — 2,077 638 1,439

Amortization of debt issue costs 14,141 11,824 11,728 96

Other 3,689 316 111 205

Total interest expense 270,000 229,779 226,497 3,282

Less:

Interest income 7,370 8,432 5,386 3,046

Capitalized interest 2,825 4,592 3,446 1,146

Interest expense (income), net $ 259,805 $ 216,755 $ 217,665 $ (910)

The increase in interest expense is due to the $3.3 billion increase in debt incurred in connection with the Transactions. The

decrease in interest income in fiscal year 2007 was due primarily to lower average invested balances after the Transactions.

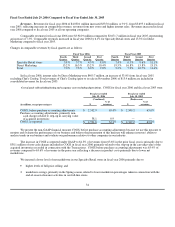

Other expense, net. In the first quarter of fiscal year 2007, we received consideration aggregating $4.2 million, or 0.1% of

revenues, in connection with the merger of Wedding Channel.com, in which we held a minority interest, and The Knot. We accounted

for our investment in Wedding Channel.com under the cost method. In prior years, we had previously reduced our carrying value of

this investment to zero.

In the fourth quarter of fiscal year 2007, we recorded $6.0 million of other income for the breakage on gift cards we previously

sold and issued. The income was recognized based upon our analysis of the aging of these gift cards, our determination that the

likelihood of future redemption is remote and our determination that such balances are not subject to escheatment laws applicable to our

operations. Prior to the fourth quarter of fiscal year 2007, we had not recognized breakage on gift cards pending, among other things, our

final determination of the applicable escheatment laws applicable to our operations. We will evaluate gift card breakage in the future on

an ongoing basis. We do not believe gift card breakage will have a material impact on our future operations.

In the fourth quarter of fiscal year 2007, we recorded a $11.5 million pretax impairment charge related to the writedown to fair

value in the net carrying value of the Horchow tradename based upon lower anticipated future revenues associated with the brand.

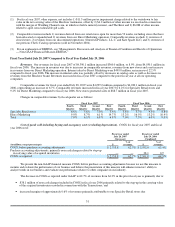

Income taxes. Our effective income tax rate was 37.9% for fiscal year 2007. Our effective income tax rate was 35.6% for

the forty-three weeks ended July 29, 2006 and 36.8% for the nine weeks ended October 1, 2005, resulting in a combined fiscal year

2006 rate of 36.4%. Our effective tax rate for fiscal year 2007 was negatively impacted by increases in tax liabilities for settlements

with taxing authorities.

We closed the Internal Revenue Service (IRS) examinations of federal tax returns for fiscal years 2004 and 2003 during the first

quarter of fiscal year 2007 and paid the related tax liability during the second quarter of fiscal year 2007. The IRS is now examining our

federal tax returns for fiscal years 2005 and 2006. We believe our recorded tax liabilities as of July 28, 2007 are sufficient to cover any

potential assessments to be made by the IRS upon the completion of their examinations. We will continue to monitor the progress of the

IRS examinations and review our recorded tax liabilities for potential audit assessments. Adjustments to increase or decrease the

recorded tax liabilities may be required in the future as additional facts become known.

33