Neiman Marcus 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

Neiman Marcus, Inc.

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 09/26/2007

Filed Period 07/28/2007

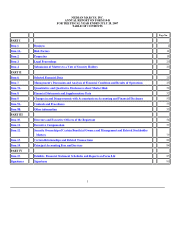

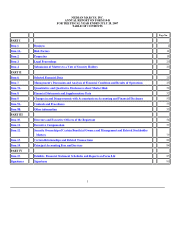

Table of contents

-

Page 1

Neiman Marcus, Inc.

10-K

Annual report pursuant to section 13 and 15(d) Filed on 09/26/2007 Filed Period 07/28/2007

-

Page 2

... jurisdiction of incorporation or organization) 1618 Main Street Dallas, Texas (Address of principal executive offices) 20-3509435 (I.R.S. Employer Identification No.) 75201 (Zip code)

Neiman Marcus, Inc.

Registrant's telephone number, including area code: (214) 743-7600

Securities registered...

-

Page 3

... by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x The aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant is zero. The registrant is a privately held corporation. As...

-

Page 4

... and Reports on Form 8-K Signatures 85 90 Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services 79...

-

Page 5

... Avenue locations. Bergdorf Goodman features high-end apparel, fashion accessories, shoes, decorative home accessories, precious and designer jewelry, cosmetics and gift items. Our Bergdorf Goodman stores accounted for 12.1% of our total revenues in fiscal year 2007, 11.5% in fiscal year 2006 and...

-

Page 6

...stock to the Company in exchange for a capital contribution of $900. Holding, the Company and Merger Sub were formed by investment funds affiliated with TPG Capital (formerly Texas Pacific Group) and Warburg Pincus LLC (collectively, the Sponsors) for the purpose of acquiring The Neiman Marcus Group...

-

Page 7

... fair value). Kate Spade LLC. In April 2005, the minority investor in Kate Spade LLC exercised the put option with respect to the sale of the full amount of its 44% stake in such company to NMG. In October 2006, we entered into an agreement to settle the put option whereby we purchased the interest...

-

Page 8

... LLC designs and markets high-end accessories and had revenues of approximately $75.5 million (after intercompany eliminations) in fiscal year 2006. Fiscal year 2007 revenues of Kate Spade LLC through its disposition in December 2006 aggregated $29.6 million. The Company's consolidated financial...

-

Page 9

...and in-store promotions at our Neiman Marcus and Bergdorf Goodman stores have featured vendors such as Chanel, Giorgio Armani, Oscar de la Renta and Manolo Blahnik. Through our print media programs, we mail various publications to our customers communicating upcoming in-store events, new merchandise...

-

Page 10

... data captured through our proprietary credit card program in connection with promotional events and customer relationship programs targeting specific customers based upon their past spending patterns for certain brands, merchandise categories and store locations. Integrated Multi-Channel Model. We...

-

Page 11

...with designer resources. Our women's and men's apparel and fashion accessories businesses are especially dependent upon our relationships with these designer resources. We monitor and evaluate the sales and profitability performance of each vendor and adjust our future purchasing decisions from time...

-

Page 12

... long-term business goals and objectives. We invest capital in new and existing stores, distribution and support facilities as well as information technology. We have gradually increased the number of our stores over the past ten years, growing our full-line Neiman Marcus and Bergdorf Goodman store...

-

Page 13

... of our main Bergdorf Goodman store in New York City and Neiman Marcus stores in San Francisco, Newport Beach, Las Vegas, Houston, and Beverly Hills; the expansion of our distribution facilities; the development and installation of a new point-of-sale system in our retail stores; the installation...

-

Page 14

... and working capital expenditures. For additional information on seasonality, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations-Executive Overview-Seasonality." Regulation The credit card operations that are conducted under our arrangements with HSBC...

-

Page 15

...Facility and the indentures governing the Senior Notes, the Senior Subordinated Notes and the 2028 Debentures may restrict NMG's current and future operations, particularly its ability to respond to changes in its business or to take certain actions. The credit agreements governing NMG's Asset-Based...

-

Page 16

... specialty apparel stores and direct marketing firms. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store...

-

Page 17

...square footage of our full-line Neiman Marcus and Bergdorf Goodman stores, and that our store remodeling program will add additional new store space from remodels that are already underway. New store openings involve certain risks, including constructing, furnishing and supplying a store in a timely...

-

Page 18

...payments from HSBC related to credit card sales. In addition, we continue to handle key customer service functions, including new account processing, most transaction authorization, billing adjustments, collection services and customer inquiries for which we receive additional compensation from HSBC...

-

Page 19

... the Credit Card Sale. Any effect of these regulations or change in the regulation of credit arrangements that would materially limit the availability of credit to our customer base could adversely affect our business. In addition, changes in credit card use, payment patterns, and default rates may...

-

Page 20

... and update the information technology systems supporting our online operations, sales operations or inventory control could prevent our customers from purchasing merchandise on our websites or prevent us from processing and delivering merchandise, which could adversely affect our business. Delays...

-

Page 21

... headquarters for Neiman Marcus, Bergdorf Goodman and Direct Marketing are located in Dallas, Texas; New York, New York; and Irving, Texas, respectively. Properties that we use in our operations include Neiman Marcus stores, Bergdorf Goodman stores, clearance centers and distribution, support...

-

Page 22

...square feet planned), Long Island in Fall 2010 (150,000 square feet planned), and Sarasota, Florida in Fall 2010 (80,000 square feet planned).

Bergdorf Goodman Stores. We operate two Bergdorf Goodman stores, both of which are located in Manhattan at 58th Street and Fifth Avenue. The following table...

-

Page 23

... and proceedings that arose in the ordinary course of our business. We believe that any liability arising as a result of these actions and proceedings will not have a material adverse effect on our financial position, results of operations or cash flows. ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF...

-

Page 24

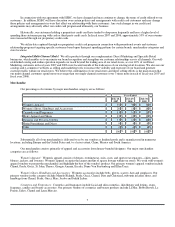

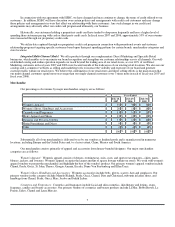

..., general and administrative expenses (excluding depreciation) Income from credit card program Depreciation and amortization Operating earnings Earnings from continuing operations before income taxes and change in accounting principle (Loss) earnings from discontinued operations, net of tax Net...

-

Page 25

... Fiscal year year ended ended July 30, July 31, 2005 2004

Fiscal year ended August 2, 2003

OTHER OPERATING DATA Capital expenditures Depreciation expense Rent expense and related occupancy costs Change in comparable revenues (8) Number of stores open at period end NON-GAAP FINANCIAL MEASURE EBITDA...

-

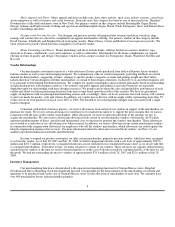

Page 26

... segment consists primarily of Neiman Marcus and Bergdorf Goodman stores. The Direct Marketing segment conducts both online operations and print catalogs under the brand names of Neiman Marcus, Bergdorf Goodman and Horchow. The Company acquired The Neiman Marcus Group, Inc. (NMG) on October 6, 2005...

-

Page 27

..., on luxury goods; changes in the level of full-price sales; changes in the level of promotional events conducted by our Specialty Retail and Direct marketing operations; our ability to successfully implement our store expansion and remodeling strategies; the rate of growth in internet sales by our...

-

Page 28

... on the level of full-price sales; our ability to order an appropriate amount of merchandise to match customer demand and the related impact on the level of net markdowns incurred; factors affecting revenues generally; changes in occupancy costs primarily associated with the opening of new stores or...

-

Page 29

... future, the HSBC Program Income may be: • • increased or decreased based upon future changes to our historical credit card program related to, among other things, the interest rates applied to unpaid balances and the assessment of late fees; and decreased based upon the level of future services...

-

Page 30

..., for fiscal year 2006. Fiscal year 2007 operating earnings increased primarily due to 1) an increase of $104.7 million in the operating earnings generated by our Specialty Retail Stores and Direct Marketing segments given the year-over-year increases in revenues, gross margins achieved and expense...

-

Page 31

... of Fall season fashions. Aggressive in-store marketing activities designed to stimulate customer buying, a lower level of markdowns and higher margins are characteristic of this quarter. The second fiscal quarter is more focused on promotional activities related to the December holiday season, the...

-

Page 32

... liabilities at fair value. The purchase accounting adjustments increased the carrying values of our property and equipment and inventory, established intangible assets for our tradenames, customer lists and favorable lease commitments and revalued our long-term benefit plan obligations, among other...

-

Page 33

...'s Catalog Gain on Credit Card Sale Total OPERATING PROFIT MARGIN Specialty Retail stores Direct Marketing Total CHANGE IN COMPARABLE REVENUES (2) Specialty Retail stores Direct Marketing Total SALES PER SQUARE FOOT Specialty Retail stores STORE COUNT Neiman Marcus and Bergdorf Goodman stores: Open...

-

Page 34

..., revenues from new stores and a net increase in revenues from our Direct Marketing operation. Internet sales by Direct Marketing were $499.0 million, an increase of 22.5% compared to fiscal year 2006. The increase in internet sales was partially offset by decreases in catalog sales as well as...

-

Page 35

...a higher portion of full-price sales and 2) net reductions in expenses as a percentage of revenues, primarily marketing and advertising, insurance, benefits and pre-opening expenses partially offset by higher incentive compensation. Operating earnings for Direct Marketing increased to $116.0 million...

-

Page 36

...ended October 1, 2005, resulting in a combined fiscal year 2006 rate of 36.4%. Our effective tax rate for fiscal year 2007 was negatively impacted by increases in tax liabilities for settlements with taxing authorities. We closed the Internal Revenue Service (IRS) examinations of federal tax returns...

-

Page 37

...a lower level of net markdowns in our Specialty Retail stores in fiscal year 2006 primarily due to: • • higher levels of full-price selling; and markdown savings, primarily in the Spring season, related to lower markdown percentages taken in connection with the end-of-season clearance activities...

-

Page 38

... on a higher level of revenues in fiscal year 2006 period and favorable insurance claims experience; lower annual incentive compensation costs of approximately 0.1% of revenues; a decrease in costs incurred to support our credit card operations subsequent to the Credit Card Sale of approximately...

-

Page 39

... card operations due to the sale of our credit card operations to HSBC in July 2005, 2) higher preopening costs and 3) higher depreciation charges as a result of higher levels of capital expenditures for new stores and store remodels in recent years. Operating earnings for Direct Marketing increased...

-

Page 40

... Credit Facility, Senior Secured Term Loan Facility, Senior Notes and Senior Subordinated Notes. EBITDA should not be considered as an alternative to operating earnings or net earnings as measures of operating performance or cash flows as measures of liquidity. EBITDA has important limitations...

-

Page 41

...AND CAPITAL RESOURCES Our cash requirements consist principally of the funding of our merchandise purchases; capital expenditures for new store construction, store renovations and upgrades of our management information systems; debt service requirements; income tax payments; and obligations related...

-

Page 42

...Atlanta and San Diego stores. We incurred capital expenditures in fiscal 2006 related to the construction of new stores in San Antonio and Boca Raton and the remodels of our San Francisco, Houston, Beverly Hills, Newport Beach and Bergdorf Goodman stores. We opened our San Antonio store in September...

-

Page 43

... security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and...

-

Page 44

... pursuant to the annual excess cash flow requirements. If a change of control (as defined in the credit agreement) occurs, NMG will be required to offer to prepay all outstanding term loans, at a prepayment price equal to 101% of the principal amount to be prepaid, plus accrued and unpaid interest...

-

Page 45

... security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and...

-

Page 46

...or any direct or indirect parent of NMG to the extent such net proceeds are contributed to NMG. At any time prior to October 15, 2010, NMG also may redeem all or a part of the Senior Notes at a redemption price equal to 100% of the principal amount of Senior Notes redeemed plus an applicable premium...

-

Page 47

... direct or indirect parent of NMG to the extent such net proceeds are contributed to NMG. At any time prior to October 15, 2010, NMG also may redeem all or a part of the Senior Subordinated Notes at a redemption price equal to 100% of the principal amount of Senior Subordinated Notes redeemed plus...

-

Page 48

... our supplemental retirement and postretirement health care benefit plans. The future obligations related to our other long-term liabilities consist of the expected benefit payments for these obligations through 2015, as currently estimated using information provided by our actuaries. The timing of...

-

Page 49

... which we source our merchandise; terrorist activities in the United States and elsewhere; political, social, economic, or other events resulting in the short- or long-term disruption in business at our stores, distribution centers or offices;

Customer Demographic Issues changes in the demographic...

-

Page 50

... of such merchandise; changes in foreign currency exchange or inflation rates; significant increases in paper, printing and postage costs;

Industry and Competitive Factors competitive responses to our loyalty programs, marketing, merchandising and promotional efforts or inventory liquidations by...

-

Page 51

.... Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues from our Specialty Retail stores are recognized at the later of the point of sale or the delivery of goods to the customer. Revenues from our Direct Marketing operation are...

-

Page 52

...periods assigned to our leased property and equipment and deferred real estate credits. We assess the recoverability of the carrying values of our store assets annually and upon the occurrence of certain events (e.g., opening a new store near an existing store or announcing plans for a store closing...

-

Page 53

...points for gifts. Generally, points earned in a given year must be redeemed no later than 90 days subsequent to the end of the annual program period. The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing levels, redemption rates...

-

Page 54

... consolidated financial statements of adopting FIN 48. In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Benefit Plans" (SFAS 158). SFAS 158 requires employers to report a postretirement...

-

Page 55

... F-62 at the end of this Annual Report on Form 10-K:

Index Page Number

Management's Report on Internal Control over Financial Reporting Reports of Independent Registered Public Accounting Firms Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Cash Flows...

-

Page 56

... Exchange Act is recorded, accumulated, processed, summarized, reported and communicated on a timely basis within the time periods specified in the Securities and Exchange Commission's rules and forms. b. Internal Control over Financial Reporting

Our management is responsible for establishing and...

-

Page 57

... Financial Officer Senior Vice President and General Counsel Senior Vice President and Chief Human Resource Officer Senior Vice President and Chief Information Officer Senior Vice President, Strategy, Business Development and Marketing President and Chief Executive Officer of Neiman Marcus Stores...

-

Page 58

... as a Divisional Merchandise Manager of Bergdorf Goodman from October 1998 to August 2000. James J. Gold has been President and Chief Executive Officer of Bergdorf Goodman since May 2004. Mr. Gold served as Senior Vice President, General Merchandise Manager of Neiman Marcus Stores from December 2002...

-

Page 59

...under the "Investor Information -Governance Documents" section. Requests for printed copies may be made in writing to The Neiman Marcus Group, Inc., Attn. Investor Relations, One Marcus Square, 1618 Main Street, Dallas, Texas 75201. We have established a means for employees, customers, suppliers, or...

-

Page 60

...that make up our executive compensation program: Direct Base salary Annual Bonus Long-term incentive through an initial stock option awarded in fiscal year 2006 and a cash incentive plan.

Indirect Health and welfare benefits Retirement benefits Life insurance Deferred compensation program Certain...

-

Page 61

Role of the Compensation Committee and the executive officers in the compensation process The Compensation Committee is responsible for determining the compensation of our named executive officers. 57

-

Page 62

... and compensation review process as well as at other times to recognize a promotion or change in job responsibilities. Merit increases are usually awarded to the named executive officers in the same percentage range as all employees and are based on overall performance and competitive market data...

-

Page 63

... in order to retain the senior management team and to enable them to share in the growth of the Company along with our equity investors. All grants of stock options under the Management Incentive Plan have an exercise price equal to the fair market value of our common stock on the date of grant...

-

Page 64

... percentile levels of a peer group of industry related companies. Retirement, termination, and change in control benefits are also part of the compensation package for each named executive officer. Our defined benefit and deferred compensation plans, as well as our change in control agreements and...

-

Page 65

... each of the named executive officers for fiscal year 2007 are as follows:

Burton M. Tansky Karen W. Katz James E. Skinner Brendan L. Hoffman James J. Gold

Target Bonus Percent of Base Salary Financial Weightings Overall Corporate Results Division Financial Results Individual Objectives Total

85...

-

Page 66

... that apply to all of our other employees. Mr. Tansky and Ms. Katz are provided additional retirement benefits under the provisions of their respective employment contracts discussed later in this section. Named executive officers earn retirement benefits under The Neiman Marcus Group, Inc. Employee...

-

Page 67

...'s long term goals, the Company and the Compensation Committee believe that maintaining change in control agreements with our key executives is a sound business decision that protects shareholder value both prior to and after a change in control. Accordingly, each of the named executive officers is...

-

Page 68

... The Company has change in control provisions in its Management Incentive Plan and its retirement plans that may provide for accelerated vesting and/or distributions in certain circumstances, and these provisions apply equally to all participants in the plans, including the named executive officers...

-

Page 69

...table on page 66. Payments under the bonus plan were calculated as described in the Compensation Discussion and Analysis beginning on page 57. The amounts in this column include the change in the actuarial value of the named executive officers' benefits under The Neiman Marcus Group, Inc. Retirement...

-

Page 70

65

-

Page 71

... named executive officer's principal balance under the KEDC plan (credited monthly with interest at an annual rate equal to the prime interest rate published in The Wall Street Journal on the last business day of the preceding calendar quarter plus two percentage points, which averaged approximately...

-

Page 72

... following table sets forth certain information regarding the total number and aggregate value of stock options held by each of our named executive officers at July 28, 2007. OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

Option Awards Stock Awards Equity Incentive Plan Awards: Market Number of Value...

-

Page 73

... applied in quantifying the present value of accumulated benefit is set forth in Note 13 to the audited consolidated financial statements on page F-35 of this Annual Report on Form 10-K. The difference in years of service is a result of the provision in Mr. Tansky's employment agreement relating...

-

Page 74

... The Wall Street Journal on the last business day of the preceding calendar quarter plus two percentage points. Amounts credited to an employee's account become payable to the employee upon termination of employment, death, unforeseeable emergency or change of control of the Company. In the event of...

-

Page 75

... Agreements As discussed in "Compensation Discussion & Analysis," The Neiman Marcus Group, Inc. has entered into employment agreements with Burton M. Tansky and Karen W. Katz and change of control agreements with each of the named executive officers. In addition, each of the named executive officers...

-

Page 76

... developed by him which relate to his employment by the Company or to the Company's business. Employment Agreement with Ms. Katz The employment agreement with Ms. Katz provides that she will act as Chief Executive Officer and President of Neiman Marcus Stores, a division of The Neiman Marcus Group...

-

Page 77

... the Company and its business. The non-competition agreement generally prohibits Ms. Katz during employment and for a period of one year from termination from becoming a director, officer, employee or consultant for any competing business that owns or operates a luxury specialty retail store located...

-

Page 78

... payments or benefits under the agreements, the officers must execute a release of claims in respect of their employment with us. Confidentiality, Non-Competition and Termination Benefits Agreements In addition to the change of control termination protection agreements, each of the named executive...

-

Page 79

... are currently anticipated under the Cash Incentive Plan. Potential Payments Upon Termination or Change-in-Control The tables below show certain potential payments that would have been made to a named executive officer if the named executive officer's employment had terminated on July 28, 2007 under...

-

Page 80

...due to Disability ($)(3)(7)(8)

Change in Control ($)(5)(7)

Compensation: Severance Bonus Stock Options Benefits & Perquisites: Retirement Plans Outplacement Services Cash Incentive Plan Payment Long-Term Disability Health and Welfare Benefits Life Insurance Benefits Total

$

- - -

$

- 1,207,000...

-

Page 81

... Company's long-term disability insurance provider. (3) Represents a lump sum payment of two times base salary, two times target bonus, a lump sum retirement benefit, and the maximum amount for outplacement service payable under Ms. Katz' change in control agreement. The amount included for health...

-

Page 82

... following a change in control ($)(5)(6)

JAMES E. SKINNER Compensation: Severance Bonus Stock Options Benefits & Perquisites: Retirement Plans Outplacement Services Deferred Compensation Plan Cash Incentive Plan Payment Long-Term Disability Health and Welfare Benefits Life Insurance Benefits Total...

-

Page 83

... months payable from the Company's long-term disability insurance provider. (3) Represents a lump sum payment of two times base salary, two times target bonus, a lump sum retirement benefit, and the maximum amount for outplacement service payable under the change in control agreements for each of...

-

Page 84

...SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information regarding equity compensation plans approved by shareholders and equity compensation plans not...

-

Page 85

... and executive officers as a group.

Amount and Nature of Beneficial Ownership (Common Stock) Options Currently Exercisable or Exercisable within 60 days Total Stock and Stock Based Holdings

Name of Beneficial Owner

Percent of Class (1)

Newton Holding, LLC 301 Commerce Street Suite 3300 Fort Worth...

-

Page 86

1618 Main Street Dallas, TX75201

80

-

Page 87

...Owner

Amount and Nature of Beneficial Ownership (Common Stock)

Options Currently Exercisable or Exercisable within 60 days

Total Stock and Stock Based Holdings

Percent of Class (1)

James J. Gold 754 Fifth Avenue New York, NY10019 Jonathan Coslet(5) 345 California Street Suite 3300 San Francisco...

-

Page 88

... common stock that may be deemed to be beneficially owned by TPG Capital, L.P. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

(4)

(5)

ITEM 13.

Our board of directors has adopted a formal written related person transaction approval policy, which sets out our policies and procedures for the review...

-

Page 89

Related Person Transactions Newton Holding, LLC Limited Liability Company Operating Agreement The investment funds associated with or designated by a Sponsor (Sponsor Funds) and certain investors who agreed to coinvest with the Sponsor Funds or through a vehicle jointly controlled by the Sponsors to...

-

Page 90

...of the Company's annual financial statements for the fiscal years ended July 28, 2007 and July 29, 2006 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were $1,718,000 and $1,957,000, respectively. Audit-Related Fees. The aggregate fees billed for audit...

-

Page 91

... reference to The Neiman Marcus Group, Inc.'s Current Report on Form 8-K dated May 4, 2005. Purchase, Sale and Servicing Transfer Agreement dated as of June 8, 2005, among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., HSBC Bank Nevada, N.A. and HSBC Finance Corporation, incorporated herein...

-

Page 92

... as of May 27, 1998, among The Neiman Marcus Group, Inc., Neiman Marcus, Inc., and The Bank of New York Trust Company, N.A., as successor trustee, incorporated herein by reference to the Company's Current Report on Form 8-K dated August 15, 2006. Employment Agreement dated as of October 6, 2005 by...

-

Page 93

... Marcus Group, Inc.'s Current Report on Form 8-K dated December 5, 2005. Form of Stock Option Grant Agreement made as of November 29, 2005 between Newton Acquisition, Inc. and certain eligible key employees, incorporated herein by reference to The Neiman Marcus Group, Inc.'s Current Report on Form...

-

Page 94

... by reference to The Neiman Marcus Group, Inc.'s Current Report on Form 8-K dated March 29, 2006. Credit Card Program Agreement, dated as of June 8, 2005, by and among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., HSBC Bank Nevada, N.A. and Household Corporation, incorporated herein by...

-

Page 95

... The Neiman Marcus Group, Inc. Key Employee Deferred Compensation Plan effective as of January 1, 2006, incorporated herein by reference to the Neiman Marcus, Inc. Annual Report on Form 10-K for the fiscal year ended July 29, 2006. Amendment No. 3 dated as of October 12, 2006 to the Credit Agreement...

-

Page 96

...Page

Management's Report on Internal Control over Financial Reporting Reports of Independent Registered Public Accounting Firms Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Notes to Consolidated...

-

Page 97

... guidelines which require employees to maintain a high level of ethical standards. In addition, the Audit Committee of the Board of Directors meets periodically with management, the internal auditors and the independent registered public accounting firm to review internal accounting controls, audit...

-

Page 98

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Neiman Marcus, Inc. Dallas, Texas We have audited the consolidated balance sheet of Neiman Marcus, Inc. and subsidiaries as of July 28, 2007, and the related consolidated statements of earnings, ...

-

Page 99

... the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Neiman Marcus, Inc. and subsidiaries as of July 28, 2007, and the related consolidated statements of earnings, cash flows, and shareholders' equity for the year then ended and our report dated September...

-

Page 100

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Neiman Marcus, Inc. Dallas, Texas We have audited the accompanying consolidated balance sheet of Neiman Marcus, Inc. and subsidiaries (the Company) as of July 29, 2006 (Successor Company) and the related consolidated statements...

-

Page 101

... Senior debentures due 2028 Senior notes Senior subordinated notes Deferred real estate credits, net Deferred income taxes Other long-term liabilities Non-current liabilities of discontinued operations Total long-term liabilities Minority interest in discontinued operations Common stock (par value...

-

Page 102

Total liabilities and shareholders' equity See Notes to Consolidated Financial Statements. F-6

$ 6,500,999

$ 6,607,961

-

Page 103

...'s Catalog Gain on credit card sale Operating earnings Interest expense (income), net Earnings from continuing operations before income taxes Income taxes Earnings from continuing operations (Loss) earnings from discontinued operations, net of taxes Net earnings See Notes to Consolidated Financial...

-

Page 104

...'s Catalog Gain on Credit Card Sale Net cash received from Credit Card Sale Impairment of Horchow tradename Other-primarily costs related to defined benefit pension and other long-term benefit plans Changes in operating assets and liabilities: (Increase) decrease in merchandise inventories (Increase...

-

Page 105

...contribution from Holding Equity contribution from management shareholders Reduction in equity for deemed dividend to management shareholders Additions to property and equipment Borrowings assumed by HSBC in connection with the Credit Card Sale See Notes to Consolidated Financial Statements.

(4,918...

-

Page 106

...for fluctuations in fair market value of financial instruments, net of tax ($706) Reclassification of amounts to net earnings, net of tax of $349 Minimum pension liability, net of tax of ($26,511) Other Total comprehensive income BALANCE AT JULY 30, 2005 Stock based compensation expense Other equity...

-

Page 107

... market value of financial instruments, net of tax of $6,510 Other Total comprehensive income BALANCE AT JULY 29, 2006 Stock based compensation expense Other equity transactions Comprehensive income: Net earnings Adjustment for unfunded benefit obligations (upon initial adoption of new accounting...

-

Page 108

...stock to the Company in exchange for a capital contribution of $900. Holding, the Company and Merger Sub were formed by investment funds affiliated with TPG Capital (formerly Texas Pacific Group) and Warburg Pincus LLC (collectively, the Sponsors) for the purpose of acquiring The Neiman Marcus Group...

-

Page 109

.... We believe appropriate merchandise valuation and pricing controls minimize the risk that our inventory values could be materially misstated. Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale. We...

-

Page 110

...periods assigned to our leased property and equipment and deferred real estate credits. We assess the recoverability of the carrying values of our store assets annually and upon the occurrence of certain events (e.g., opening a new store near an existing store or announcing plans for a store closing...

-

Page 111

.... Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues from our Specialty Retail stores are recognized at the later of the point of sale or the delivery of goods to the customer. Revenues from our

Direct Marketing operation are...

-

Page 112

..., aging of accounts receivable, write-off experience and expectations of future performance. Gift Cards. We sell gift cards at our Specialty Retail stores and through our Direct Marketing operation. Unredeemed gift cards aggregated $33.1 million at July 28, 2007 and $30.1 million at July 29, 2006...

-

Page 113

...points for gifts. Generally, points earned in a given year must be redeemed no later than 90 days subsequent to the end of the annual program period. The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing levels, redemption rates...

-

Page 114

... consolidated financial statements of adopting FIN 48. In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Benefit Plans" (SFAS 158). SFAS 158 requires employers to report a postretirement...

-

Page 115

... on our consolidated financial statements. In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities" (SFAS 159). SFAS 159 expands opportunities to use fair value measurement in financial reporting and...

-

Page 116

..., we recorded preliminary purchase accounting adjustments to increase the carrying values of our property and equipment and inventory, to establish intangible assets for our tradenames, customer lists and favorable lease commitments and to revalue our long-term benefit plan obligations, among other...

-

Page 117

...-off deferred real estate credits 9) Increase in long-term benefit obligations, primarily pension obligations 10) Tax impact of purchase accounting adjustments 11) Increase carrying values of assets of Gurwitch Products, L.L.C and Kate Spade LLC Deemed dividend to management shareholders Net assets...

-

Page 118

... 2006. Kate Spade LLC designs and markets high-end accessories and had revenues of approximately $75.5 million (after intercompany eliminations) in fiscal year 2006. The Company's consolidated financial statements, accompanying notes and other information provided in this Annual Report on Form...

-

Page 119

... affiliates. NOTE 6. CREDIT CARD PROGRAM Credit Card Sale. On July 7, 2005, HSBC Bank Nevada, National Association (HSBC) purchased our approximately three million private label Neiman Marcus and Bergdorf Goodman credit card accounts and related assets, as well as the outstanding balances associated...

-

Page 120

... proprietary credit card program is as follows:

(Successor) Forty-three Fiscal year weeks ended ended July 29, July 28, 2006 2007 (Predecessor) Fiscal year Nine weeks ended ended July 30, October 1, 2005 2005

(in thousands)

Income: HSBC Program Income Finance charge income Expenses: Bad debt, net...

-

Page 121

... follows:

(Successor) July 29, July 28, 2006 2007

Accrued salaries and related liabilities Amounts due customers Self-insurance reserves Sales returns reserves Interest payable Income taxes payable Sales tax Loyalty program liability Other Total NOTE 9. LONG-TERM DEBT The significant components of...

-

Page 122

... security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and...

-

Page 123

... pursuant to the annual excess cash flow requirements. If a change of control (as defined in the credit agreement) occurs, NMG will be required to offer to prepay all outstanding term loans, at a prepayment price equal to 101% of the principal amount to be prepaid, plus accrued and unpaid interest...

-

Page 124

...accounts, all payments received by NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of inventory by NMG and the subsidiary guarantors, certain related assets and proceeds of the foregoing.

•

Capital stock...

-

Page 125

...or any direct or indirect parent of NMG to the extent such net proceeds are contributed to NMG. At any time prior to October 15, 2010, NMG also may redeem all or a part of the Senior Notes at a redemption price equal to 100% of the principal amount of Senior Notes redeemed plus an applicable premium...

-

Page 126

... direct or indirect parent of NMG to the extent such net proceeds are contributed to NMG. At any time prior to October 15, 2010, NMG also may redeem all or a part of the Senior Subordinated Notes at a redemption price equal to 100% of the principal amount of Senior Subordinated Notes redeemed plus...

-

Page 127

... 2,945.9

The above table does not reflect future excess cash flow prepayments, if any, that may be required under the Senior Secured Term Loan Facility. Interest Rate Swaps. The Company uses derivative financial instruments to help manage its interest rate risk. Effective December 6, 2005...

-

Page 128

... management employees for up to 87,992.0 shares of the common stock of the Company. Options generally vest over four to five years and expire 10 years from the date of grant. A summary of the status of our stock option plan as of July 28, 2007 and July 29, 2006 and changes during the fiscal periods...

-

Page 129

...charge for stock compensation. In fiscal year 2005, the Predecessor made stock-based awards in the form of 1) restricted stock awards for which there was no exercise price payable by the employee, 2) purchased restricted stock awards for which the exercise price was equal to 50% of the fair value of...

-

Page 130

... weeks ended July 29, 2006 (Predecessor) Nine weeks ended October 1, 2005

(in thousands)

Fiscal yea ended July 30, 2005

Income tax expense at statutory rate State income taxes, net of federal income tax benefit Tax expense (benefit) related to tax settlements and other changes in tax liabilities...

-

Page 131

...on the employees' years of service and compensation over defined periods of employment. Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits (Postretirement Plan) if they meet certain service and minimum age requirements. The...

-

Page 132

... 2007 (Successor) SERP Plan Fiscal years 2006

Postretirement Plan Fiscal years 2007 20 (Successor)

Projected benefit obligations: Beginning of year Service cost Interest cost Actuarial loss (gain) Benefits paid, net End of year Accumulated benefit obligations: Beginning of year End of year

$ 364...

-

Page 133

... and timing of the expected benefit payments. Changes in the assets held by the Pension Plan in fiscal years 2007 and 2006 are as follows:

Fiscal years (in thousands) 2007 (Successor) 2006

Fair value of assets at beginning of year Actual return on assets Benefits paid Fair value of assets at end of...

-

Page 134

F-37

-

Page 135

... value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by the Pension Plan, the average rate of compensation increase by Pension Plan and SERP Plan participants and the health care cost trend rate for the Postretirement Plan. We review these...

-

Page 136

F-38

-

Page 137

... 10 to 16 years. Rate of future compensation increase. The assumed average rate of compensation increase is the average annual compensation increase expected over the remaining employment periods for the participating employees. We utilized a rate of 4.5% for the periods beginning July 28, 2007...

-

Page 138

... Redesign. In September 2007, our Board of Directors approved certain changes to our long-term benefits program. Effective January 1, 2008, we will offer a new, enhanced retirement savings plan (RSP) whereby Participants' balances in our current 401(k) Plan will be automatically transferred to the...

-

Page 139

... for stock-based compensation programs of the Predecessor. Performance objectives and targets are based on cumulative EBITDA percentages for three year periods beginning in fiscal year 2006. Earned awards for each completed performance period will be credited to a book account and will earn interest...

-

Page 140

... both online and print catalog operations under the Neiman Marcus, Bergdorf Goodman and Horchow brand names. Both the Specialty Retail stores and Direct Marketing segments derive their revenues from the sales of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers...

-

Page 141

... Non-cash items related to other valuation adjustments made in connection with the Acquisition Other expense, net (1) Transaction and other costs Loss on disposition of Chef's Catalog Gain on Credit Card Sale Total CAPITAL EXPENDITURES Specialty Retail stores Direct Marketing Total DEPRECIATION...

-

Page 142

F-43

-

Page 143

... providing support services to our Direct Marketing operations and Neiman Marcus Funding Corporation through which the Company previously conducted its credit card operations prior to the Credit Card Sale. Previously, our non-guarantor subsidiaries also included Kate Spade LLC (prior to its sale in...

-

Page 144

...)

Company

NMG

July 29, 2006 (Successor) NonGuarantor Guarantor Subsidiaries Subsidiaries

Eliminations

Consol

ASSETS Current assets: Cash and cash equivalents Merchandise inventories Other current assets Current assets of discontinued operations Total current assets Property and equipment, net...

-

Page 145

...including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Amortization of customer lists and favorable lease commitments Other (income) expense, net Operating earnings (loss...

-

Page 146

...

Consolid

Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Transaction and other costs Operating earnings Interest income, net...

-

Page 147

... buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Loss on disposition of Chef's Catalog Gain on credit card sale Operating earnings Interest expense, net Intercompany...

-

Page 148

... commitments Stock-based compensation charges Deferred income taxes Impairment of Horchow tradename Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating...

-

Page 149

... value of inventory Stock-based compensation charges Deferred income taxes Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and liabilities, net...

-

Page 150

-

Page 151

...issue costs Stock-based compensation charges Deferred income taxes Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and liabilities, net Net cash...

-

Page 152

... of Chef's catalog Gain on Credit Card Sale Net cash received from Credit Card Sale Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and...

-

Page 153

... its Bergdorf Goodman stores, NM Nevada Trust which holds legal title to certain real property and intangible assets used by NMG in conducting its operations and Neiman Marcus Funding Corporation through which the Company previously conducted its credit card operations prior to the Credit Card Sale...

-

Page 154

... 29, 2006 (Successor) NonGuarantor Subsidiaries

(in thousands)

Company

NMG

Eliminations

Consolidat

ASSETS Current assets: Cash and cash equivalents Merchandise inventories Other current assets Current assets of discontinued operations Total current assets Property and equipment, net Goodwill...

-

Page 155

... buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Amortization of customer lists and favorable lease commitments Other (income) expense, net Operating earnings Interest...

-

Page 156

...

Consolidate

Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Transaction and other costs Operating earnings Interest income, net...

-

Page 157

...Consolidated

Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation expense Loss on disposition of Chef's Catalog Gain on credit card sale Operating...

-

Page 158

... commitments Stock-based compensation charges Deferred income taxes Impairment of Horchow tradename Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating...

-

Page 159

... value of inventory Stock-based compensation charges Deferred income taxes Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and liabilities, net...

-

Page 160

...issue costs Stock-based compensation charges Deferred income taxes Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and liabilities, net Net cash...

-

Page 161

... of Chef's catalog Gain on Credit Card Sale Net cash received from Credit Card Sale Other, primarily costs related to defined benefit pension and other long-term benefit plans Intercompany royalty income payable (receivable) Equity in earnings of subsidiaries Changes in operating assets and...

-

Page 162

...(2

11

Fiscal year 2006 Nine weeks ended October 1, 2005 (Predecessor) Four weeks ended October 29, 2005

Second Quarter (Successor)

Third Quarter

Fourth Quarter

T

Revenues Gross profit (1) Earnings from continuing operations (Loss) earnings from discontinued operations, net of tax Net earnings...

-

Page 163

..., thereunto duly authorized. NEIMAN MARCUS, INC. By: /S/ NELSON A. BANGS Nelson A. Bangs Senior Vice President and General Counsel

Dated: September 26, 2007 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of...

-

Page 164

... margin on actual sales returns, net of commissions. All periods presented have been adjusted to exclude the operations of Gurwitch Products, L.L.C. and Kate Spade LLC. Reserve eliminated in connection with the sale of our proprietary credit card receivables. Write-off of uncollectible accounts net...

-

Page 165

... element of rentals Total fixed charges Earnings: Earnings from continuing operations before income taxes and change in accounting principle Add back: Fixed charges Amortization of capitalized interest Less: Capitalized interest Total earnings Ratio of earnings to fixed charges (1)

$

$

255,859 14...

-

Page 166

... Care Solutions, Inc. The Neiman Marcus Group, Inc. Willow Bend Beverage Corporation Worth Avenue Leasing Company

New York New York Delaware Texas Texas Texas Delaware Virginia Massachusetts Delaware California Ontario, Canada Delaware Texas Florida

Neiman Marcus Holdings, Inc. Bergdorf Goodman...

-

Page 167

...21, 2007, with respect to the consolidated financial statements and schedule of Neiman Marcus, Inc. and subsidiaries and the effectiveness of internal control over financial reporting of Neiman Marcus, Inc. and subsidiaries included in this Annual Report on Form 10-K for the year ended July 28, 2007...

-

Page 168

... as to Note 4), relating to the consolidated financial statements and financial statement schedule of Neiman Marcus, Inc. (which report expresses an unqualified opinion and includes an emphasis-of-amatter paragraph relating to discontinued operations), appearing in this Annual Report on Form 10-K of...

-

Page 169

...'s board of directors (or persons performing the equivalent functions): a) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process...

-

Page 170

...'s board of directors (or persons performing the equivalent functions): a) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process...

-

Page 171

...Oxley Act of 2002, the undersigned officer of Neiman Marcus, Inc. (the Company) hereby certifies, to such officer's knowledge, that: (i) the Annual Report on Form 10-K of the Company for the fiscal year ended July 28, 2007 (the Report) fully complies with the requirements of Section 13(a) or Section...