Motorola 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Based on the results of the 2013 annual assessment of the recoverability of goodwill, the fair values of both reporting

units exceeded their book values, indicating that there was no impairment of goodwill.

The Company performed a qualitative assessment to determine whether it was more-likely-than-not that the fair value of

each reporting unit was less than its carrying amount for fiscal year 2012. In performing this qualitative assessment the

Company assessed relevant events and circumstances including macroeconomic conditions, industry and market conditions,

cost factors, overall financial performance, changes in share price, and entity-specific events. In addition, the Company

considered the fair value derived for each reporting unit in conjunction with the 2010 goodwill impairment test which included

a full step one fair value analysis similar to the valuation discussed above. The Company compared this prior fair value against

the current carrying value of each reporting unit noting fair value continued to significantly exceed carrying value for both

reporting units. The Company performed a sensitivity analysis on the fair value determined for each reporting unit in

conjunction with the 2010 goodwill impairment test for changes in significant assumptions including the weighted average cost

of capital used in the income approach and changes in expected cash flows. For fiscal 2012, these changes in assumptions and

estimated cash flows resulted in an increase in fair value for the Government reporting unit and a slight decrease in fair value

for the Enterprise reporting unit. In spite of this small decrease in estimated fair value of the Enterprise reporting unit, the

reporting unit's fair value significantly exceeded its carrying value. As such, the Company concluded it was more-likely-than-

not that the fair value of each reporting unit exceeded its carrying value. Therefore, the two-step goodwill impairment test was

not required.

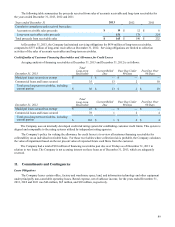

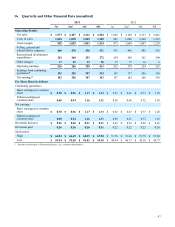

15. Valuation and Qualifying Accounts

The following table presents the valuation and qualifying account activity for the years ended December 31, 2013, 2012

and 2011:

Balance at

January 1 Charged to

Earnings Used Adjustments* Balance at

December 31

2013

Allowance for doubtful accounts $ 51 $ 14 $ (8) $ (1) $ 56

Inventory reserves 163 73 (58) — 178

Customer reserves 144 615 (609)(4) 146

2012

Allowance for doubtful accounts 45 8 (4) 2 51

Allowance for losses on long-term

receivables** 10 — — (10) —

Inventory reserves 170 67 (73)(1) 163

Customer reserves 125 456 (416)(21) 144

2011

Allowance for doubtful accounts 49 7 (4)(7) 45

Allowance for losses on long-term

receivables 1 10 (1) — 10

Inventory reserves 157 37 (30) 6 170

Customer reserves 117 580 (565)(7) 125

* Adjustments include translation adjustments

** During 2012, the adjustment of $10 million within Allowance for Losses on Long-term Receivables relates to a reclass from non-current to current.