Motorola 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Investment Policy

The Company has adopted an investment policy designed to meet or exceed the expected rate of return on plan assets

assumption. To achieve this, the plans retain professional investment managers that invest plan assets in equity, fixed income

securities, and cash equivalents. In addition, some plans invest in insurance contracts. The Company uses long-term historical

actual return experience with consideration of the expected investment mix of the plans’ assets, as well as future estimates of

long-term investment returns, to develop its expected rate of return assumption used in calculating the net periodic cost. The

Company has target mixes for these asset classes for all plans, which are readjusted periodically when an asset class weighting

deviates from the target mix, with the goal of achieving the required return at a reasonable risk level.

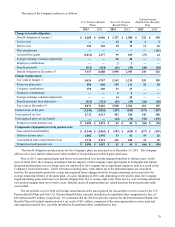

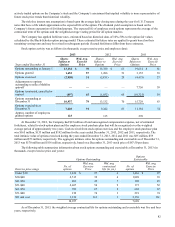

The weighted-average asset allocations by asset categories for all pension and the Postretirement Health Care Benefits

Plans were as follows:

All Pension Benefit Plans Postretirement Health Care

Benefits Plan

December 31 2013 2012 2013 2012

Target Mix:

Equity securities 55% 64% 57% 65%

Fixed income securities 43% 35% 42% 34%

Cash and other investments 2% 1% 1% 1%

Actual Mix:

Equity securities 55% 64% 58% 64%

Fixed income securities 42% 34% 40% 32%

Cash and other investments 3% 2% 2% 4%

Within the equity securities asset class, the investment policy provides for investments in a broad range of publicly-traded

securities including both domestic and foreign equities. Within the fixed income securities asset class, the investment policy

provides for investments in a broad range of publicly-traded debt securities including U.S. Treasury issues, corporate debt

securities, mortgage and asset-backed securities, as well as foreign debt securities. In the cash and other investments asset class,

investments may be in cash, cash equivalents or insurance contracts.

Cash Funding

The Company contributed $150 million to its U.S. Pension Benefit Plans during 2013, compared to $340 million

contributed in 2012. The Company expects to make cash contributions of approximately $300 million to its U.S. Pension

Benefit Plans and approximately $35 million to its Non-U.S. Pension Benefit Plans in 2014. The Company does not expect to

make cash contributions to the Postretirement Health Care Benefits Plan in 2014.

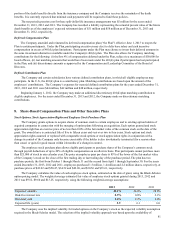

Expected Future Benefit Payments

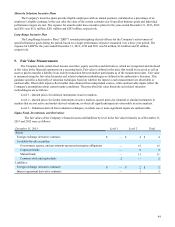

The following benefit payments are expected to be paid:

Year U.S. Pension

Benefit Plans

Non U.S.

Pension

Benefit Plans

Postretirement

Health Care

Benefits Plan

2014 $ 286 $ 41 $ 25

2015 298 42 24

2016 312 43 23

2017 328 44 22

2018 347 46 21

2019-2023 2,097 245 96

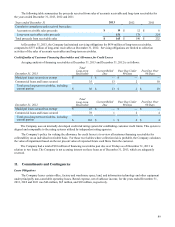

Other Benefit Plans

Split-Dollar Life Insurance Arrangements

The Company maintains a number of endorsement split-dollar life insurance policies that were taken out on now-retired

officers under a plan that was frozen prior to December 31, 2004. The Company had purchased the life insurance policies to

insure the lives of employees and then entered into a separate agreement with the employees that split the policy benefits

between the Company and the employee. Motorola Solutions owns the policies, controls all rights of ownership, and may

terminate the insurance policies. To effect the split-dollar arrangement, Motorola Solutions endorsed a portion of the death

benefits to the employee and upon the death of the employee, the employee’s beneficiary typically receives the designated