Motorola 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

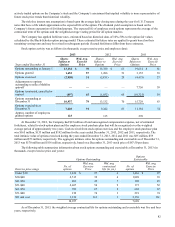

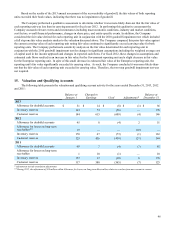

Valuation Methodologies

Level 1 - Quoted market prices in active markets are available for investments in common and preferred stock and

common stock equivalents. As such, these investments are classified within Level 1.

Level 2 - The securities classified as Level 2 are comprised primarily of corporate, government, agency, and government

sponsored enterprise fixed income securities. Our pension plan assets also include commingled equities classified as Level 2.

These securities are priced using pricing services, bid/offer, and last trade. Prices may also be obtained from brokers,

counterparties, fund administrators, online securities data services, or investment managers. Fixed income securities and

commingled equities, including short-term instruments, may be priced using pricing models comprised of observable inputs

which include, but are not limited to, market quotations, yields, maturities, call features, and the security's terms and conditions.

In determining the fair value of the Company's foreign currency derivatives, the Company uses forward contract and

option valuation models employing market observable inputs, such as spot currency rates, time value and option volatilities.

Since the Company primarily uses observable inputs in its valuation of its derivative assets and liabilities, they are classified as

Level 2 assets.

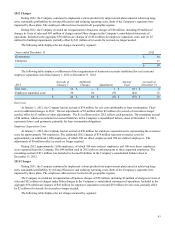

Level 3 - The securities classified as Level 3 primarily consist of corporate bonds held in one of our non-U.S. pension

plans. These corporate bonds are valued using pricing models which contain unobservable inputs and have limited liquidity.

Determining the fair value of these securities requires the use of unobservable inputs, such as indicative quotes from dealers,

extrapolated data, proprietary models and qualitative input from investment advisors. The Company had no Level 3 assets at

December 31, 2012.

At December 31, 2013, the Company had $2.1 billion of investments in money market funds (Level 2) classified as Cash

and cash equivalents in its condensed consolidated balance sheet, compared to $422 million at December 31, 2012. The money

market funds had quoted market prices that are equivalent to par.

Using quoted market prices and market interest rates, the Company determined that the fair value of long-term

debt at December 31, 2013 was $2.5 billion (Level 2), compared to a face value of $2.5 billion. Since considerable judgment is

required in interpreting market information, the fair value of the long-term debt is not necessarily indicative of the amount

which could be realized in a current market exchange.

All other financial instruments are carried at cost, which is not materially different from the instruments’ fair

values.

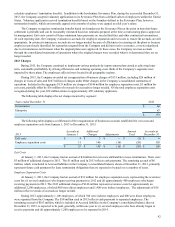

10. Long-term Customer Financing and Sales of Receivables

Long-term Customer Financing

Long-term receivables consist of trade receivables with payment terms greater than twelve months, long-term loans and

lease receivables under sales-type leases. Long-term receivables consist of the following:

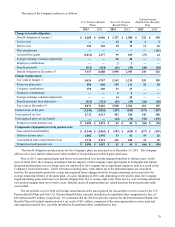

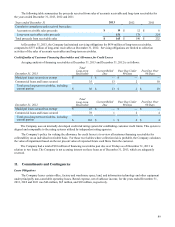

December 31 2013 2012

Long-term receivables $ 36 $ 101

Less current portion (30)(41)

Non-current long-term receivables, net $ 6 $ 60

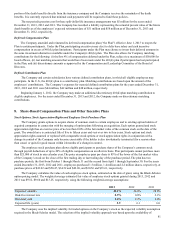

The current portion of long-term receivables is included in Accounts receivable and the non-current portion of long-term

receivables is included in Other assets in the Company’s consolidated balance sheets. Interest income recognized on long-term

receivables for the years ended December 31, 2013, 2012 and 2011 was $2 million, $7 million and $15 million, respectively.

Certain purchasers of the Company's products and services may request that the Company provide long-term financing

(defined as financing with a term greater than one year) in connection with the sale of products and services. These requests

may include all or a portion of the purchase price of the products and services. The Company's obligation to provide long-term

financing may be conditioned on the issuance of a letter of credit in favor of the Company by a reputable bank to support the

purchaser's credit or a pre-existing commitment from a reputable bank to purchase the long-term receivables from the

Company. The Company had outstanding commitments to provide long-term financing to third-parties totaling $120 million at

December 31, 2013, compared to $84 million at December 31, 2012.

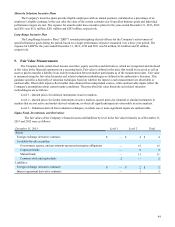

Sales of Receivables

From time to time, the Company sells accounts receivable and long-term receivables to third-parties under one-time

arrangements while others are sold to third-parties under committed facilities. The Company may or may not retain the

obligation to service the sold accounts receivable and long-term receivables.