Motorola 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

In February 2007, the Company amended the Regular Pension Plan and the MSPP, modifying the definition of average

earnings. For the years ended prior to December 31, 2007, benefits were calculated using the rolling average of the highest

annual earnings in any five years within the previous ten calendar year period. Beginning in January 2008, the benefit

calculation was based on the set of the five highest years of earnings within the ten calendar years prior to December 31, 2007,

averaged with earnings from each year after 2007. In addition, effective January 2008, the Company amended the Regular

Pension Plan, modifying the vesting period from five years to three years.

In December 2008, the Company amended the Regular Pension Plan, the Officers’ Plan and the MSPP (collectively, the

“U.S. Pension Benefit Plans”) such that, effective March 1, 2009: (i) no participant shall accrue any benefit or additional

benefit on or after March 1, 2009, and (ii) no compensation increases earned by a participant on or after March 1, 2009 shall be

used to compute any accrued benefit.

Certain health care benefits are available to eligible domestic employees meeting certain age and service requirements

upon termination of employment (the “Postretirement Health Care Benefits Plan”). For eligible employees hired prior to

January 1, 2002, the Company offsets a portion of the postretirement medical costs to the retired participant. As of January 1,

2005, the Postretirement Health Care Benefits Plan was closed to new participants. During 2012, the Postretirement Health

Care Benefits Plan was amended. As of January 1, 2013, benefits under the Postretirement Health Care Benefits Plan, are paid

to a retiree health reimbursement account instead of directly providing health insurance coverage to the participants. Covered

retirees are now able to use the annual subsidy they receive through this account toward the purchase of their own health care

coverage from private insurance companies and for reimbursement of eligible health care expenses.

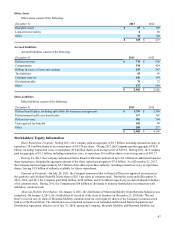

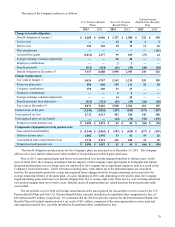

Net Periodic Cost

The net periodic costs (benefit) for pension and Postretirement Health Care Benefits plans were as follows:

U.S. Pension Benefit Plans Non U.S. Pension Benefit

Plans Postretirement Health Care

Benefits Plan

Years ended December 31 2013 2012 2011 2013 2012 2011 2013 2012 2011

Service cost $ — $ — $ — $ 11 $ 10 $ 17 $ 2 $ 3 $ 4

Interest cost 352 349 344 70 75 72 11 16 22

Expected return on plan

assets (364) (421) (390) (79)(78)(77)(10)(12)(16)

Amortization of:

Unrecognized net loss 130 260 189 15 22 17 14 12 10

Unrecognized prior

service benefit —— — (6)(3)(9)(43)(16) —

Settlement/curtailment

loss (gain) —— 8 ——(9)—— —

Net periodic pension cost

(benefit) $ 118 $ 188 $ 151 $ 11 $ 26 $ 11 $(26)$ 3 $ 20

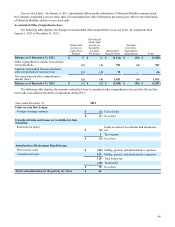

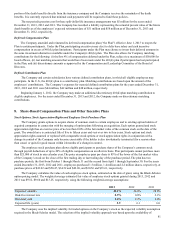

The amendment to the Postretirement Health Care Benefits Plan effective January 1, 2013 resulted in a remeasurement

of the plan generating an $87 million decrease in accumulated other comprehensive loss, net of taxes. The majority of that $87

million decrease will be recognized over approximately three years, or the period in which the remaining employees eligible for

the plan will quality for benefits under the plan. During the year ended December 31, 2013, $43 million of prior service cost

credit was recognized, including the amount associated with the 2012 amendment resulting in a net credit for periodic cost in

2013.