Motorola 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Inventory Valuation

We record valuation reserves on our inventory for estimated excess or obsolescence. The amount of the reserve is equal

to the difference between the cost of the inventory and the estimated market value based upon assumptions about future

demand and market conditions. On a quarterly basis, management performs an analysis based on future demand requirement

estimates of the underlying inventory to identify reserves needed for excess and obsolescence. We use our best judgment to

estimate appropriate reserves based on this analysis. In addition, we adjust the carrying value of inventory if the current market

value of that inventory is below our cost.

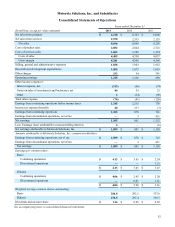

At December 31, 2013 and 2012, Inventories consisted of the following:

December 31 2013 2012

Finished goods $ 232 $ 244

Work-in-process and production materials 468 432

700 676

Less inventory reserves (178)(163)

$ 522 $ 513

We balance the need to maintain strategic inventory levels to ensure competitive delivery performance to our customers

against the risk of inventory obsolescence due to rapidly changing technology and customer requirements. As reflected above,

our inventory reserves represented 25% of the gross inventory balance at December 31, 2013, compared to 24% of the gross

inventory balance at December 31, 2012. We have inventory reserves for excess inventory, pending cancellations of product

lines due to technology changes, long-life cycle products, lifetime buys at the end of supplier production runs, business exits,

and a shift of production to outsourced manufacturing.

If future demand or market conditions are less favorable than those projected by management, additional inventory

writedowns may be required.

Income Taxes

Our effective tax rate is based on pre-tax income and the tax rates applicable to such income in the various jurisdictions

in which we operate. An estimated effective tax rate for the year is applied to our quarterly operating results. In the event that

there is a significant unusual or discrete item recognized, or expected to be recognized, in our quarterly operating results, the

tax attributable to that item is separately calculated and recorded at the same time as the unusual or discrete item. We consider

the resolution of prior year tax matters to be such items. Significant judgment is required in determining our effective tax rate

and in evaluating our tax positions. We adjust reserves for unrecognized income tax benefits in light of changing facts and

circumstances. We recognize the tax benefit of a tax position only if it is more-likely-than-not to be sustained.

Tax regulations may require items of income and expense to be included in a tax return in different periods than the items

are reflected in the consolidated financial statements. As a result, the effective tax rate reflected in the consolidated financial

statements may be different than the tax rate reported in the income tax return. Some of these differences are permanent, such

as expenses that are not deductible on the tax return, and some are temporary differences, such as depreciation expense.

Temporary differences create deferred tax assets and liabilities. Deferred tax assets generally represent items that can be used as

a tax deduction or credit in the tax return in future years for which we have already recorded the tax benefit in the consolidated

financial statements. Deferred tax liabilities generally represent tax expense recognized in the consolidated financial statements

for which the tax payment has been deferred or expense for which we have already taken a deduction on an income tax return,

but has not yet been recognized in the consolidated financial statements.

We account for income taxes by recognizing deferred tax assets and liabilities using enacted tax rates for the effect of the

temporary differences between the book and tax basis of recorded assets and liabilities. We make estimates and judgments with

regard to the calculation of certain income tax assets and liabilities. Deferred tax assets are reduced by valuation allowances if,

based on the consideration of all available evidence, it is more-likely-than-not that all or some portion of the deferred tax asset

will not be realized. Significant weight is given to evidence that can be objectively verified.

We evaluate deferred income taxes on a quarterly basis to determine if valuation allowances are required by considering

available evidence, including historical and projected taxable income and tax planning strategies that are both prudent and

feasible.

During 2013, our deferred tax valuation allowances were adjusted primarily for current year movement in deferred taxes

and expiration of carryforwards. During 2012, we recorded $60 million of tax benefit related to the reversal of a significant

portion of the valuation allowance established on certain foreign deferred tax assets. During 2011, we reassessed our valuation

allowance requirements taking into consideration the distribution of Motorola Mobility. We evaluated all available evidence in

our analysis, including the historical and projected pre-tax profits generated by our U.S. operations. We also considered tax