Motorola 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

acquired Twisted Pair Solutions during the fourth quarter, which further extends our MOTOTRBO radio to

commercial smartphone device users as well. One of the key long-term growth drivers for the PCR market is the

majority of the 40 million radios deployed in the global market that are still analog technology. We are leading that

transition to digital with the most comprehensive portfolio in the PCR market.

In 2013, we made progress expanding our services business and, in particular, lifecycle management contracts. These

agreements provide customers with the ability to stay current on the latest software versions with routine upgrades.

We have signed almost 200 of these agreements over the past three years. These contracts tend to be long in duration,

with approximately 40% of the new ASTRO agreements we signed this year to be completed over at least ten years.

We had one of our best years in TETRA in EA, driven by the continued expansion of our infrastructure footprint with

this mission-critical standard. We signed a number of large deals including: (i) a multi-year support contract for

Airwave’s Critical Communications Network, one of the largest TETRA networks in the world, delivering voice and

data services to the UK’s emergency services and (ii) a $187 million public safety contract with Libya to provide

country-wide coverage.

• In our Enterprise segment: The core product lines stabilized and returned to growth over the second half of the year

as we grew backlog and saw increased spending in the industry. Our focus this year has been on improving the

business operationally and financially, with a stronger portfolio with investments in the Android operating platform

and new devices. As Android has emerged, we are well positioned with a truly enterprise-grade portfolio, complete

with our own Motorola Extensions product to enhance, integrate and secure the Android operating system. We have

four new models running on the current version of Android and our MC67 is available on both Windows and Android.

We began to see traction at the end of the year within our expansion portfolio, including the MC40, SB1 and MP6000

as deals move from trial to adoption. In addition, we continue to launch innovative products in our core verticals such

as the DS4800 in retail and the VC70 for manufacturing and warehouse operations. We have also made progress in

building out our managed services capabilities with mobility lifecycle management, as we help customers streamline

deployment, optimize performance and manage their environment.

Looking Forward

In the Government segment, we feel we are well positioned for 2014 with strong backlog and solid demand from state

and local governments and many international markets. We believe that while regulatory mandates to improve spectrum

efficiency have encouraged some of our U.S. customers to upgrade, our new product introductions and expanded solutions

portfolio will continue to be a driver for growth across our U.S. and international markets, as customers will continue to invest

in our next-generation systems with the assurance that new radios with enhanced features remain interoperable and backward-

compatible.

In addition to our investment in our radio communication systems, we have been investing in R&D for next generation

public safety. Private public safety broadband networks based on the LTE standard are an important next generation tool for

our first-responder customers, and we believe our expertise in both public and private networks makes us uniquely qualified to

provide LTE solutions. During 2013, we experienced delays in public safety LTE opportunities and the deployment of LTE

networks due to the finalization of standards. We now expect to see an increase in public safety LTE revenues beginning in

2015 and beyond, led initially by international deployments.

We’re driving growth in verticals beyond public safety. We’ve secured contracts with energy and utility customers and

expect this trend to continue in 2014. We continue to make tailored investments for vertical expansion. For example, new

features within the ASTRO product portfolio include special alerts for the mining market and enhanced data for meter reading

capabilities to serve the utilities market.

Our government customer base is composed of thousands of customers, predominantly at the U.S. state and local level

with various funding sources. These customers are at different stages of network evolution and aging in a long cycle business.

We believe the fundamentals for our business and customer base provide a significant degree of resiliency for this segment as

we continue to see strength within the international government market and U.S. state and local governments.

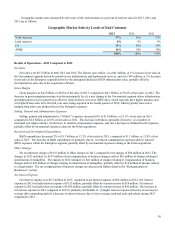

While we saw declines for full year 2013 in the Enterprise segment due to delayed spend by our customers as they

continued to address a challenging macroeconomic environment, prioritized funding for cloud and ERP maintenance, and

encountered some uncertainty around operating system roadmaps, we saw increased spending and growth in the second half of

2013. We have experienced strong customer engagements that lead us to believe customers will continue to invest in our

mobile computing, data capture, and WLAN technologies, which yield high return on investment and enable real-time

information to their workforce. In addition, we believe IT hardware spending trends will be more favorable during 2014.