Motorola 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

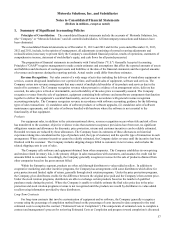

specific factors, and (iii) stratifying the data points, when appropriate, based on customer, magnitude of the transaction and

sales volume.

The Company also considers the geographies in which the products or services are sold, major product and service

groups, customer classification, and other environmental or marketing variables in determining VSOE, TPE, and ESP.

Once elements of an arrangement are separated into more than one unit of accounting, revenue is recognized for each

separate unit of accounting based on the nature of the revenue as described above.

The Company's arrangements with multiple deliverables may also contain one or more software deliverables that are

subject to software revenue recognition guidance. The revenue for these multiple-element arrangements is allocated to the

software deliverable(s) and the non-software deliverable(s) based on the relative selling prices of all of the deliverables in the

arrangement using the fair value hierarchy outlined above. In circumstances where the Company cannot determine VSOE or

TPE of the selling price for any of the deliverables in the arrangement, ESP is used for the purpose of allocating the

arrangement consideration between software and non software deliverables.

The Company accounts for multiple-element arrangements that consist entirely of software or software-related products,

including the sale of software upgrades or software support agreements to previously sold software, in accordance with

software accounting guidance. For such arrangements, revenue is allocated to the deliverables based on the relative fair value

of each element, and fair value is determined using VSOE. Where VSOE does not exist for the undelivered software element,

revenue is deferred until either the undelivered element is delivered or VSOE is established, whichever occurs first. When the

final undelivered software element is post contract support, service revenue is recognized on a ratable basis over the remaining

service period. When VSOE of a delivered element has not been established, but VSOE exists for the undelivered elements,

the Company uses the residual method to recognize revenue when the fair value of all undelivered elements is determinable.

Under the residual method, the fair value of the undelivered elements is deferred and the remaining portion of the arrangement

consideration is allocated to the delivered elements and is recognized as revenue.

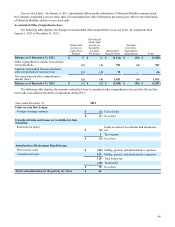

Cash Equivalents: The Company considers all highly-liquid investments purchased with an original maturity of three

months or less to be cash equivalents. Restricted cash was $63 million at December 31, 2013 and $63 million at December 31,

2012.

Sigma Fund: Prior to December 2013, the Company invested a most of its U.S. dollar-denominated cash in a fund (the

“Sigma Fund”) which was managed by independent investment management firms under specific investment guidelines

restricting the type of investments held and their time to maturity. In December 2013, the Company completed the liquidation

of the Sigma Fund and migrated the international U.S. dollar denominated cash to a U.S. dollar cash pool invested in U.S.

dollar prime money market funds. These money market funds are classified as Cash and cash equivalents within the

Consolidated balance sheet as of December 31, 2013.

Prior to the liquidation of the Sigma Fund, investments in the Sigma Fund were carried at fair value primarily based on

valuation pricing models and broker quotes. These pricing models utilized observable inputs including, but not limited to:

market quotations, yields, maturities, call features, and the security's terms and conditions. The fair value measurements of the

Sigma Fund were deemed Level 2 fair value measures as of December 31, 2012.

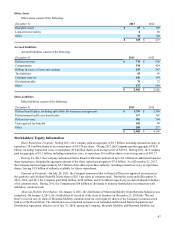

Investments: Investments in equity and debt securities classified as available-for-sale are carried at fair value. When

applicable, debt securities classified as held-to-maturity are carried at amortized cost. Equity securities that are restricted for

more than one year or that are not publicly traded are carried at cost. Certain investments are accounted for using the equity

method if the Company has significant influence over the issuing entity.

The Company assesses declines in the fair value of investments to determine whether such declines are other-than-

temporary. This assessment is made considering all available evidence, including changes in general market conditions, specific

industry and individual company data, the length of time and the extent to which the fair value has been less than cost, the

financial condition and the near-term prospects of the entity issuing the security, and the Company’s ability and intent to hold

the investment until recovery. Other-than-temporary impairments of investments are recorded to Other within Other income

(expense) in the Company’s consolidated statements of operations in the period in which they become impaired.

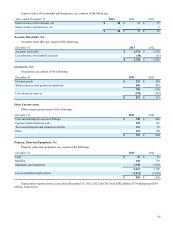

Inventories: Inventories are valued at the lower of average cost (which approximates cost on a first-in, first-out basis)

or market (net realizable value or replacement cost).

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated depreciation.

Depreciation is recorded on a straight-line basis, based on the estimated useful lives of the assets (buildings and building

equipment, five to forty years; machinery and equipment, two to ten years) and commences once the assets are ready for their

intended use.

Goodwill and Intangible Assets: Goodwill is assessed for impairment at least annually at the reporting unit level. The

Company performs its annual assessment of goodwill for impairment in the fourth quarter of each year. The annual assessment