Motorola 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

uncertainty or volatility in the capital markets may result in higher funding costs for us and adversely affect our ability to

access funds.

We may, from time to time, seek to retire certain of our outstanding debt through open market cash purchases, privately-

negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market conditions, our liquidity

requirements, contractual restrictions and other factors.

Share Repurchase Program: Through actions taken on July 28, 2011, January 30, 2012, July 25, 2012, and July 22, 2013,

the Board of Directors has authorized an aggregate share repurchase amount of up to $7.0 billion of our outstanding shares of

common stock (the “share repurchase program”). The share repurchase program does not have an expiration date. As of

December 31, 2013, we have used approximately $5.2 billion of the share repurchase authority, including transaction costs, to

repurchase shares, leaving approximately $1.8 billion of authority available for future repurchases.

We paid an aggregate of $1.7 billion during 2013, including transaction costs, to repurchase approximately 28.6 million

shares at an average price of $59.30 per share. All repurchased shares have been retired.

Payment of Dividends: We paid cash dividends to holders of our common stock of $292 million in 2013, $270 million in

2012, and $72 million in 2011.

During 2011, we also paid $8 million of dividends to minority shareholders in connection with subsidiary common stock.

Credit Facilities

As of December 31, 2013, we had a $1.5 billion unsecured syndicated revolving credit facility (the “2011 Motorola

Solutions Credit Agreement”) that is scheduled to expire on June 30, 2014. We must comply with certain customary covenants,

including maintaining maximum leverage and minimum interest coverage ratios as defined in the 2011 Motorola Solutions

Credit Agreement. We were in compliance with our financial covenants as of December 31, 2013. As of and during the year

ended December 31, 2013, we did not borrow under the 2011 Motorola Solutions Credit Agreement.

Contractual Obligations and Other Purchase Commitments

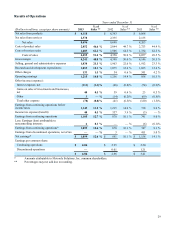

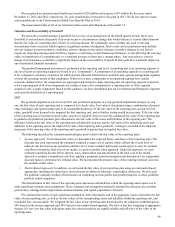

Summarized in the table below are our obligations and commitments to make future payments under long-term debt

obligations, lease obligations, purchase obligations and tax obligations as of December 31, 2013.

Payments Due by Period

(in millions) Total 2014 2015 2016 2017 2018 Uncertain

Timeframe Thereafter

Long-term debt obligations $ 2,457 $ 20 $ 5 $ 6 $ 406 $ 6 $ — $ 2,014

Lease obligations 491 99 71 56 44 34 — 187

Purchase obligations* 56 49 5 2 — — — —

Tax obligations 156 25 — — — — 131 —

Total contractual obligations $ 3,160 $ 193 $ 81 $ 64 $ 450 $ 40 $ 131 $ 2,201

*Amounts included represent firm, non-cancelable commitments.

Lease Obligations: We lease certain office, factory and warehouse space, land, information technology and other

equipment, principally under non-cancelable operating leases. Our future minimum lease obligations, net of minimum sublease

rentals, totaled $491 million. Rental expense, net of sublease income, was $66 million in 2013, $65 million in 2012, and $92

million in 2011.

Purchase Obligations: During the normal course of business, in order to manage manufacturing lead times and help

ensure adequate component supply, we enter into agreements with contract manufacturers and suppliers that either allow them

to procure inventory based upon criteria as defined by us or establish the parameters defining our requirements. In addition, we

have entered into software license agreements which are firm commitments and are not cancelable. As of December 31, 2013,

we had entered into firm, noncancelable, and unconditional commitments under such arrangements through 2016. The total

payments expected to be made under these agreements are $56 million, of which $53 million relate to take or pay obligations

from arrangements with suppliers for the sourcing of inventory supplies and materials and $3 million relate to software

contracts supporting engineering. We do not anticipate the cancellation of any of our take or pay agreements in the future and

estimate that purchases from these suppliers will exceed the minimum obligations during the agreement periods.

Tax Obligations: We have approximately $156 million of unrecognized income tax benefits relating to multiple tax

jurisdictions and tax years. Based on the potential outcome of our global tax examinations, or the expiration of the statute of

limitations for specific jurisdictions, it is reasonably possible that the unrecognized tax benefits will change within the next

twelve months. The associated net tax impact on the effective tax rate, exclusive of valuation allowance changes, is estimated

to be in the range of a $50 million tax charge to a $75 million tax benefit, with cash payments not expected to exceed $25

million.