Motorola 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

Motorola Solutions, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Dollars in millions, except as noted)

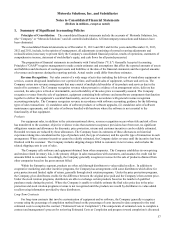

1. Summary of Significant Accounting Policies

Principles of Consolidation: The consolidated financial statements include the accounts of Motorola Solutions, Inc.

(the “Company” or “Motorola Solutions”) and all controlled subsidiaries. All intercompany transactions and balances have

been eliminated.

The consolidated financial statements as of December 31, 2013 and 2012 and for the years ended December 31, 2013,

2012 and 2011, include, in the opinion of management, all adjustments (consisting of normal recurring adjustments and

reclassifications) necessary to present fairly the Company's consolidated financial position, results of operations, statements of

comprehensive income, statement of stockholder's equity, and cash flows for all periods presented.

The preparation of financial statements in conformity with United States ("U.S.") Generally Accepted Accounting

Principles ("GAAP") requires management to make certain estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

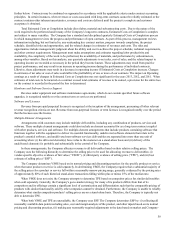

Revenue Recognition: Net sales consist of a wide range of activities including the delivery of stand-alone equipment or

services, custom design and installation over a period of time, and bundled sales of equipment, software and services. The

Company enters into revenue arrangements that may consist of multiple deliverables of its products and services due to the

needs of its customers. The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has

occurred, the sales price is fixed or determinable, and collectability of the sales price is reasonably assured. The Company

recognizes revenue from the sale of equipment, equipment containing both software and nonsoftware components that function

together to deliver the equipment’s essential functionality, and services in accordance with general revenue recognition

accounting principles. The Company recognizes revenue in accordance with software accounting guidance for the following

types of sales transactions: (i) standalone sales of software products or software upgrades, (ii) standalone sales of software

maintenance agreements, and (iii) sales of software bundled with hardware where the software is not essential to the

functionality of that equipment.

Products

For equipment sales, in addition to the criteria mentioned above, revenue recognition occurs when title and risk of loss

has transferred to the customer, objective evidence exists that customer acceptance provisions have been met, no significant

obligations remain and allowances for discounts, price protection, returns and customer incentives can be reliably estimated.

Recorded revenues are reduced by these allowances. The Company bases its estimates of these allowances on historical

experience taking into consideration the type of products sold, the type of customer, and the specific type of transaction in each

arrangement. Where customer incentives cannot be reliably estimated, the Company defers revenue until the incentive has been

finalized with the customer. The Company includes shipping charges billed to customers in net revenue, and includes the

related shipping costs in cost of sales.

The Company sells software and equipment obtained from other companies. The Company establishes its own pricing

and retains related inventory risk, is the primary obligor in sales transactions with customers, and assumes the credit risk for

amounts billed to customers. Accordingly, the Company generally recognizes revenue for the sale of products obtained from

other companies based on the gross amount billed.

Within the Enterprise segment, products are often sold through distributors to value-added resellers. In addition to

cooperative marketing and other incentive programs, the Company has arrangements with some distributors which allow for

price protection and limited rights of return, generally through stock rotation programs. Under the price protection programs,

the Company gives distributors credits for the difference between the original price paid and the Company’s then current price.

Under the stock rotation programs, distributors are able to exchange certain products based on the number of qualified

purchases made during the period. Where the Company is unable to reliably estimate the final sales price due to the price

protection and stock rotation programs revenue is not recognized until the products are resold by distributors to value-added

resellers using information provided by these distributors.

Long-Term Contracts

For long-term contracts that involve customization of equipment and/or software, the Company generally recognizes

revenue using the percentage of completion method based on the percentage of costs incurred to date compared to the total

estimated costs to complete the contract (“Estimated Costs at Completion”). The components of estimated costs to complete a

contract and management’s process for reviewing Estimated Costs at Completion and progress toward completion is discussed