Motorola 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

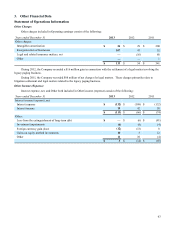

Balance Sheet Information

Sigma Fund

During the fourth quarter of 2013, the Company exited the Sigma Fund. The balance of Sigma Fund as December 31,

2012 consisted of the following:

Cash $ 149

Government, agency, and government-sponsored enterprise obligations 1,984

$ 2,133

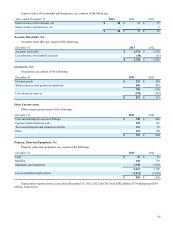

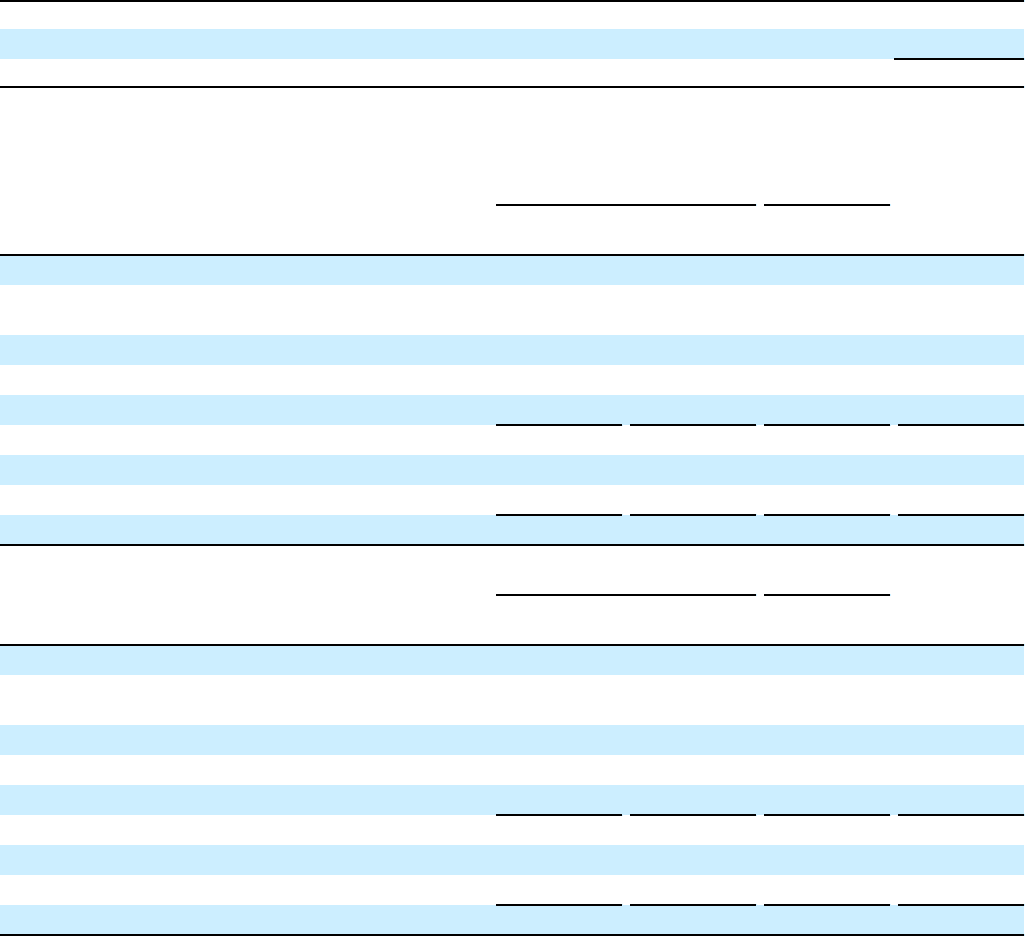

Investments

Investments consist of the following:

Recorded Value Less

December 31, 2013 Short-term

Investments Investments Unrealized

Gains Cost

Basis

Available-for-sale securities:

Government, agency, and government-sponsored

enterprise obligations $ — $ 15 $ — $ 15

Corporate bonds 2 7 — 9

Mutual funds — 11 — 11

Common stock and equivalents — 2 — 2

2 35 — 37

Other investments, at cost — 201 — 201

Equity method investments — 15 — 15

$ 2 $ 251 $ — $ 253

Recorded Value Less

December 31, 2012 Short-term

Investments Investments Unrealized

Gains Cost

Basis

Available-for-sale securities:

Government, agency, and government-sponsored

enterprise obligations $ — $ 15 $ — $ 15

Corporate bonds 2 11 — 13

Mortgage-backed securities — 2 — 2

Common stock and equivalents — 10 3 7

2 38 3 37

Other investments, at cost — 189 — 189

Equity method investments — 13 — 13

$ 2 $ 240 $ 3 $ 239

The Company reclassified $96 million of cash surrender values of its split-dollar value life insurance plans as of

December 31, 2012, from Other assets to Investments, to conform to the balance sheet presentation as of December 31, 2013.

During the years ended December 31, 2013, 2012 and 2011, the Company recorded investment impairment charges of $6

million, $8 million and $4 million, respectively, representing other-than-temporary declines in the value of the Company’s

equity investment portfolio. Investment impairment charges are included in Other within Other income (expense) in the

Company’s consolidated statements of operations.