Motorola 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

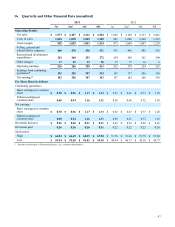

95

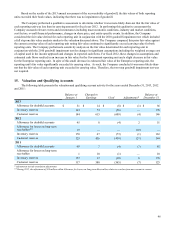

respectively. As of December 31, 2013, future amortization expense is estimated to be $24 million in 2014, $19 million in

2015, $17 million in 2016, $13 million in 2017 and $6 million in 2018.

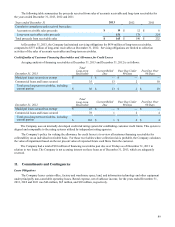

Amortized intangible assets, excluding goodwill, by segment are as follows:

2013 2012

December 31,

Gross

Carrying

Amount Accumulated

Amortization

Gross

Carrying

Amount Accumulated

Amortization

Government $ 55 $ 48 $ 53 $ 48

Enterprise 1,199 1,119 1,198 1,094

$ 1,254 $ 1,167 $ 1,251 $ 1,142

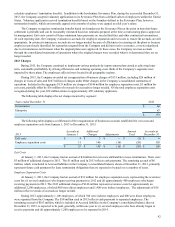

Goodwill

The following table displays a rollforward of the carrying amount of goodwill by segment from January 1, 2012 to

December 31, 2013:

Government Enterprise Total

Balance as of January 1, 2012

Aggregate goodwill acquired $ 350 $ 2,642 $ 2,992

Accumulated impairment losses — (1,564)(1,564)

Goodwill, net of impairment losses 350 1,078 1,428

Goodwill acquired — 83 83

Goodwill divested (1) — (1)

Balance as of December 31, 2012

Aggregate goodwill acquired/disposed 349 2,725 3,074

Accumulated impairment losses — (1,564)(1,564)

Goodwill, net of impairment losses 349 1,161 1,510

Purchase accounting tax adjustments — (2)(2)

Foreign currency — 1 1

Balance as of December 31, 2013

Aggregate goodwill acquired 349 2,724 3,073

Accumulated impairment losses — (1,564)(1,564)

Goodwill, net of impairment losses $ 349 $ 1,160 $ 1,509

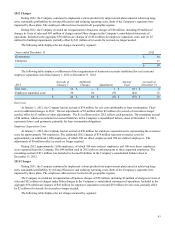

The Company conducts its annual assessment of goodwill for impairment in the fourth quarter of each year. The goodwill

impairment assessment is performed at the reporting unit level. A reporting unit is an operating segment or one level below an

operating segment. The Company has determined that the Government segment and Enterprise segment each meet the

definition of a reporting unit.

The goodwill impairment test for fiscal 2013 was performed using a two step goodwill impairment analysis. In step one,

the fair value of each reporting unit is compared to its book value. Management must apply judgment in determining the

estimated fair value of these reporting units. Fair value is determined using a combination of present value techniques and

quoted market prices of comparable businesses. If the fair value of the reporting units its book value, goodwill is not deemed to

be impaired for that reporting unit, and no further testing would be necessary. If the fair value of the reporting unit is less than

its book value, the Company performs step two. Step two uses the calculated fair value of the reporting unit to perform a

hypothetical purchase price allocation to the fair value of the assets and liabilities of the reporting unit. The difference between

the fair value of the reporting unit calculated in Step One and the fair value of the underlying assets and liabilities of the

reporting unit is the implied fair value of the reporting unit's goodwill. A charge is recorded in the financial statements if the

carrying value of the reporting unit's goodwill is greater than its implied fair value.

The Company weighted the valuation of its reporting units at 50% based on the income approach and 50% based on the

market-based approach. The Company believes that this weighting is appropriate because it is the Company's view that value

indications under the selected methods are equally reliable and reflective of the value of the reporting units.