Motorola 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

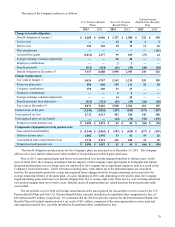

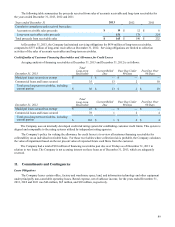

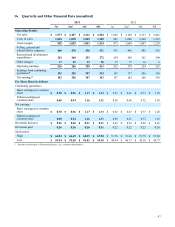

The fair values of the Company’s financial assets and liabilities by level in the fair value hierarchy as of December 31,

2012 were as follows:

December 31, 2012 Level 1 Level 2 Total

Common stock and equivalents $ 346 $ — $ 346

Commingled equity funds — 434 434

Corporate bonds — 18 18

Government, agency, and government-sponsored enterprise obligations — 233 233

Commingled bond funds — 257 257

Commingled short-term investment funds — 7 7

Total investment securities $ 346 $ 949 $ 1,295

Cash 8

Accrued income receivable —

Insurance contracts* 59

Fair value plan assets $ 1,362

* Comprised of annuity contracts issued by life insurance companies for one of the Company's non-U.S. pension plans

The table above includes securities on loan as part of a securities lending arrangement of $29 million of common stock

and equivalents, $2 million of government, agency, and government-sponsored enterprise obligations, and $27 million of

corporate bonds. All securities on loan are fully collateralized.

There were no significant transfers between Level 1 and Level 2 during 2013 or 2012.

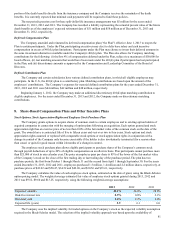

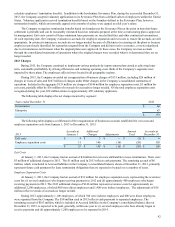

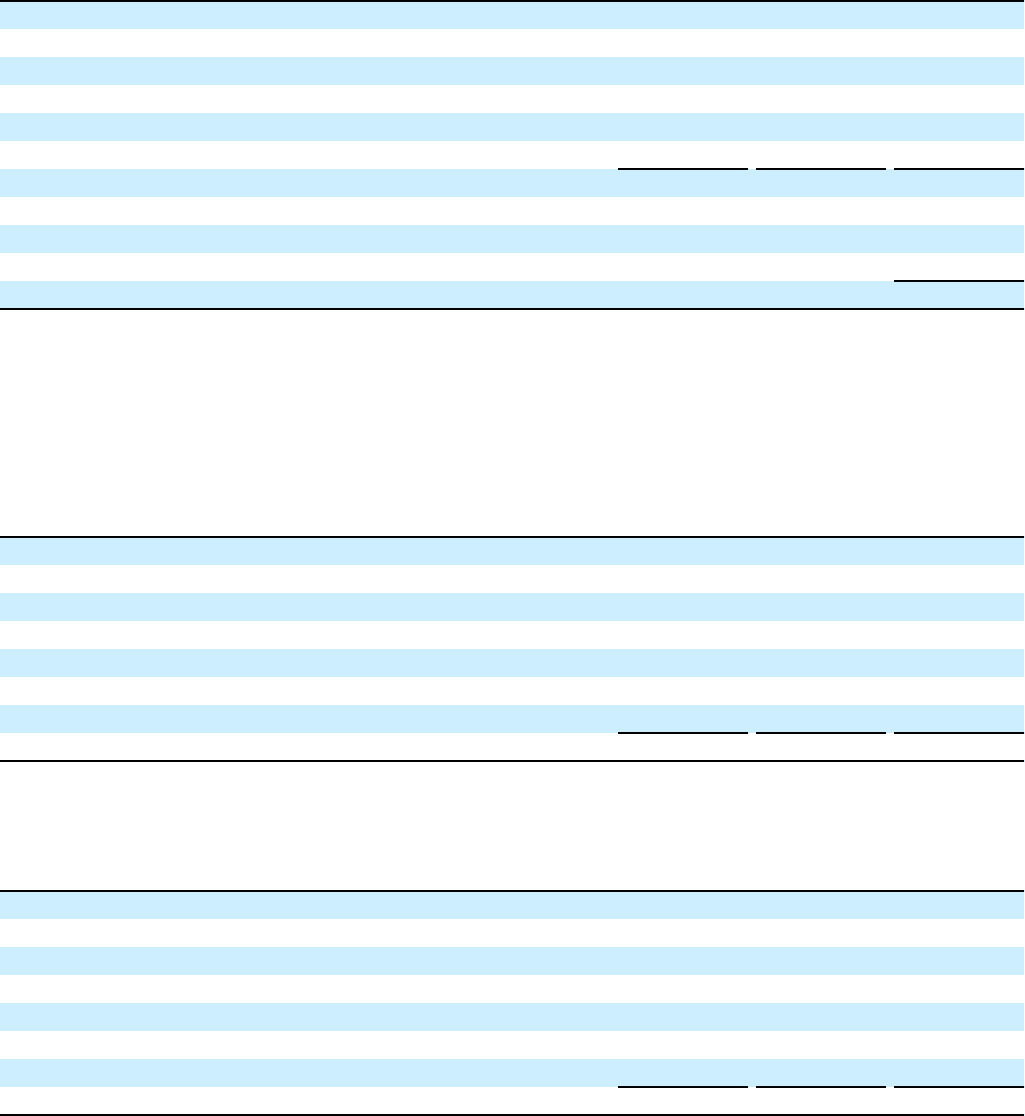

Postretirement Health Care Benefits Plan

December 31, 2013 Level 1 Level 2 Total

Common stock and equivalents $ 38 $ — $ 38

Commingled equity funds — 55 55

Government, agency, and government-sponsored enterprise obligations — 6 6

Other government bonds — 1 1

Corporate bonds — 9 9

Commingled bond funds — 49 49

Commingled short-term investment funds — 3 3

Fair value plan assets $ 38 $ 123 $ 161

The table above includes securities on loan as part of a securities lending arrangement of $3 million of common stock and

equivalents, $5 million of government, agency, and government-sponsored enterprise obligations, and $1 million of corporate

bonds. All securities on loan are fully cash collateralized.

December 31, 2012 Level 1 Level 2 Total

Common stock and equivalents $ 44 $ — $ 44

Commingled equity funds — 56 56

Government, agency, and government-sponsored enterprise obligations — 9 9

Corporate bonds — 9 9

Mortgage-backed bonds — 1 1

Commingled bond funds — 30 30

Commingled short-term investment funds — 6 6

Fair value plan assets $ 44 $ 111 $ 155

The table above includes securities on loan as part of a securities lending arrangement of $4 million of common stock and

equivalents and $7 million of government, agency, and government-sponsored enterprise obligations. All securities on loan are

fully cash collateralized.

There were no significant transfers between Level 1 and Level 2 during 2013 or 2012.