Motorola 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

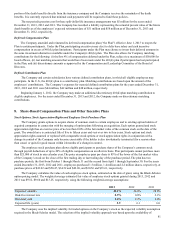

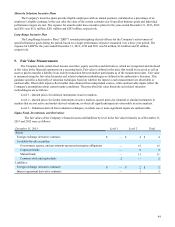

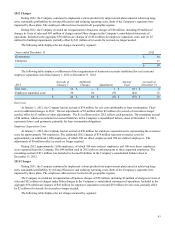

Motorola Solutions Incentive Plans

The Company's incentive plans provide eligible employees with an annual payment, calculated as a percentage of an

employee’s eligible earnings, in the year after the close of the current calendar year if specified business goals and individual

performance targets are met. The expense for awards under these incentive plans for the years ended December 31, 2013, 2012

and 2011 was $121 million, $201 million and $203 million, respectively.

Long-Range Incentive Plan

The Long-Range Incentive Plan (“LRIP”) rewards participating elected officers for the Company’s achievement of

specified business goals during the period, based on a single performance objective measured over a three year period. The

expense for LRIP for the years ended December 31, 2013, 2012 and 2011 was $6 million, $12 million and $3 million,

respectively.

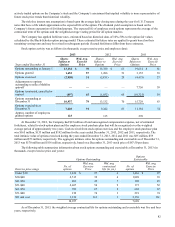

9. Fair Value Measurements

The Company holds certain fixed income securities, equity securities and derivatives, which are recognized and disclosed

at fair value in the financial statements on a recurring basis. Fair value is defined as the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. Fair value

is measured using the fair value hierarchy and related valuation methodologies as defined in the authoritative literature. This

guidance specifies a hierarchy of valuation techniques based on whether the inputs to each measurement are observable or

unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the

Company's assumptions about current market conditions. The prescribed fair value hierarchy and related valuation

methodologies are as follows:

Level 1 - Quoted prices for identical instruments in active markets.

Level 2 - Quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in

markets that are not active and model-derived valuations, in which all significant inputs are observable in active markets.

Level 3 - Valuations derived from valuation techniques, in which one or more significant inputs are unobservable.

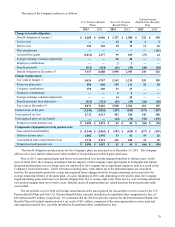

Sigma Fund, Investments, and Derivatives

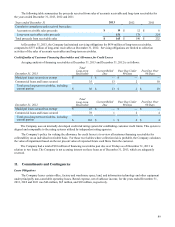

The fair values of the Company’s financial assets and liabilities by level in the fair value hierarchy as of December 31,

2013 and 2012 were as follows:

December 31, 2013 Level 1 Level 2 Total

Assets:

Foreign exchange derivative contracts $ — $ 4 $ 4

Available-for-sale securities:

Government, agency, and government-sponsored enterprise obligations — 15 15

Corporate bonds —99

Mutual funds — 11 11

Common stock and equivalents 2 — 2

Liabilities:

Foreign exchange derivative contracts $ — $ 2 $ 2

Interest agreement derivative contracts —33