Motorola 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

resulted in diversity in practice. The ASU requires an entity to measure these obligations as the sum of the amount the

reporting entity agreed to pay on the basis of its arrangement among its co-obligors and any additional amount the reporting

entity expects to pay on behalf of its co-obligors. The ASU also requires an entity to disclose the nature and amount of the

obligation as well as other information about those obligations. The ASU is to be applied retrospectively to all prior periods

presented for those obligations resulting from joint and several liability arrangements within the scope of updates that exist

within the Company's statement of financial position at the beginning of the year of adoption. This guidance will be effective

for the Company beginning January 1, 2014. The Company anticipates that the adoption of this standard will not have a

material impact on its consolidated financial statements or footnote disclosures.

In January 2014, the FASB issued ASU No. 2014-05, “Service Concession Arrangements.” The ASU clarifies that an

operating entity should not account for a services concession arrangement with a public-sector grantor as a lease if: (i) the

grantor controls or has the ability to modify or approve the services the operating entity must provide, to whom it must provide

them, and at what price and (ii) the grantor controls any residual interest in the infrastructure at the end of the arrangement. In

addition, the infrastructure used in a service concession arrangement would not be recognized as property, plant and equipment

of the operating entity. The ASU is to be applied on a modified retrospective basis to service concession arrangements

outstanding upon adoption and will be effective for the Company beginning January 1, 2015. The Company is currently

assessing the impact of this standard on its consolidated financial statements and footnote disclosures.

2. Discontinued Operations

On January 1, 2012, the Company completed a series of transactions which resulted in exiting the amateur, marine and

airband radio businesses. The operating results of the amateur, marine and airband radio businesses, formerly included as part

of the Government segment, are reported as discontinued operations in the consolidated statements of operations for all periods

presented.

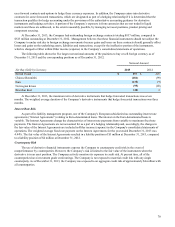

On October 28, 2011, the Company completed the sale of its wireless broadband businesses. During the year ended

December 31, 2011, the Company recorded a pre-tax gain related to the sale of the wireless broadband businesses of $40

million, net of closing costs, in its results from discontinued operations. The operating results of the wireless broadband

businesses, formerly included as part of the Enterprise segment, are reported as discontinued operations in the statements of

operations for all periods presented.

On April 29, 2011, the Company completed the sale of certain assets and liabilities of its Networks business to Nokia

Siemens Networks ("NSN"). The results of operations of the portions of the Networks business sold are reported as

discontinued operations for all periods presented. Based on the terms and conditions of the Networks business divestiture, the

sale was subject to a purchase price adjustment that was contingent upon the review of final assets and liabilities transferred to

NSN and was based on the change in net assets from the original agreed upon sale date. During the year ended December 31,

2011, the Company received approximately $1.0 billion of net proceeds and recorded a pre-tax gain related to the completion of

this sale of $434 million, net of closing costs, and an agreed upon purchase price adjustment of $120 million in its results from

discontinued operations.

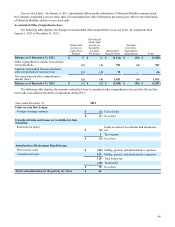

On January 4, 2011, the distribution of Motorola Mobility was completed. The stockholders of record as of the close of

business on December 21, 2010 received one (1) share of Motorola Mobility common stock for each eight (8) shares of the

Company’s common stock held as of the record date. Immediately following the distribution, the Company changed its name to

Motorola Solutions, Inc. The distribution was structured to be tax-free to Motorola Solutions and its stockholders for U.S. tax

purposes (other than with respect to any cash received in lieu of fractional shares). The historical financial results of Motorola

Mobility are reflected in the Company’s consolidated financial statements and footnotes as discontinued operations for all

periods presented.

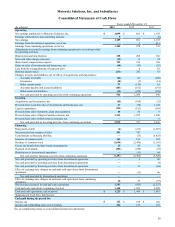

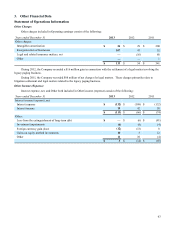

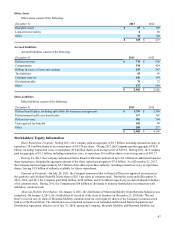

The following table displays summarized activity in the Company’s consolidated statements of operations for

discontinued operations during the years ended December 31, 2012 and 2011.

Years ended December 31 2012 2011

Net sales $ — $ 1,346

Operating earnings 11 201

Gains (loss) on sales of investments and businesses, net (7) 474

Earnings before income taxes 8 667

Income tax expense 5 256

Earnings from discontinued operations, net of tax 3 411