Motorola 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

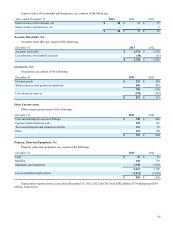

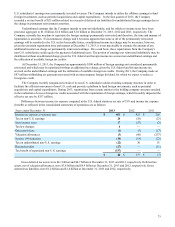

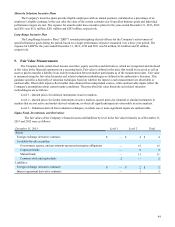

Significant components of deferred tax assets (liabilities) are as follows:

December 31 2013 2012

Inventory $ 51 $ 1

Accrued liabilities and allowances 135 134

Employee benefits 825 1,544

Capitalized items 179 254

Tax basis differences on investments 20 28

Depreciation tax basis differences on fixed assets 16 19

Undistributed non-U.S. earnings (9)(150)

Tax carryforwards 1,382 1,155

Business reorganization 39 12

Warranty and customer reserves 39 45

Deferred revenue and costs 263 310

Valuation allowances (256)(308)

Deferred charges 38 36

Other (62)(60)

$ 2,660 $ 3,020

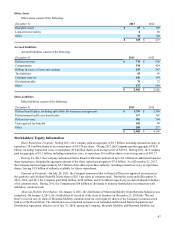

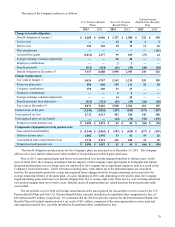

At December 31, 2013 and 2012, the Company had valuation allowances of $256 million and $308 million, respectively,

against its deferred tax assets, including $233 million and $272 million, respectively, relating to deferred tax assets for non-U.S.

subsidiaries. The Company’s valuation allowances for its non-U.S. subsidiaries had a net decrease of $39 million and $64

million during 2013 and 2012, respectively. The decrease in the valuation allowance relating to deferred tax assets of non-U.S.

subsidiaries reflects current year deferred tax movements, expiration of loss carryforwards and exchange rate variances.

During 2012, we recorded $60 million of tax benefit related to the reversal of a significant portion of the valuation

allowance established on certain foreign deferred tax assets. In the first quarter of 2011, the Company reassessed its valuation

allowance requirements taking into consideration the distribution of Motorola Mobility. The Company evaluated all available

evidence in its analysis, including the historical and projected pre-tax profits generated by the Company's U.S. operations. The

Company also considered tax planning strategies that are prudent and can be reasonably implemented. During 2011, the

Company recorded $274 million of tax benefits related to the reversal of a significant portion of the valuation allowance

established on U.S. deferred tax assets.

The U.S. valuation allowance as of December 31, 2013 relates to state tax carryforwards. The Company believes that the

remaining deferred tax assets are more-likely-than-not to be realizable based on estimates of future taxable income and the

implementation of tax planning strategies.